Follow our LIVE blog for the latest updates on the new Omicron variant of COVID-19 and its impact

Amit Pabari, MD at CR Forex Advisors:

If not stronger US dollar; then India’s own sluggish economic indicators along with supply bottlenecks are likely to pressurize on the Indian Rupee over short term. In commodity pack, Crude oil prices are up by 15% over the last 5 days- quoting near $85 mark, iron ore is up by 37% from its November bottom, copper is up by 8% from December low, Palm oil is higher by 20% over last 19 days.

Further, India’s sea transport freight rates are up by 15% this month amid port congestion and bottlenecks in the US, Europe and China. On trade front, India’s trade deficit widened to $21.7 in December as imports rose by 38%. Other economic data, CPI inflation at 5-month high, IIP at a 9-month low. WPI is expected to remain near 13.5%. Lastly, big bull-RBI has supported the pair by intervening heavily near 73.70-80 levels over the last two days.

Hence, 73.50-73.70 is likely to remain a strong bottom for the USDINR pair and one can expect a strong rebound towards 74.80-75.20 over near term. Today, the pair is likely to trade in the range of 73.80 to 74.15 zone with an upside bias.

JUST IN | December WPI at 13.56%

December wholesale price index (WPI) inflation for December 2021 was at 13.56% against 14.23% MoM.

December core WPI inflation was at 11% versus 12.2%, MoM.

Ashoka Buildcon emerges as lowest bidder for NHAI project in Karnataka

Ashoka Buildcon has emerged as the lowest bidder (L-1) and the quoted bid price of the project is Rs 829.49 crore.

The company had submitted bid to the National Highways Authority of India (NHAI) in respect of the project viz. ‘Request for Proposal for Construction of 6 laning from Belgaum to Sankeshwar Bypass of NH-48 in the state of Karnataka on Engineering, Procurement & Construction (EPC) mode under Bharatmala Pariyojana (Package-I)’.

Ashoka Buildcon was quoting at Rs 104.25, down Rs 0.20, or 0.19 percent on the BSE.

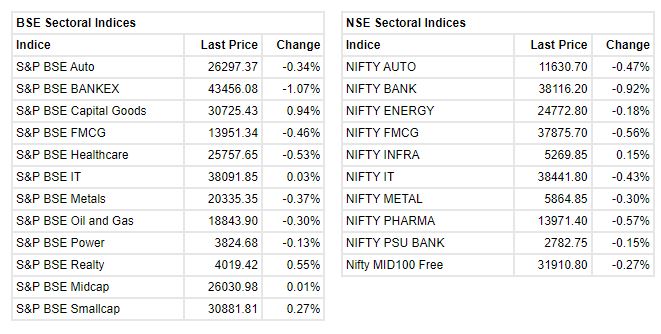

Market at 12 PMBenchmark indices continued to trade in the negative territory with Nifty below 18200 amid selling seen in the auto, bank, FMCG, pharma and oil & gas sectors.The Sensex was down 318.99 points or 0.52% at 60916.31, and the Nifty was down 81.60 points or 0.45% at 18176.20. About 1757 shares have advanced, 1359 shares declined, and 83 shares are unchanged.

Aditya Birla Fashion to acquire 51% stake in House Of Masaba Lifestyle

Aditya Birla Fashion & Retail board at its meeting held today have approved a proposal of acquisition of 51% stake in ‘House of Masaba Lifestyle Private limited’, the entity which houses apparel, non-apparel, beauty & personal care and accessories business under the brand ‘Masaba’ by way of entering into a Binding Term Sheet, as per the press release.

Aditya Birla Fashion & Retail touched a 52-week high of Rs 312.95 and was quoting at Rs 310.50, up Rs 1.95, or 0.63 percent on the BSE.

Petrol, Diesel prices today:

Petrol and diesel prices remained unchanged for the 70th day in a row on January 14, according to a price notification by state-owned fuel retailers.

This is the second-longest duration of paused prices since the daily rate revision was introduced in June 2017, as per the available data. Prior to that, there was an 82-day gap between March 17 and June 6, 2020.

This comes as the central government cut excise duty on November 4, 2021 to give relief from prices that had touched an all-time high.

The government cut the duty on petrol by Rs 5 per litre and that on diesel by Rs 10 a litre resulting in an equivalent reduction in retail pump rates. Following this, many states and Union Territories cut local sales tax or value-added tax (VAT) to give further relief to consumers.

Kotak Equities keeps add rating on Nykaa, price target of Rs 2,150

Brokerage firm Kotak Institutional Equities has initiated coverage on shares of FSN E-commerce, parent of Nykaa, with an ‘add’ rating and a price target of Rs 2,150. The brokerage expects Nykaa’s topline growing 33 percent annually over the next eight years aided by its leadership in the fashion and beauty and personal care market.

“Nykaa’s model focusing on content-based customer acquisition, curation and convenience is scalable with long-term growth potential,” the brokerage house said. Higher competitive intensity resulting in slower growth rates or margins is the key risk to the brokerage’s call.

Shares of Nykaa were down 0.3 percent at Rs 2,053.6 on the NSE.

Kotak Institutional Equities put sell on Avenue Supermarts

After falling for four consecutive sessions, Dmart shares gained over 1% in the opening trade. The stock declined over 10% between 7-13 January.

According to Kotak Institutional Equities report its December quarter revenue growth of 22% year on year was decent but not stellar in the context of 3Q being a normal quarter from a Covid perspective.

“GM and EBITDA margins of 14.9% and 9.6% respectively were lower-than-anticipated due to lower sales of general merchandize. Store addition of 17 during 3Q surprised on the upside.

We revise down FY2022 revenues by 1% as we bake in lower sales in 4Q but maintain FY2023 estimates”, the brokerage firm said. The brokerage firm has a sell rating on the stock and given a target price to Rs 3200 a share.

China’s export growth likely eased further in December: Reuters poll

China’s export growth likely lost more steam in December as a key economic driver continues to weaken, while imports also slowed and concerns over the Omicron variant weighed on the demand outlook, a Reuters poll showed on Thursday.

Exports in December were expected to have risen 20.0% from a year earlier, according to the median forecast of 29 economists in the poll, still robust but moderating from a 22.0% expansion in November.

Imports were forecast to have risen 26.3% from a year earlier, the poll showed, compared with 31.7% in November.

The customs authority will release the data on Jan. 14.

Market at 11 AM

Benchmark indices were trading lower with Nifty below 18200 with selling is seen in the auto, bank, IT and realty names.

The Sensex was down 312.90 points or 0.51% at 60922.40, and the Nifty was down 76.20 points or 0.42% at 18181.60. About 1750 shares have advanced, 1309 shares declined, and 85 shares are unchanged.

Gaurav Garg, Head of Research, Capitalvia Global Research:

Investors will look to the Wholesale Price Index (WPI) data, which will be released later in the day. While India’s economic recovery is on a solid path amid rapid vaccination progress, coal shortages and high oil prices could put the brakes on economic activity in the near term, according to a UN report.

The country’s GDP is forecast to grow at 6.5 percent in fiscal year 2022, down from 8.4 percent in the previous financial year.

Our research suggests that the levels of 18400 may act as important resistance levels in the market. If the market sustained above the levels of 18000, we can expect the market to trade in the range of 18000-18400.