Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Market Updates: Benchmark indices are trading lower with Nifty below 14800.The Sensex was down 476.94 points or 0.96% at 49,289.00, and the Nifty was down 120.90 points or 0.81% at 14,774. About 1422 shares have advanced, 1134 shares declined, and 103 shares are unchanged.

Rupee Updates: Indian rupee is trading flat at 74.02 per dollar, amid selling seen in the domestic equity market. On April 29, the rupee ended 32 paise higher at 74.04 per dollar against previous close of 74.36.

Rupee Outlook

“USDINR was sold off yesterday on corporate inflows but as the dollar index rises, we can expect the rupee to give back some gains. FPIs have turned buyers on stocks but we have to wait and watch the sustainability,” said Anil Kumar Bhansali, Head- Treasury at Finrex Treasury Advisors.

Credit Rating

Heranba Industries said credit rating agency CRISIL has upgraded its long term rating on the total bank loan facilities of the company to A from A-, with stable outlook, and short term rating to A1 from A2+.

Maruti Suzuki India Update

The company informed exchanges that all variants of Super Carry have been upgraded to new version of RPAS system. The revised ex-showroom price applicable in Delhi shall vary from Rs 4,48,000 to Rs 5,46,000, it said.

Overwhelming Response To The Proposed Group Restructuring, Says Motherson Sumi Systems

“We thank our shareholders for their support and trust in the capabilities of Motherson. This is an important step for us to achieve the next phase of growth for our group. The existing automotive business along with the addition of the exciting new business verticals, makes us confident of achieving our Vision 2025 targets,” said Vivek Chaand Sehgal, Chairman.

“Motherson Sumi Wiring India (MSWIL) will be the largest listed automotive wiring harness player in India with a nationwide manufacturing footprint. MSWIL will benefit from the continued parentage of MSSL along with an increased focus from Sumitomo Wiring Systems, Japan (SWS) to cater to the fast-growing Indian automotive market,” the company said.

Motherson Sumi Systems (MSSL) combined with the business of Samvardhana Motherson International (SAMIL) creates a solid platform to achieve stated Vision 2025. The company will now fully own its international business Samvardhana Motherson Automotive Systems Group BV (SMRPBV); which not only results in a simplification of the group structure and enhanced cash flows; but also, further diversifies MSSL’s revenue and product mix by addition of products like automotive lighting, shock absorbers, sheet metal, HVAC etc in line with 3CX10 strategy, it added.

Analysts Price In Economic Impact Of Second COVID Wave: Here Are 14 Stocks For Stable Returns

If the second wave of COIVD-19 extends beyond May-end, the hit on economy and corporate earnings could be worrying, experts say. They name 14 stocks with strong fundamentals to look at for long term

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

New Covid cases of 3.79 lakhs and deaths numbering 3645 during the last 24 hrs tell us that the light at the end of the tunnel, which the market is focussed on, is a long way away. But the market is taking cues from the second wave experience of other countries where the Covid second wave curve flattened & fell in around two months. This explains the resilience of the market in the midst of very negative Covid-related news.

An important point to be understood is that global markets are highly correlated, and therefore, a major correction, when it happens, is likely to be global.

Meanwhile, Q4 results continue to be good particularly in high-quality financials, IT and cement. FIIs have again turned buyers during the last 2 days. This is likely to pre-empt major shorting by the bears.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The Nifty seems a little lost in its direction this morning. However, the current trend continues to remain bullish and dips like these can be utilized to trickle in buy positions for a higher target of 15100. A strong support lies at 14400 and since that is a steep stop to maintain, a buy on dips approach would be most advisable.

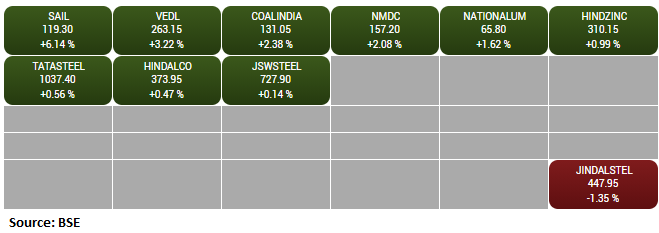

BSE Metal index rose 1 percent supported by the SAIL, Vedanta, Coal India:

Abhishek Goenka, Founder & CEO, IFA Global:

US Q1 GDP growth came in below expectations at 6.4% QoQ (exp 6.7%). Jobless claims were a tad higher than expected and core PCE was in line at 2.3% QoQ. With Fed overlooking recent elevated inflation, terming it transitory, the data would reinforce market belief in Fed communication of ‘lower for longer’. US short-term real rates continue to remain low. This is weighing on the Dollar. The Dow ended the session 0.7% higher.