Sharekhan View On Ashok Leyland:

We expect Ashok Leyland to benefit from the faster recovery in CV volumes and improvement in EBITDA margins, led by operating leverage benefits.

The company is well placed in the industry to benefit from increased economic activities related to infrastructure, mining, and e-commerce, aided by its focus on growing its market share through increased penetration across all regions and new product launches.

The company’s profitability is expected to improve significantly in the medium term, with its EBITDA expected to post a 166% CAGR over FY2021-FY2023E.

Investments by investors and strategic partners in its EV subsidiary can lead to value unlocking and re-rating of the stock going forward.

We retain our buy rating on the stock with a revised price target of Rs 165.

Nifty Information Technology index rose 1 percent led by the Coforge, Mphasis, Mindtree

Macquarie View on One97 Communications:

Broking firm Macquarie has maintained underperform rating on One97 Communications with a target at Rs 450 per share.

The profitability still an uphill battle, while there was a marginal improvement in EBITDA losses and operating take rates are still weak.

The financial services business still sub-scale, however core business model uncertainties remains. It could take 12 quarters for EBITDA losses to break-even, reported CNBC-TV18.

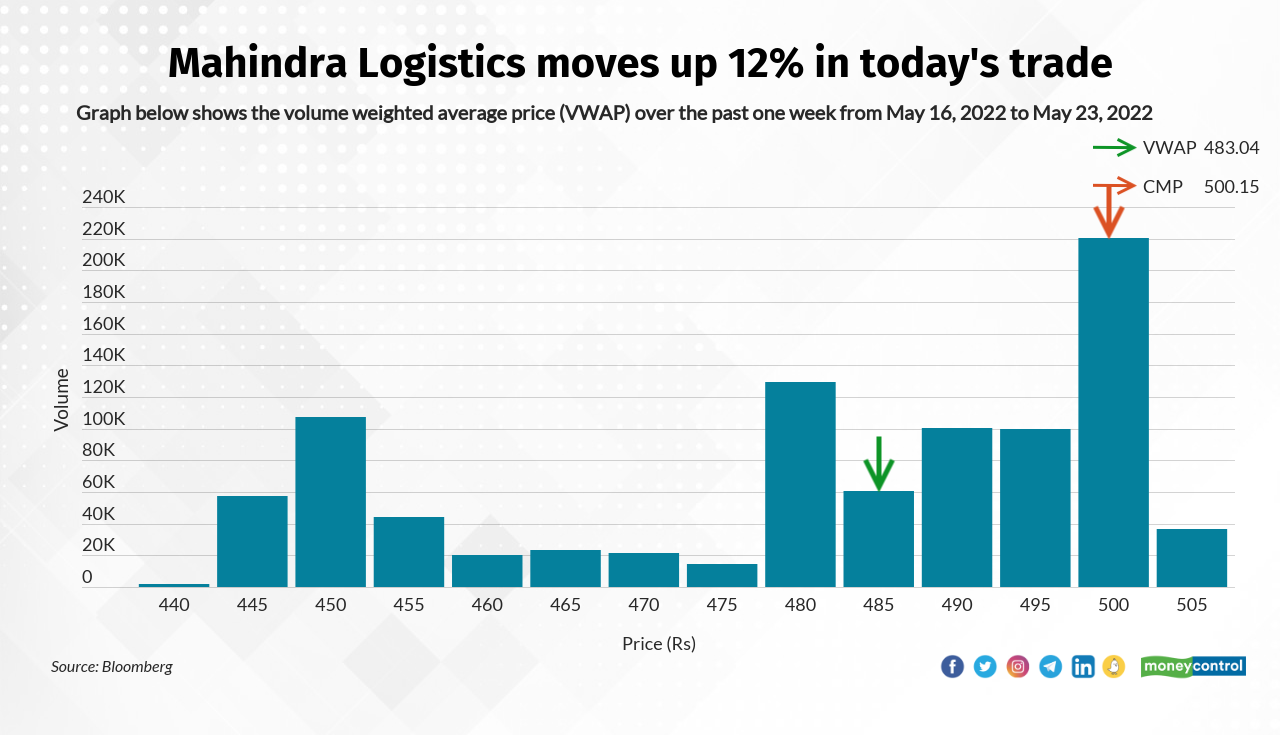

Mahindra Logistics was quoting at Rs 495.40, up Rs 45.05, or 10 percent. It has touched an intraday high of Rs 507 and an intraday low of Rs 461.70. The scrip was trading with volumes of 34,076 shares, compared to its five day average of 9,242 shares, an increase of 268.72 percent.

#OnCNBCTV18 | Announcements made over the weekend are not the only stress on subsidy. Fiscal consolidation has been hit quite significantly, says Aurodeep Nandi of Nomura pic.twitter.com/SyG9w8BL7b

— CNBC-TV18 (@CNBCTV18Live) May 23, 2022

eMudhra IPO updates: India’s largest licensed certified authority (CA) in the digital signature certificates space, eMudhra Limited, saw its public issue being booked 66 percent on the second day of subscription.

Investors have bid for 74.76 lakh shares against an IPO size of 1.13 crore units. Retail investors booked 1.27 times or 72.94 lakh shares of the portion set aside for them. Non-institutional investors booked 7 percent or 1.82 lakh shares allotted to them, while qualified institutional buyers were yet to subscribe to the issue.

Gulf Oil Lubricants Q4: Net profit grew 6% at Rs 63.4 crore against Rs 59.8 crore (YoY). Revenue was up 23.5% at Rs 638.9 crore against Rs 517.4 crore (YoY). EBITDA rose 14.1% at Rs 89.1 crore against Rs 78.1 crore (YoY). EBITDA margin at 13.9% against 15.15 (YoY).

Market Update at 11 AM: Sensex is up 352.07 points or 0.65% at 54678.46, and the Nifty added 78 points or 0.48% at 16344.20.

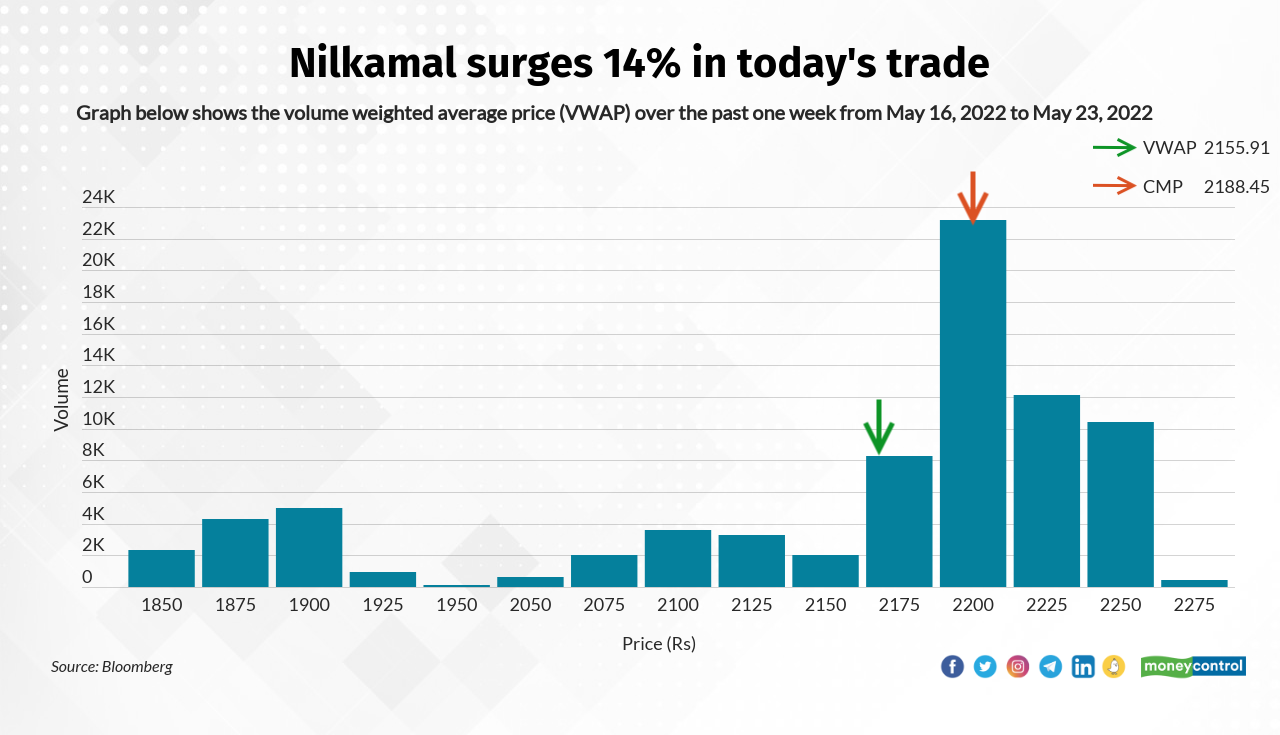

Nilkamal was quoting at Rs 2,182.65, up Rs 269.15, or 14.07 percent and trading with volumes of 3,267 shares, compared to its five day average of 184 shares, an increase of 1,679.41 percent.The share touched a 52-week high of Rs 3,174 and a 52-week low of Rs 1,830.80 on 03 August, 2021 and 17 May, 2022, respectively. Currently, it is trading 31.23 percent below its 52-week high and 19.22 percent above its 52-week low.

Goldman Sachs View on One97 Communications:

Research firm Goldman Sachs has maintained buy rating on One97 Communications with a target at Rs 1,070 per share.

The Q4 exhibited another quarter of strong & improving monetisation of payments vertical as the growth momentum for financial services & cloud business remained robust.

The cash burn has been improving, while company reiterated its guidance of adjusted EBITDA breakeven by September 2023, reported CNBC-TV18.

CLSA View On Ashok Leyland:

Brokerage firm CLSA has downgraded Ashok Leyland rating to outperform from buy and raised the target to Rs 149 per share.

The sharp increase in ASPs & cost management improved profit & margin. And CV upcycle is likely to last for next 3 years, reported CNBC-TV18.

Ashok Leyland was quoting at Rs 137.30, up Rs 7.00, or 5.37 percent on the BSE.

Metal stocks slump after government imposes export duty

ICICI Securities has said it is an “extremely negative development” for the steel sector and it expects broad-based multiple de-rating