Ajit Mishra, VP – Research, Religare Broking:

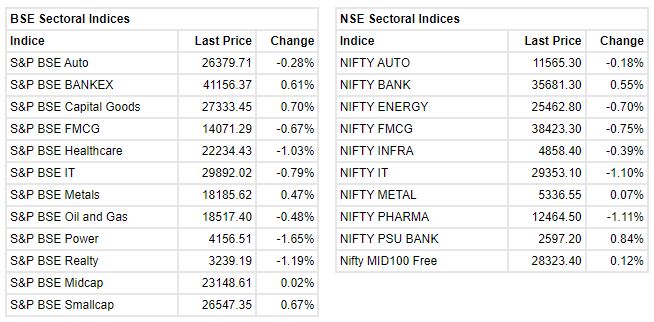

Markets traded volatile and ended marginally lower for the second consecutive session. After the initial uptick, the benchmark drifted gradually lower however recovery in the last half an hour of the trade trimmed losses. Finally, the Nifty index ended lower by 0.3% to close at 16,522.75 levels. A mixed trend was witnessed on the sectoral front wherein banking, capital goods and metals ended higher whereas realty, IT and healthcare traded subdued. Meanwhile, positivity on the broader front kept the participants occupied.

With macro data behind us, the performance of the global markets amid the lingering inflation fear would dictate the trend. Besides, monsoon updates ahead of the monetary policy meet would also be in focus. Amid all, we reiterate our bullish view and suggest continuing with the “buy on dips” approach.

Reliance Brands signs JV with Plastic Legno SPA “to strengthen toy manufacturing ecosystem in India.” pic.twitter.com/e18jolZiCt

— CNBC-TV18 (@CNBCTV18Live) June 1, 2022

Deepak Jasani, Head of Retail Research, HDFC Securities:

Nifty closed lower for the second consecutive session on June 1. Nifty opened flat, and started to fall mildly post 11:45 Hrs. It made a bottom at 14:45 hrs post which a small recovery was seen. At close Nifty was down 0.23% or 37.9 points at 16546.7 Volumes on the NSE were lower than recent averages. Nifty has corrected the earlier upmove gradually and could see the next leg up soon. 16414 is an important support.

Mohit Nigam, Head – PMS, Hem Securities:

Indian benchmark indices ended the day on a negative note with Nifty50 closing at 16522 and Sensex closing at 55,381. Benchmark indices made a cautious start amid mixed global market cues. Markets entered green terrain in the late morning session led by strong buying in metal, PSU and oil and gas scrips. But soon the euphoria faded away as sell off in IT scrips dragged the market into negative terrain below the crucial levels of 16500. Though the markets recovered in the last session and closed above crucial levels of 16500.

On the technical front, the key resistance levels for Nifty50 are 16700 and on the downside 16350 can act as strong support. Key resistance and support levels for Bank Nifty are 36200 and 35000 respectively.

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained choppy for the day as the benchmark index ended without a directional move. On the higher end, 50-EMA has been acting as a crucial resistance. However, the Nifty slipped not very far from the previous close. The trend remains sideward for the near term. Support is visible at 16400, whereas on the higher end, resistance is likely to remain intact at 16700.

Vinod Nair, Head of Research at Geojit Financial Services:

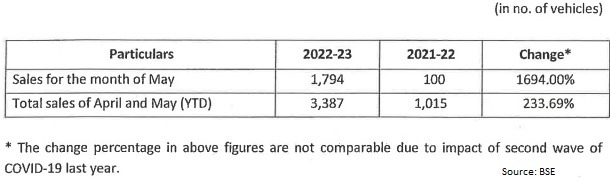

Continuous rise in crude oil prices due to EU’s decision to partially ban Russian oil hindered global market. Indian economy registered a growth of 8.7% in FY22 but is expected to slow down in FY23 to 7.2%, as per the latest RBI forecast. Auto sales data, posted by major manufacturers, witnessed growth in passenger and commercial vehicle segments due to pick up in the construction sector however two-wheeler and tractor segments continued to remain under pressure.

Just in: Ashwani Bhatia takes charge as Whole-time Member at SEBI

Rupee at close: Rupee ends at 77.52 per US dollar against May 31 close of 77.64 per US dollar

Market at Close: Benchmark indices ended in the red for the second concutive day as Sensex slipped 185.24 points or 0.33% at 55381.17, and the Nifty shed 61.70 points or 0.37% at 16522.80. About 1800 shares have advanced, 1450 shares declined, and 132 shares are unchanged.Among the sectors, pharma, power, realty were the top losers while buying was seen in financials and capital goods names. The midcap index ended flat while the smallcap index added half a percent.

Atul Auto In FocusThe company sold 1,794 units in the month of May, up significantly from 100 units sold in same month last year

Expert’s Take on Market

Due to the spectacular run witnessed over the last 2 years, equity markets had, earlier this year, moved to a fairly valued zone as a result of which allocation to equities in investor portfolios were closer to their strategic allocation limits. For the last 12 months, we have been cautious on equities as an asset class given the expensive valuations, Anupama Sharma, Executive Director at IIFL Wealth said.

However, markets have corrected since the beginning of the year due to the war in Ukraine, concerns over the Omicron impacting growth recovery, and the higher inflation and interest rates dampening investor sentiment. Further, these upheavals have impacted ground level growth as well with recent data indicating that India’s economic growth slowed down to 4.1% in the fourth quarter of FY22 and estimates for full year GDP growth in FY22 getting pruned down to 8.7% from 8.9% estimated in February.

Markets have corrected over the last 6 months and participants are now quickly discounting the impact of high inflation and the rising interest rate scenario. We believe that markets are likely to continue witnessing volatility. In the backdrop of such a landscape, investors should maintain asset allocation disciplines and take advantage of the volatility by building equity positions at compelling valuations, she said.

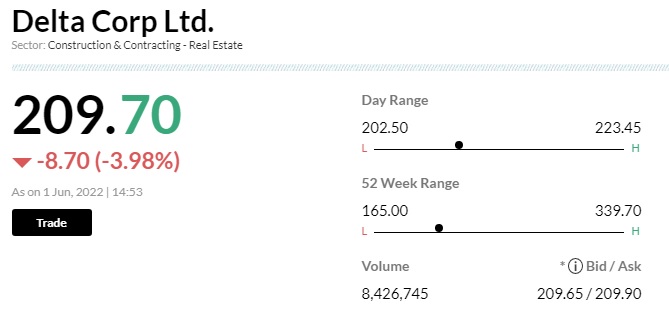

Delta CorpAce investor Rakesh Jhunjhunwala sold 25 lakh equity shares (0.93 percent of total shareholding) in the company via open market transactions.With this, Jhunjhunwala’s shareholding stands reduced to 6.16 percent, down from 7.1 percent earlier.