Vodafone Idea board approves Rs 436 crore fund raise planThe board of telecom major Vodafone Idea on June 22 approved the plan to raise a fund of Rs 436 crore from a Vodafone Group entity, via issuance of up to 42.76 lakh equity shares or warrants convertible into equity shares.The board of directors, which met earlier in the day, has “approved raising of funds aggregating up to Rs 436.21 crore by way of issuance of either: (a) up to 42,76,56,421 equity shares of the face value of Rs 10 each; or (b) up to 42,76,56,421 warrants convertible into equity shares, to Euro Pacific Securities Ltd (a Vodafone Group entity and promoter of the company), on a preferential basis”, a regulatory filing noted.

Gold Prices Today: Yellow metal to come under selling pressure after Powell’s comments; support around Rs 50,500

“The notion that precious metal prices are range-bound suggests that there may be selling pressure near the range’s upper end. Gold has resistance at Rs 51300 and support at Rs 50500. Silver has…

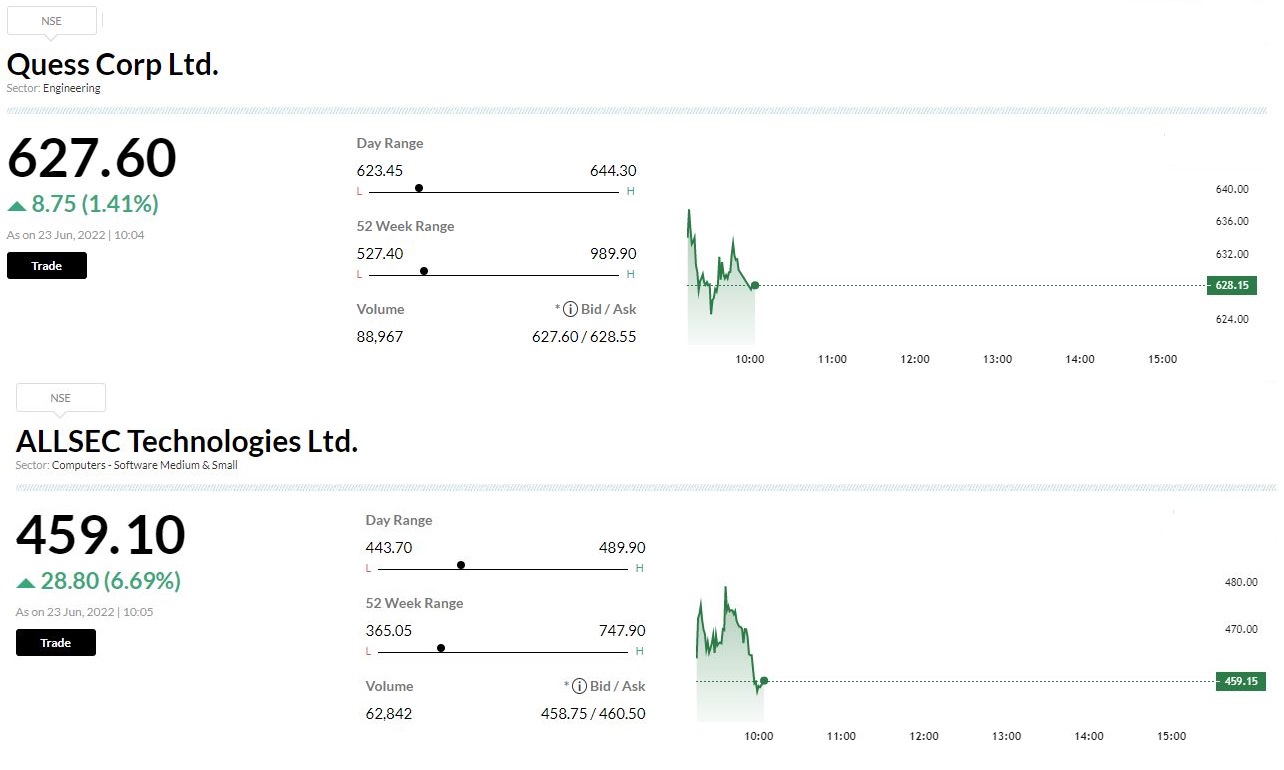

Allsec Technologies, Quess Corp board approve Scheme of AmalgamationThe board of directors of Allsec Technologies and Quess Corp in their respective meetings have approved the Scheme of Amalgamation which provides for the merger of Allsec into Quess.

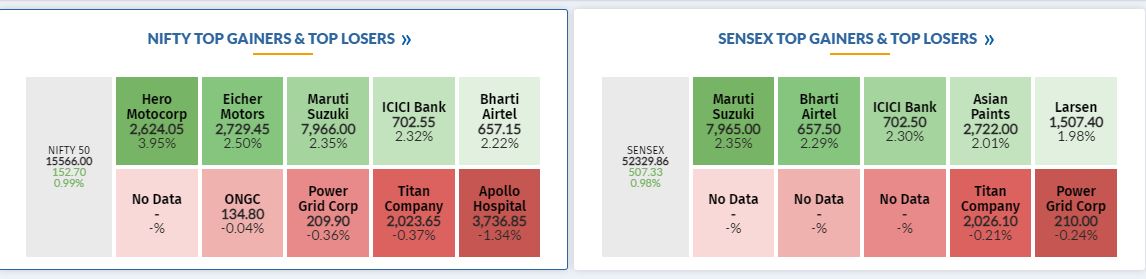

Market at 10 AMBenchmark indices were trading higher with Nifty above 15500.The Sensex was up 488.92 points or 0.94% at 52311.45, and the Nifty was up 151.20 points or 0.98% at 15564.50. About 2028 shares have advanced, 640 shares declined, and 95 shares are unchanged.

India’s January-March current account deficit falls to $13.4 billion

India’s current account deficit (CAD) fell to $13.4 billion in January-March 2022 from $22.2 billion in October-December 2021, according to data released by the Reserve Bank of India (RBI) on June 22. The deficit was $8.1 billion in January-March 2021. In percentage terms, the CAD in January-March 2022 was 1.5 percent of GDP, down from 2.6 percent of GDP the previous quarter.

“The sequential decline in CAD in Q4:2021-22 (January-March) was mainly on account of a moderation in trade deficit and lower net outgo of primary income,” the central bank said. India’s merchandise trade deficit fell to $54.5 billion in the first quarter of 2022 from $59.8 billion the previous quarter, helping bring down the CAD.

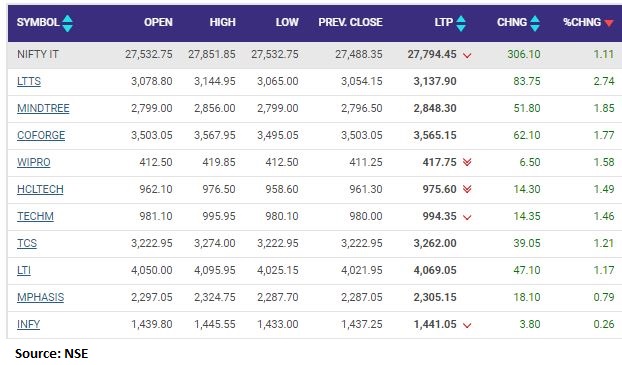

Nifty Information Technology index added 1 percent supported by the L&T Technology Services, Mindtree, Coforge

Gold Prices Update:

Gold prices inched lower on Thursday, pressured by expectations of aggressive interest rate hikes after the U.S. Federal Reserve chief doubled down on the central bank’s fight against inflation.

Spot gold was down 0.2% at $1,832.91 per ounce by 0239 GMT. U.S. gold futures fell 0.2% to $1,834.30.

BSE Auto index gained 1 percent led by the Hero MotoCorp, Eicher Motors, Tata Motors

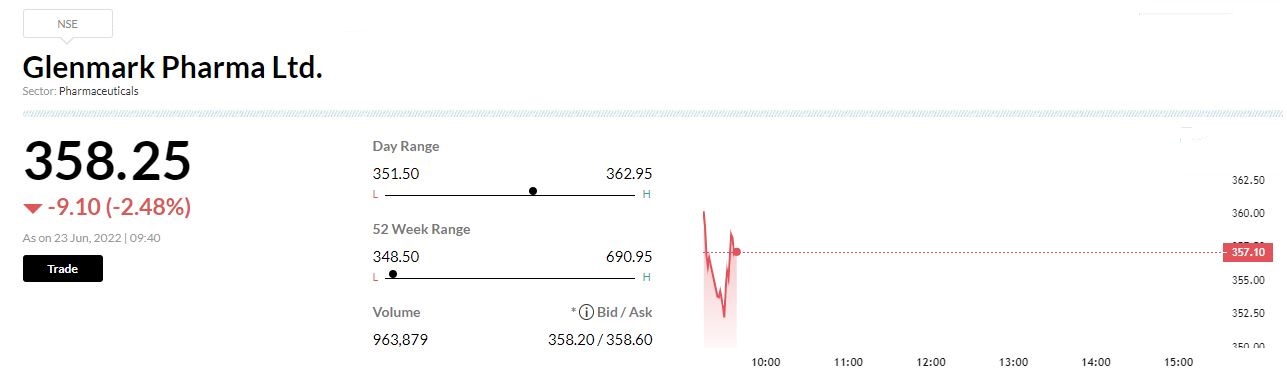

USFDA issues Form 483 with 6 observations for Glenmark Pharma’s Baddi unitThe USFDA has issued Form 483 with six observations after an inspection at Glenmark Pharma’s formulation manufacturing facility based out of Baddi, India between June 13, 2022 and June 22, 2022. The company is committed to undertake all necessary steps required to address their observations at the earliest. The Company is committed to maintaining the highest quality manufacturing standards at all of its facilities across the globe, company said in its release.

Trade Spotlight | What should you do with Matrimony, Sterling Tools, IOL Chemicals, ITI, Trident on Thursday?

At current juncture, Trident is in crucial support zone of Rs 35-36. Moreover, exactly at those levels, we have seen Bullish Engulfing on June 21 along with volume picking up and it is a sign of…

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

With every passing day the probability of the US economy falling into recession is increasing. This will keep the markets weak till there are indications of inflation cooling enabling the Fed to go a bit slow on raising rates. Such a scenario will emerge only if there is a big dip in crude prices.

Since the Nifty has clearly broken the lower band of 15800- 16800 in which it was trading for some time, the structure of the market has become weak. Relentless selling by FPIs and expectations of further selling have created a trade set-up where every rally will be sold into.

The only sensible investment strategy in this complex and uncertain time is to buy high-quality stocks on dips and wait with patience.

Apart from financials which look good, IT gaining from rupee depreciation and select autos gaining from metal price crash are good buys for long-term investment.

Daily Voice | Large cap space more attractively priced right now, expect migration from mid-small caps if volatility continues, says Abhay Agarwal of Piper Serica

We expect FPI flows to become positive only after the global markets stabilize and crude price corrects to well under $100 a barrel.