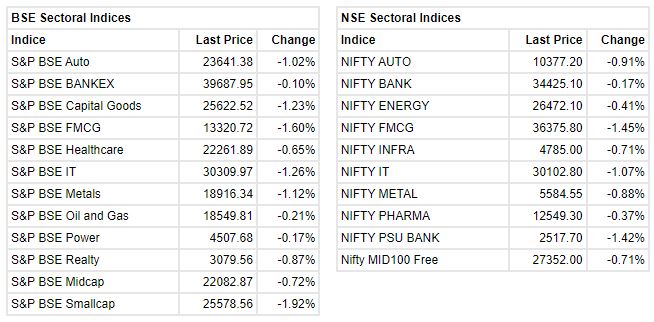

Market update at 11 AM: Sensex is down 428.53 points or 0.79% at 53936.32, and the Nifty shed 120.60 points or 0.74% at 16119.40.

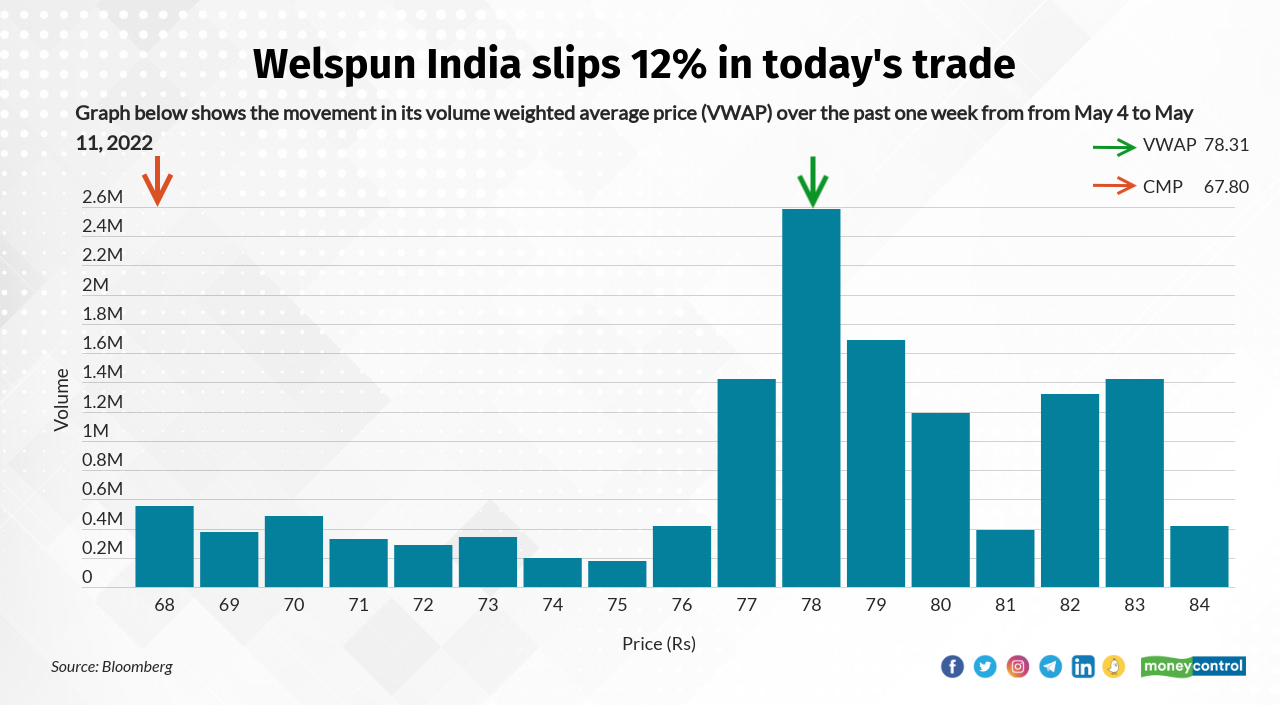

BuzzingWelspun India touched 52-week low of Rs 63.20, falling 15 percent after company reported a 62 percent year-on-year fall in consolidated profit at Rs 51.25 crore in quarter ended March 2022, impacted by lower operating income, lower other income, and tepid topline growth. Revenue grew by 4.3 percent to Rs 2,227 crore and EBITDA increased by 29.3 percent to Rs 226.5 crore during the same period.

Morgan Stanley View on Cipla

The brokerage house has kept an overweight rating on Cipla with a target of Rs 1,122 per share.

Morgan Stanley expects mid-teen growth for branded generics business and mid-teen growth for high-value complex launches in the US.

The company continues to build a robust pipeline of inhalers and keeps building complex injectables and peptides for the longer term, CNBC-TV18 reported.

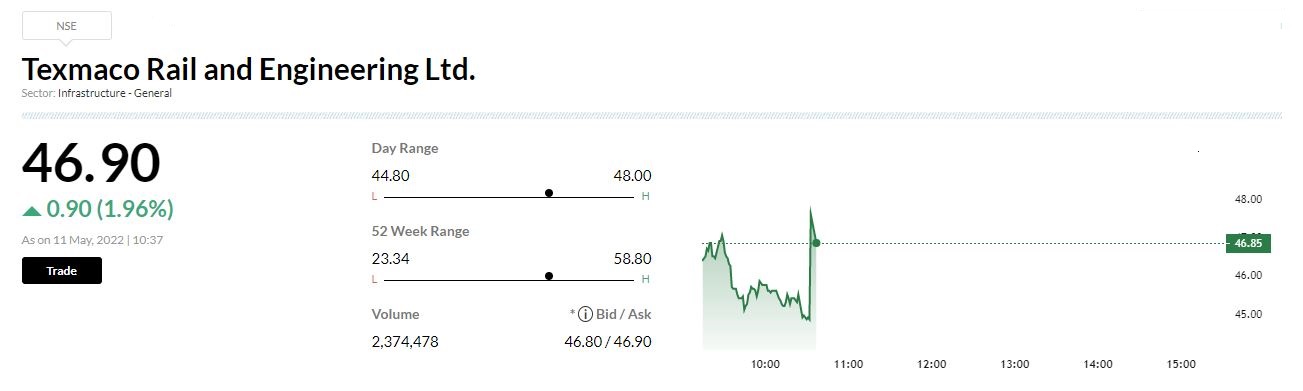

Texmaco Rail receives orderTexmaco Rail and Engineering has received an order for 20.067 wagons valuing Rs 6,450 crores approximately (to be executed over a period ofthirty-nine months) against the recent Railway tender for wagons issued by the Indian Railways, company said in its press release.

Delhivery IPO Updates:

The initial public offering of logistics services provider Delhivery saw investors bid for 2.25 lakh shares against IPO size of 6.25 crore shares on the first day of bidding.

The offer size has been reduced to 6.25 from 10.75 crore shares as the company has raised Rs 2,346.7 crore from 64 anchor investors including Baillie Gifford Pacific Fund, Schorder International, AIA Singapore, Amansa Holdings, Aberdeen, Goldman Sachs, and Singapore.

Retail investors bid for 2 percent of the shares reserved for them, while employees booked 1 percent of their portion.

The company has reserved shares worth Rs 20 crore for employees who will get shares at a Rs 25 discount to the final offer price. The price band for the offer, which closes on May 13, has been fixed at Rs 462-487 per share.

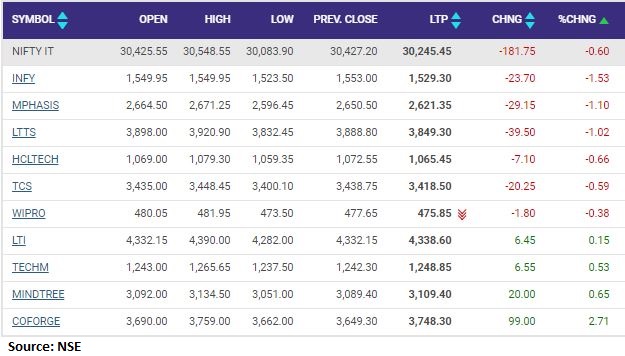

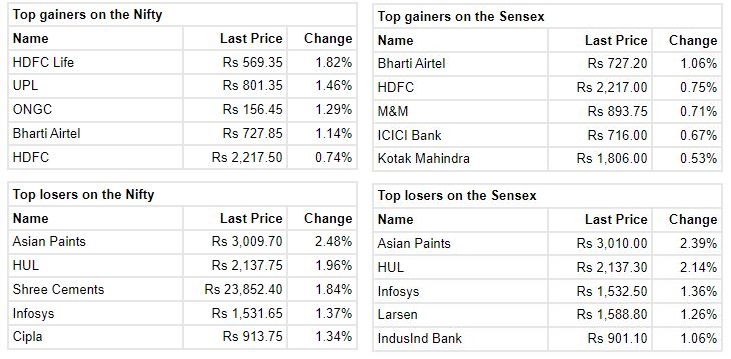

Nifty Information Technology index down 0.6 percent dragged by the Infosys, Mphasis, L&T Technology Services

Goldman Sachs View on Cipla:

The foreign research house has kept a sell rating on Cipla and slashed target price to Rs 850 per share.

Sales/EBITDA grew 14/-6% year on year which was well below consensus, while higher US/India sales were partially offset by weakness in bulk drug business.

The US revenue improved on back of momentum in Albuterol & Arformoterol.

The research firm lowered FY23-24 earnings per share (EPS) estimates by 2-11%, CNBC-TV18 reported.

Venus Pipes and Tubes IPO Updates:

The initial public offering of stainless steel pipes and tubes maker Venus Pipes and Tubes was subscribed 2 percent on day one as investors bid for 80,914 shares against the IPO size of 35.51 lakh shares.

The company raised Rs 49.62 crore from three anchor investors a day ahead of the issue opening, reducing the offer size from 50.74 to 35.51 lakh shares.

Anchor investors bid at the higher end of IPO price band of Rs 310-326 per share.

Retail investors bid for 4 percent of the quota, while the portion set aside for non-institutional investors was subscribed of 1,380 shares against 7.61 lakh shares. Qualified institutional buyers are yet to participate in the offer.

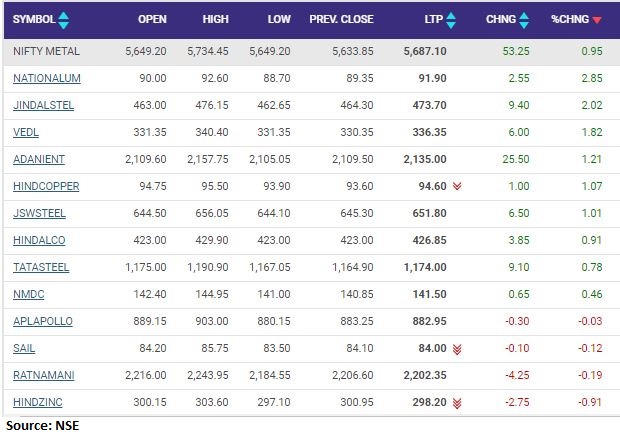

Nifty Metal index trading higehr supported by the NALCO, Jindal Steel, Vedanta

Market at 10 AMBenchmark indices were trading lower in the volatile session with Nifty below 16200.The Sensex was down 200.37 points or 0.37% at 54164.48, and the Nifty was down 47.80 points or 0.29% at 16192.20. About 937 shares have advanced, 1847 shares declined, and 97 shares are unchanged.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Three trends stand out in the ongoing bear phase in the market. One, India is outperforming: while Nasdaq and S&P 500 are down 27% and 17% from the peak, Nifty is down only 12%. Two, large-caps are outperforming mid-and small-caps: Small-cap and Mid-cap indices are down 24% and 17% respectively from the peak while Nifty is down only 12%. Three, value is outperforming growth.

Sustained buying by DIIs and retail investors is imparting resilience to the market even when FPIs continue to be in the sell mode. An unhealthy trend in the market is retail investors chasing low-grade cheap stocks.

The only sensible strategy in this highly volatile environment is to buy small quantities of high quality stocks for the long-term and refrain from speculation.