L&T Construction wins orders for its buildings & factories business

The Buildings & Factories Business of L&T Construction has secured an order from a leading automobile major to construct a state-of-the-art manufacturing facility in Haryana, India.

The scope involves Design & Execution of Civil, Structural & Architectural works including external development works. This win is on the back of a prestigious order from Reliance Life Sciences, a leading bio-tech major to construct their state-of-the-art life sciences products manufacturing facility in Maharashtra, India.

The Business has also won an order from the Government of Assam, Public Works Department to construct a Police reserve campus in Guwahati.

The scope of works includes Design and Construction of accommodation facilities for Police, office space, multi-level car parking and allied buildings in all aspects including structure, finishes, MEP, and related external development works. This project is to be executed in 36 months.

Larsen & Toubro was quoting at Rs 1,912.05, up Rs 40.60, or 2.17 percent.

Market at 10 AMBenchmark indices were trading higher with around 17400.The Sensex was up 414.48 points or 0.71% at 58479.95, and the Nifty was up 129.40 points or 0.75% at 17403.70. About 2269 shares have advanced, 635 shares declined, and 104 shares are unchanged.

10 year yield hits three month high as JPMorgan continues to keep Indian bonds off its index

JPMorgan is keeping Indian bonds off its emerging market sovereign bond index for now citing investment hurdles that must be resolved for the inclusion to take place, the index provider said.

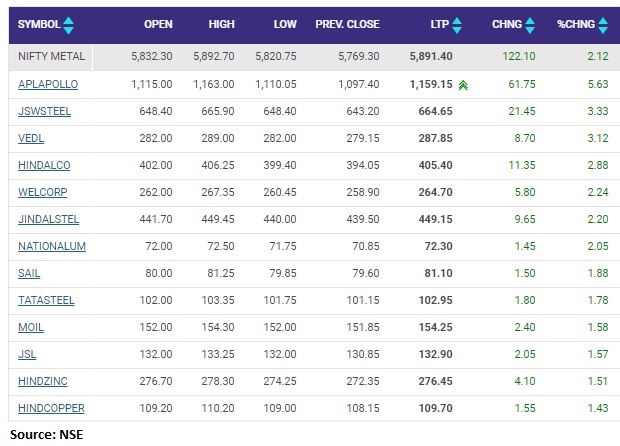

Nifty Metal index rose 1 percent supported by the APL Apollo Tubes, JSW Steel, Vedanta

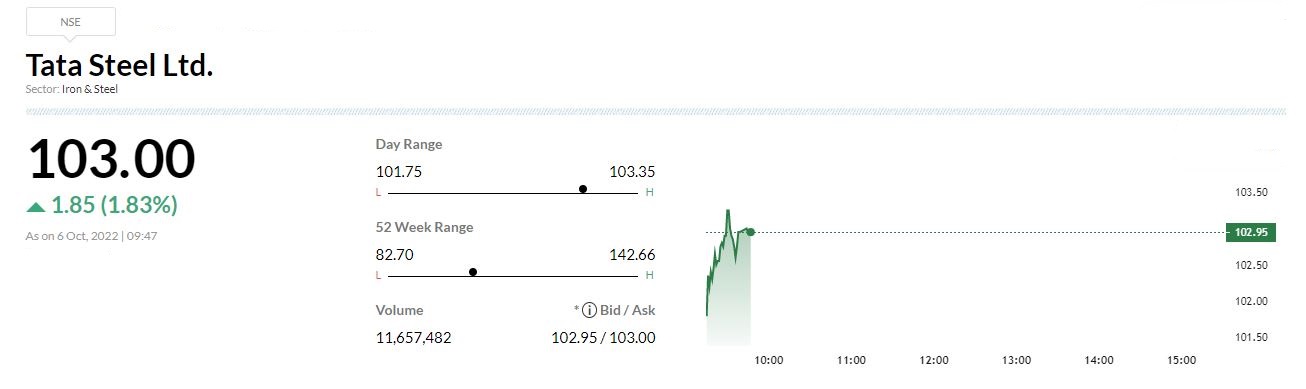

Tata Steel divests 19% stake in AL Rimal to TanmiaT S Global Holdings Pte Ltd (formerly T S Global Mineral Holdings Pte Ltd), a wholly-owned subsidiary of Tata Steel Limited, had entered into an agreement with Oman National Investments Development Company (Tanmia) and the existing shareholders of Al Rimal to transfer its 19% shareholding in Al Rimal to Tanmia thereby divesting its equity stake in Al Rimal from 70% to 51%.Tata Steel Limited, through T S Global Holdings Pte Ltd, has concluded the divestment of its 19% equity stake in AI Rimal to Tanmia on October 3, 2022, thereby reducing its shareholding from 70% to 51% in Al Rimal.

Lodha achieves its best ever Q2 pre-sales performance of Rs 3,148 crore

Lodha achieved its best ever Q2 pre-sales performance of Rs 3,148 crore showing a growth of 57% on a YoY basis.

Our H1 sales totaled to Rs 6,004 crore which is ~52% of our full year guidance of Rs 11,500 crore.

Collections were Rs 2,375 crore in 2QFY23 up 24% on a YoY basis. Collections were predictably impacted by seasonal factors – lower construction activity during monsoon and deferral of registerations during 15 day inauspicious period (Pitrupaksh / Shraadh).

Macrotech Developers was quoting at Rs 979.00, up Rs 7.70, or 0.79 percen

BSE Capital Goods index added 1 percent led by the Bharat Forge, Graphite India, BHEL

Mahindra Lifespace Developers forms joint ventures with Actis

Mahindra Lifespace Developers has executed definitive documents to establish joint ventures with Actis, for developing industrial and logistics real estate facilities across India.

Subject to requisite approvals and finalisation of other definitive documents, the Company or its Affiliates and Actis or its Affiliates will jointly invest in Asset Owning SPVs and in an entity that will provide business services to the Asset Owning SPVs.

The company or its Affiliates may own stakes in the range of 26% to 40% in these entities, and the balance will be owned by Actis or its Affiliates.

Mahindra Lifespace Developers was quoting at Rs 480, up Rs 7.45, or 1.58 percent on the BSE.

Electronics Mart India IPO subscribed 1.69 times

The initial public offering (IPO) of Electronics Mart India, the fourth largest consumer durables and electronics retailers in India, was subscribed 1.69 times on the first day of the subscription on October 4.

The offer garnered bids for 10.58 crore equity shares against an offer size of 6.25 crore equity shares.

The offer size was reduced to 6.25 crore equity shares from around 8.47 crore after raising Rs 150 crore through anchor book on October 3.

Retail investors were once again at the forefront, subscribing 1.98 times the allotted quota. Non-institutional investors bought 104 percent of the portion set aside for them.

Qualified institutional investors bought 2.99 crore shares against 1.78 crore shares reserved for them.

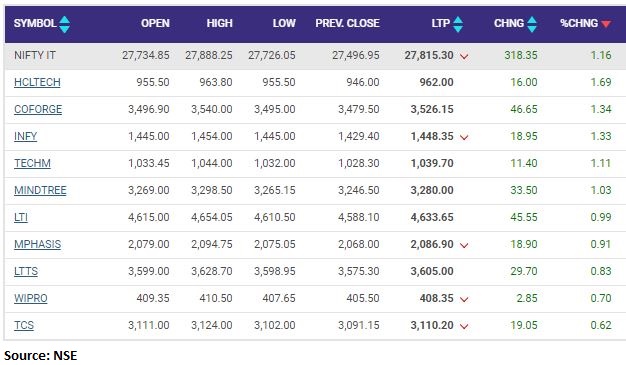

Nifty Information Technology index rose 1 percent led by the HCL Technologies, Coforge, Infosys

Tirthankar Das, Technical & Derivative Analyst, Retail, Ashika Stock Broking

On the technical front, Nifty formed a long bullish candle following a rather larger Engulfing candle indicating of an upside breakout of the larger consolidation movement around 16,800-17,200 levels. Key to note that Index is presently flirting around the crucial 200dma, sustaining above or below which would dictate the direction of the Index. However, for the Index to end its prolonged correction, it needs to close above 17350 in order to buck the trend else corrective bias might continue though Index presently trading in neutral to oversold price conditions hence pullback seems inevitable.

Presently a trader needs to show patience and need to avoid trading aggressively in the market as the risk of a bare minimum correction of 38.2% of the entire rally from 15,183 to 18,096 comes around 16990 followed by 50% correction at 16650 remains.

During the day, index is likely to open on a positive note, tracking positive morning global cues. Formation of lower high- lower low signifies corrective bias. Hence, until and unless Index provides a decisive close above 17350, it would be a sell-on-rise market.

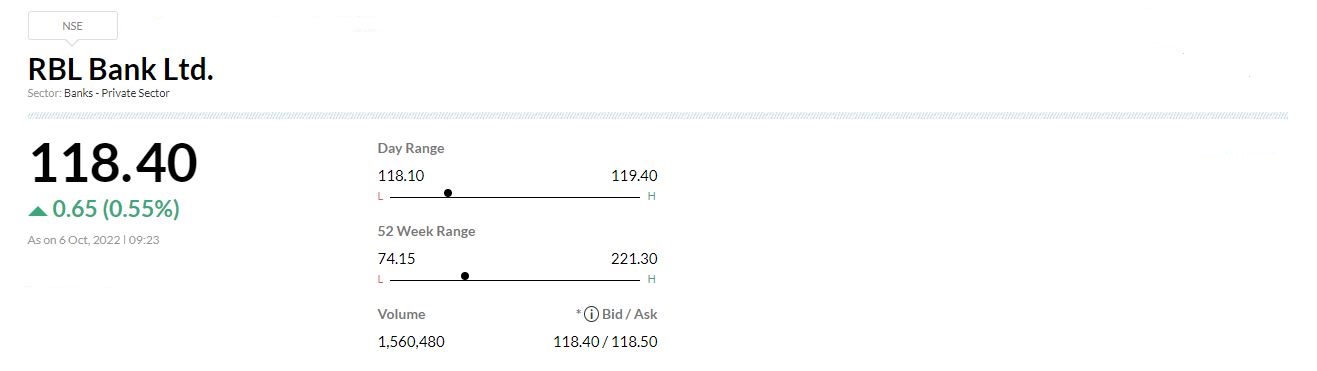

RBL Bank Q2 Business Update

RBL Bank’s total deposits for September 2022 were up 5% at Rs 79,407 crore against Rs 75,588 crore and Gross Advances were up 12% at Rs 64,677 crore versus Rs 57,939 crore, YoY.