RBI Monetary Policy Committee hikes interest rates by 50 bps. Check out the latest news, developments, and analysis!

Motilal Oswal, MD & CEO, Motilal Oswal Financial Services on RBI MPC rate hike:

RBI in its latest MPC meeting has hiked the repo rate by 50bps to 5.4 percent level which was seen before the Covid-19 pandemic. The Central Bank raised the interest rate for the third consecutive month since May 2022 by cumulatively 140 bps in its effort to contain inflation. Despite this sharp hike, RBI expects the inflation to remain above its comfort zone and has retained its CPI inflation forecast at 6.7 percent for FY23. RBI expects India’s GDP growth to remain strong at 7.2 percent in FY23.

We believe, the commodity prices have cooled off including crude oil, the inflation may be peaking out. We expect RBI may not be very aggressive in its subsequent policy meets and being more data driven based on inflation numbers.

IGL piped cooking gas price hiked by Rs 2.63 per unit in Delhi due to rise in input costs

Naveen Kulkarni , Chief Investment Officer, Axis Securities

With core inflation continuing to hover well above the upper tolerance limit, the RBI increased the repo rate by 50 bps, broadly in line with market expectations. Repo rates reverted to pre-pandemic levels, the highest since August 2019. The MPC maintained its stance on calibrated withdrawal of accommodation while supporting growth. We have seen system liquidity tighten since RBI started withdrawing excess liquidity, and system credit growth improved to 14%. With credit growth looking up, we believe the banks with a higher share of floating rates and a robust CASA-led deposit franchise should be placed well in this increasing interest rate environment. While the domestic inflationary pressures seem to be easing out gradually, the geopolitical tensions, volatility in global financial markets, and emerging risk of the global recession continue to remain key risks. Thus, the RBI has retained its inflation estimates for FY23, mildly tweaking Q2 and Q3 estimates, expecting relief only from Q4 onwards. It has also retained its growth estimates at 7.2% for FY23.

Inflation is expected to remain above the central bank’s threshold

Inflation is expected to remain above the central bank’s 6% threshold in the second and third quarters of this fiscal year, for which the MPC stressed that sustained high inflation could destabilise inflation expectations and harm growth in the medium. Volatility in global markets is leading to imported inflation CPI forecast for FY23 kept unchanged at 6.7% with Quarterly CPI: Q2FY23 at 7.1%, Q3FY23 at 6.4%, Q4FY23 at 5.8%, Q1 FY24 at 5%.

Aurodeep Nandi, India Economist & Vice President, Nomura on RBI Policy

The RBI’s 50bp hike was largely in line with market expectations, that was divided between it and a 35bp hike. Very importantly, with the RBI retaining the policy stance of “withdrawal of accommodation”, the implicit message is that rates are yet to reach neutral territory, and that more rate hikes are warranted – a view that we agree with. The RBI continues to signal that all options are on the table, which is a prudent strategy given the elevated levels of uncertainties on both, growth as well as inflation.

NTPC declares complete commissioning of 296 MW Fatehgarh Solar

PV Project

NTPC has successfully completed the commissioning of fifth part capacity of 48.8 MW out of 296 MW Fatehgarh Solar PV Project at Jaisalmer, Rajasthan. The commercial Operations of the fifth part commenced on August 5. Now, full capacity of 296 MW has been commissioned. With this, standalone installed and commercial capacity of NTPC has become 54818 MW, while group installed and commercial capacity of NTPC has become 69183 MW.

Anuj Puri, Chairman – ANAROCK Group

A rate hike was expected, but the expectation was for a maximum of 35 bps. The hike by 50 bps is definitely on the higher side, and home loan lending rates will now edge further into the red zone.

This is the third consecutive rate hike in the last two months and finally marks the end of the all-time best low-interest rates regime – one of the major factors that drove housing sales across the country since the pandemic. This whammy comes along with the inflationary trends of primary raw materials, including cement, steel, labour, etc., that have recently led to a rise in property prices. Together, these factors – rising home loan rates and construction costs – will impact residential sales that did reasonably well in the first half of 2022. As per ANAROCK Research, approx. 1.85 lakh units were sold in H1 2022 across the top 7 cities.

The repo rate now stands at 5.4%, thus reaching the pre-pandemic levels. While inflation has partially eased as compared to the surge in April, it continues to be above the RBI’s target.

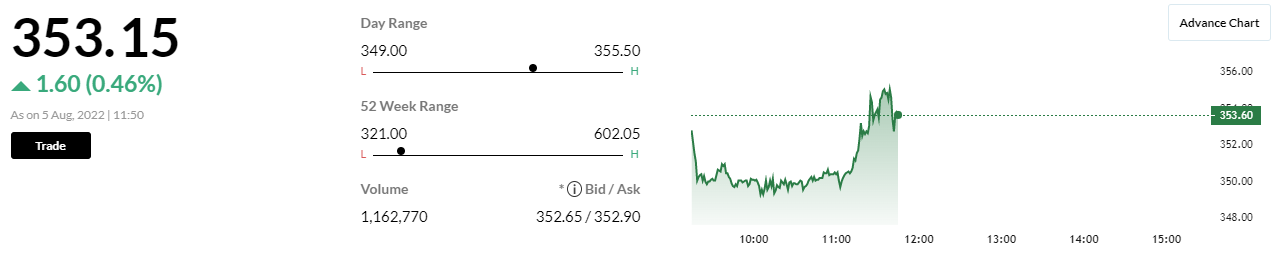

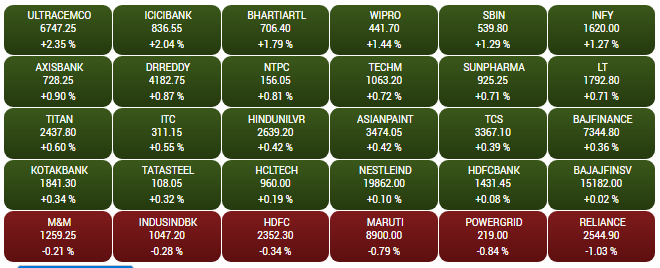

Market update at 11.00 AM

Benchmark indices continue to trade higher with Sensex up 247.42 points or 0.42% at 58546.22, and the Nifty was up 62.45 points or 0.36% at 17444.45.Source : BSE

Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank on RBI Monetary Policy

The MPC decisions have been in line with our expectations. Given the increasing external sector imbalances and global uncertainties the need for front loaded action was imperative. We continue to see 5.75% repo rate by Dec 2022.

RBI retains the real GDP growth projection for 2022-23 at 7.2 per cent

The real GDP growth projection for 2022-23 is retained at 7.2 per cent, with Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent; and Q4

at 4.0 per cent, and risks broadly balanced. RBI projects the real GDP growth for Q1FY24 at 6.7 per cent.