For all Budget related news including in depth analysis and detailed information, click here

Max Financial Large Trade | 12.27 lakh shares (0.35% equity) worth Rs 97.53 crore change hands at average of Rs 795 per share.

Max Financial Services was quoting at Rs 777.80, down Rs 57.75, or 6.91 percent.

Dilip Buildcon has received the letter of acceptance (LOA) for two (2) HAM projects worth Rs 1,373.6 crore from the National Highways Authority of India.

| Company | CMP | High Low | Fall from Day’s High |

|---|---|---|---|

| UltraTechCement | 7,202.10 | 7,239.00 7,046.00 | -0.51% |

Wipro401.50 403.90

399.55-0.59%

Chirag Mehta, CIO, Quantum AMC

As expected, the budget is heavy on Capex (at 10 lakh crore, increase of 37% from FY23 revised estimates) which is needed to ensure the cyclical recovery continues. Infra (railways 2.4 lakh crore, 50 new airports and clean energy 35,000 crores) along with the Agri push will help the rural economy improve by boosting employment and incomes.

Allocation to affordable housing of 79,000 crores, increase of 66%, will also help the housing market retain momentum. Incentives for local production in form of lower duties will also be helpful.

Overall, this budget push on capex will ensure that the private capex greenshoots really sustain, help inclusive growth and make the economy become more resilient in light of the global slowdown.

Both Equity and Bond markets have reacted positively to the budget, as the thrust to maintain the cyclical recovery and largely maintain fiscal prudence has helped lift sentiments.

Mahindra & Mahindra total auto sales for January 2023 at 64,335 vehiclesMahindra & Mahindra announced that its overall auto sales for the month of January 2023 stood at 64,335 vehicles.In the Utility Vehicles segment, Mahindra sold 32,915 vehicles in January 2023, despite disruptions in supply chain of Crash Sensors and Air Bag ECUs due to availability of semiconductors. The Passenger Vehicles segment (which includes UVs, Cars and Vans) sold 33,040 vehicles in January 2023.Exports for the month were at 3,009 vehicles. In the Commercial Vehicles segment, Mahindra sold 21,724 vehicles in January 2023.

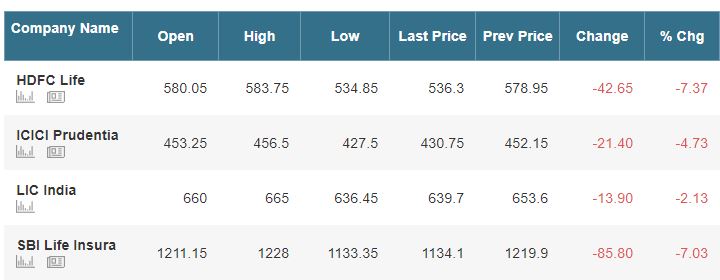

Insurance stocks under pressure

Tata Motors January Auto Sales:Total Domestic Sales up 9.9% at 79,681 units versus 72,485 units, YoY.

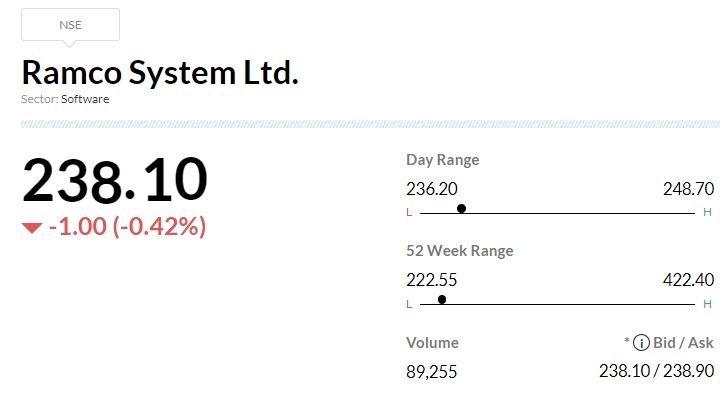

Ramco Systems Q3Ramco Systems has posted loss of Rs 50.2 crore versus loss of Rs 60.3 crore and revenue was up 7.5% at Rs 127.5 crore versus Rs 118.6 crore, YoY.

Lakshmi Iyer, CEO-Investment Advisory, Kotak Investment Advisors

India budget 2023 has offered a multi-dimensional view. The 3 Cs which stand out are – Capex increase – consumption boost – capital gains tax status quo. Mindful of the fact that there is hardly any space for fiscal expansion.

FY 24 FD is pegged at 5.9% and expected to see progressive reduction by FY 2026. Clearly a bull’s-eye budget satisfying most strata of the society and of course a thumbs up from the market as well.

Sanjay Moorjani, Research Analyst, SAMCO Securities

The government’s relief on personal income tax by providing rebate upto Rs.7 lakh and making changes in the slab rate under the new income-tax regime comes as a major boost to the Indian markets. The FM did not tinker with the capital gains which has cheered the markets.

As the disposable income increases, FMCG sector gets a shot in the arm which are already battling inflation. BFSI sector also stands to gain as deposits and investments in insurance, mutual funds rise.

Market at 1 PM

Benchmark indices extended the gains and trading at day’s high with Nifty around 18000.

The Sensex was up 1,175.09 points or 1.97% at 60724.99, and the Nifty was up 293.10 points or 1.66% at 17955.30. About 2195 shares have advanced, 1009 shares declined, and 126 shares are unchanged.