NHPC may consider monetisation of asset on August 10

NHPC said the board of directors on August 10 may consider monetization of future cash flow (consisting return on equity, capacity based incentive) of one or more power station (s) for suitable tenure, as part of the funding plan of CAPEX for the current financial year 2022-23.

NHPC was quoting at Rs 35.60, down Rs 0.25, or 0.70 percent.

BPCL losses widen in Q1: Should you buy, hold or sell the stock now?

Revenue from operations rose to Rs 1.38 lakh crore from Rs 89,688.98 crore in April-June 2021.

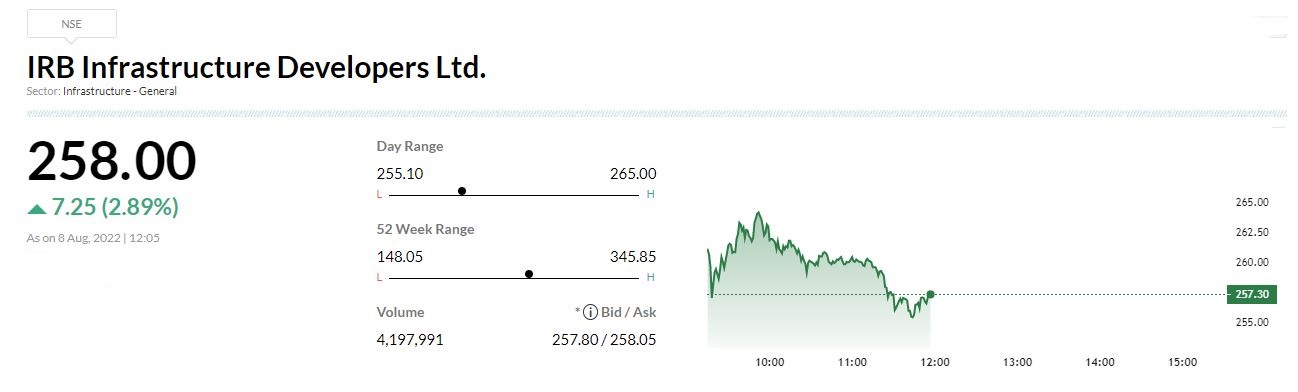

Buzzing:IRB Infrastructure Developers: The road developer has reported a 405% year-on-year increase in consolidated profit at Rs 363.2 crore for June FY23 quarter driven by higher operating income. Revenue grew by 18.4% to Rs 1,924.6 crore compared to corresponding period last fiscal.

Market at 12 PMBenchmark indices were holding on the gains with Nifty around 17450.The Sensex was up 289.35 points or 0.50% at 58677.28, and the Nifty was up 76 points or 0.44% at 17473.50. About 1801 shares have advanced, 1336 shares declined, and 150 shares are unchanged.

SoftBank posts $23 billion loss in June quarter:

Japan’s SoftBank Group Corp reported a net loss of 3.16 trillion yen ($23.34 billion) for the quarter ended June 30 as investors continued dumping shares of high-growth technology companies, a kind that the Japanese investment conglomerate favours the most, amid rising interest rates across the globe.

SoftBank’s Vision Fund investment unit, through which the Japanese conglomerate invests in companies, posted a net loss of as much as $21 billion hitting the company’s profits for the quarter ended June. According to Reuters’ estimates, the Vision Fund investment unit was expected to report a loss of as much as $10 billion.

Titan Q1 profit surge drives shares 8% up in early trade: What should you do now?

Titan Q1: Standalone revenue for the Tata group company rose 176 percent to Rs 8,961 crore. On a sequential basis, revenue rose 23 percent.

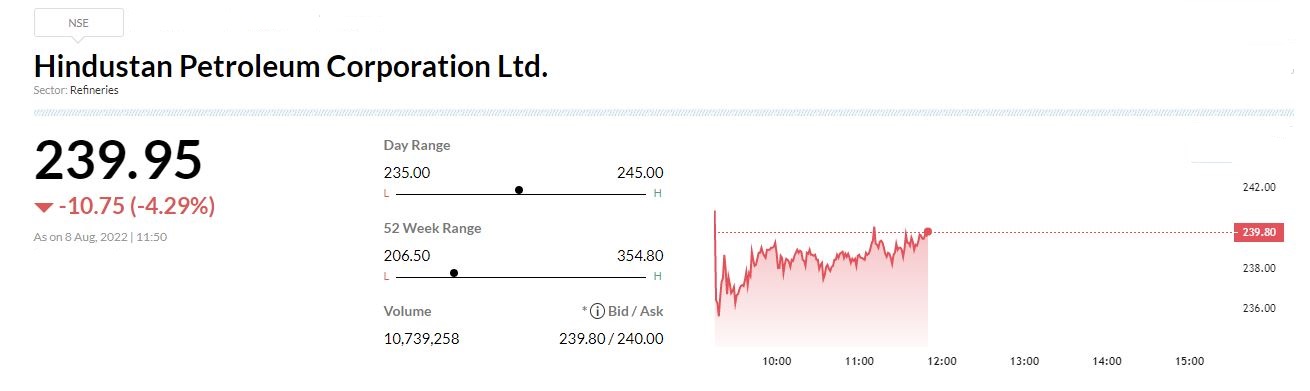

Buzzing:Hindustan Petroleum Corporation posted a big loss of Rs 10,197 crore for the quarter ended June FY23 against profit of Rs 1,795 crore for the same period last year, impacted by erosion in the marketing margin on motor fuels and LPG. Revenue grew by 56% YoY to Rs 1.22 lakh crore during the same period.

Results on August 8:

Bharti Airtel, Adani Ports and Special Economic Zone, Power Grid Corporation of India, NALCO, Astrazeneca Pharma India, Chemcon Speciality Chemicals, City Union Bank, Delhivery, Dhanlaxmi Bank, Gujarat Narmada Valley Fertilizers & Chemicals, Housing & Urban Development Corporation, JK Tyre & Industries, Jaypee Infratech, Vedant Fashions, Samvardhana Motherson International, Sequent Scientific, Sun Pharma Advanced Research Company, Subex, Torrent Power, and Whirlpool of India will be in focus ahead of June quarter earnings on August 8.

Macquarie View on Titan Company

Brokerage house has kept outperform rating on the stock with a target at Rs 2,900 per share.

The Q1 pointed to healthy watch/eyewear margin.

Macquarie raised FY23/FY24/FY25 EPS estimates by 3 percent each to factor in margin strength. The Q1 reaffirms resilience of Titan’s customer demand, reported CNBC-TV18.

BSE Capital Good index gained 1 percent supported by the Siemens, Suzlon Energy, Hindustan Aeronautics

RBI may hike repo rate to 6.00%, pace may slow: Analysts

The RBI’s monetary policy committee (MPC) raised its repo rate by 50 basis points on Friday, the third increase in the current cycle, to cool stubbornly high inflation that has remained above its…

Geojit on ITC: ITC is a diversified conglomerate with presence in FMCG, hotels, paperboards and specialty papers, packaging, and agri-business. The company directly employs over 36,500 people across businesses. Its standalone revenue in Q1FY23 stood at Rs 18,164 crore, up 41 percent YoY and 11.9 percent QoQ, led by strong show across operating segments. EBITDA grew 41.5 percent YoY to Rs 5,648 crore, with a stable EBITDA margin of 31.1 percent despite input cost pressure. PAT stood at Rs 4,169 crore, up 38.4 percent YoY and down 0.5 percent QoQ. The reason for the sequential decline is a fall in other income.

The company has a sharp focus on investing in cutting-edge technology, leveraging customer relationships and delivering strong performance across segments. We expect the coming festival season to boost consumption expenditure, which will support growth momentum. Hence, we reiterate our buy rating on the stock with a rolled forward target of Rs 352 based on SOTP valuation.