Click here for the latest news on coronavirus, the state tally and its vaccine development

Stocks In The News | KSB, IIFL Finance, Themis Medicare, Hatsun Agro Product, Equitas Holdings

Stocks In The News | KSB, IIFL Finance, Themis Medicare, Hatsun Agro Product, Equitas Holdings” title=”

Stocks In The News | KSB, IIFL Finance, Themis Medicare, Hatsun Agro Product, Equitas Holdings” title=”Stocks In The News | KSB, IIFL Finance, Themis Medicare, Hatsun Agro Product, Equitas Holdings

“>

RailTel Corporation of India, Texmaco Infrastructure, Elecon Engineering, Vesuvius India, Ester Industries, Rain Industries, Virinchi, Mawana Sugars, Himadri Speciality Chemical, Vipul, are also among…

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services: We are now in a see-sawing market moving up & down in response to positive & negative news. But the long-term texture of the market has been ‘ buy on dips’ and this strategy has been rewarding in this bull run. The sell-off in the US market yesterday was the market’s response to 10- year yield touching 1.6 percent. The Fed’s interpretation of the rising yield is that it is discounting better growth prospects while the market typically discounts stock prices at a lower PE when interest rates rise. Fed’s declared commitment to inject liquidity and keep rates low through 2023 can ensure a buoyant market this year. So investors can utilize opportunities thrown up by corrections to buy quality stocks is performing sectors.

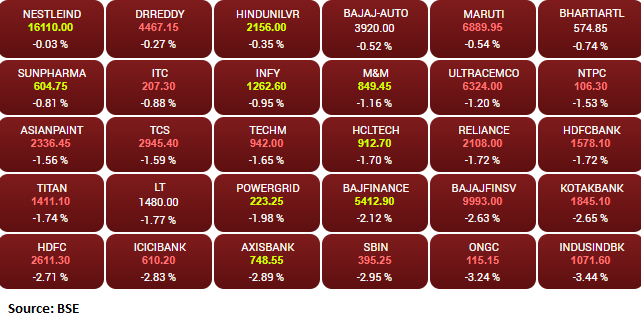

Market opens: Sensex is down 917.24 points or 1.80% at 50122.07, and the Nifty down 267.80 points or 1.77% at 14829.60.

Top Buy And Sell Ideas By Mitessh Thakkar, Yogesh Mehta For Short Term

Mitessh Thakkar of mitesshthakkar.com suggests buying Aurobindo Pharma with a stop loss of Rs 876, target at Rs 835 and Coal India with a stop loss of Rs 146, target at Rs 165.

ICICI Direct on market: Nifty extended its gains as positive global cues helped the market to open higher though later it remained in a range of 100 points. According to option chain, 14,900 and 15,000 Put option have substantial OI, which should provide support in case of a fall while 15,100 and 15,200 Call option have significant OI, which should cap gains. The major Put base is at 15,000 strike with 15 lakh shares while the major Call base is at the 15,100 strike with 14 lakh shares.

Bank Nifty opened higher but later profit booking was seen, especially in private banks. According to option chain, 35,500 and 36,000 Put option have substantial OI, which should act as support in case of a fall. On the other hand, 37,000 and 37,500 Call option have noteworthy OI, which should cap upside gains.

Sriram Iyer, Senior Research Analyst at Reliance Securities: Copper ended lower on Thursday after touching new highs, tracking overseas prices, while the rest of metals also ended lower tracking overseas prices. Prices also moved higher amid low supplies for the metal. Additionally, some profit taking was also observed at higher levels.

Technically, LME Copper could trade in the range of $9210-$9380 levels. Domestic copper and rest of metals could open lower this Friday morning, tracking overseas prices. Technically, MCX Copper February made all-time high at 745.50 levels and above 720 could see up to 726-731 levels. Support is at 716-712 levels. MCXMETLDEX March could see Bearish momentum where it could trade in a range of 15000-15280 levels.

16 new stocks set to trade in F&O market begining today

Sixteen stocks are set to trade in the futures and options (F&O) market from the March series, starting tomorrow. The F&O list is close to about 146 stocks as of now and from tomorrow this number will be 156.

Alembic Pharmaceuticals, Alkem Laboratories, AU Small Finance Bank, City Union Bank, Deepak Nitrite, Granules India, Gujarat Gas, IRCTC, L&T Technology Services, L&T Infotech, Mphasis, Navin Fluorine, Nippon Life, Pfizer, PI Industries and Trent are the new entrants.

Retail loans to remain most affected due to pandemic: Moody’s

Moody’s Investors Service on Thursday said loans to retail customers, especially those to low-income borrowers, will remain most affected due to the shock caused by the coronavirus pandemic. Despite the pandemic challenges, asset quality at Indian banks has performed better than expected at the start of the outbreak, Moody’s said.

“Corporate loans, in particular, have performed well because banks prior to the pandemic had largely provisioned for legacy problem loans and tightened underwriting standards,” Moody’s Vice President and Senior Credit Officer Srikanth Vadlamani said.

Asian Markets Asian stocks opened sharply lower on Friday after Wall Street’s main indexes tumbled, with technology-related stocks under pressure following a steep rise in benchmark U.S. Treasury yields.

Australia’s S&P/ASX 200 fell 2% in early trade, on track for the biggest intraday percentage loss since Jan. 28. Japan’s Nikkei 225 was down 1.8% while Hong Kong’s Hang Seng index futures lost 1.69%.

What Changed For The Market While You Were Sleeping? Top 10 Things To Know

Trends on SGX Nifty indicate a gap-down opening for the index in India with a 281 points loss.

SGX Nifty: Trends on SGX Nifty indicate a gap-down opening for the index in India with a 281 points loss. The Nifty futures were trading at 14,899 on the Singaporean Exchange around 07:30 hours IST.