JUST IN | China Central Bank has cut reserve ratios by 50 basis points.

Tata Power, IIT Madras signed MoU:

Tata Power and IIT Madras have inked pact to collaborate on R&D, consultancy, advocacy, training and technology solutions.

According to a statement, the two organisations have signed a memorandum of understanding (MoU) to facilitate this collaboration.

As a part of the MoU, Tata Power and IIT Madras will aim to pursue advanced research in areas of future technology.

Tata Power Company was quoting at Rs 221.95, down Rs 3.65, or 1.62 percent.

HDFC Securities on HCL Technologies

HCL Technologies has a strong globally diversified presence and provides comprehensive IT services to an established customer base. It has strong expertise in engineering and R&D services and its end-customers are spread across industry segments.

The company continues to win multiyear deals in Cloud transformation, cyber security, etc. The company has a good track record in client acquisitions and engaging in vendor consolidation opportunities over the recent past. HCL Tech has strong presence in data science and engineering. The company expects healthy double digit growth in revenues in FY22E

We believe the base case fair value of the stock is Rs 1271 (20x Sept FY23E EPS) and the bull case fair value of the stock is Rs 1339 (21x Sept FY23E EPS) over the next two quarters. Investors can buy at LTP and add further on dips in the Rs 1042-1062 band (16.5x Sept FY23E EPS). At the LTP of Rs 1171, the stock is trading at 18.4x Sept FY23E EPS

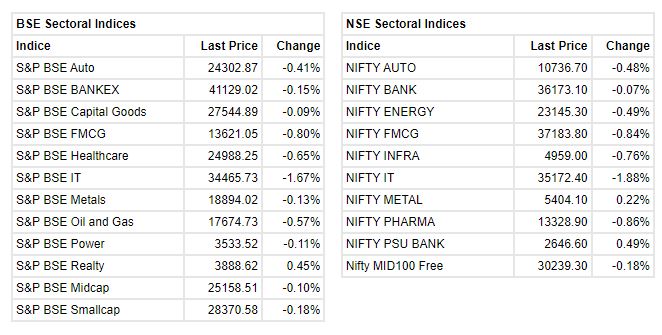

European markets are trading in the green with FTSE, CAC and DAX up over half a percent each

Gaurav Garg, Head of Research, Capitalvia Global Research: Indian equity benchmarks added losses in the noon session, with both Sensex and Nifty trading in the red. Indian shares fell as the country recorded more cases of the Omicron variant over the weekend. Investors awaited the central bank decision that could leave interest rates on hold to sustain an economic recovery from the pandemic lows in 2020. Our research suggests that 56800-56350 levels may act as support level in the market. We can expect the market to take a reversal from the support levels of 56800-56350.

Anand Rathi IPO updates: The initial public offering of Anand Rathi Wealth, one of the leading non-bank wealth solutions firms in India, has been subscribed 5.21 times on December 6, the final day of bidding, garnering bids for 4.41 crore equity shares against the IPO size of 84.75 lakh equity shares.

The reserved portion for qualified institutional buyers was subscribed 60 percent, and that of non-institutional investors saw 8.19 times subscription. Retail investors continued to provide strong support to the issue with their allotted quota being subscribed 6.82 times, and employees have put in bids 1.05 times the portion set aside for them.

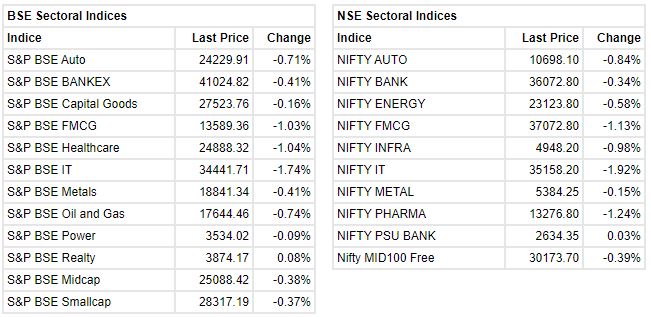

Market update at 2 PM: Sensex is down 503.59 points or 0.87% at 57192.87, and the Nifty down 153.20 points or 0.89% at 17043.50.

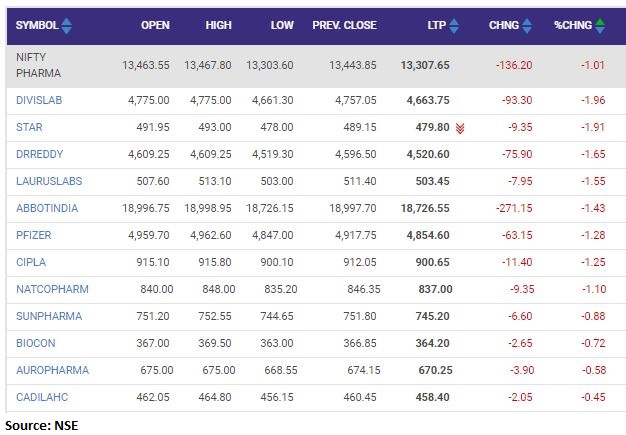

Nifty Pharma index shed 1 percent dragged by the Divis Laboratories, Dr. Reddy’s Laboratories, Strides Pharma Science

Anand Rathi IPO sees 4.81 times subscription on day 3

The initial public offering of Anand Rathi Wealth, one of the leading non-bank wealth solutions firms in India, has been subscribed 4.81 times on December 6, the final day of bidding, garnering bids for 4.08 crore equity shares against the IPO size of 84.75 lakh equity shares.

The reserved portion for qualified institutional buyers was subscribed 18 percent, and that of non-institutional investors saw 7.63 times subscription.

Retail investors continued to provide strong support to the issue with their allotted quota being subscribed 6.49 times, and employees have put in bids 1.03 times the portion set aside for them.

Yash Gupta, Equity Research Analyst, Angel One

Shriram Properties Limited IPO to open from 8th December 2021 to 10th December 2021, company has fixed the price band of Rs 113 – Rs 118. The total issue size will be Rs 600 crores which include Rs 250 crores of fresh issue and an offer for sale of Rs 350.

The company has fixed the market lot of 125 shares. The expected listing will be on 20th December 2021. Company has reported a negative profit after tax of Rs 60 crores in the first half of 2022 along with that company has also reported a negative profit after tax of Rs 68.1 crores in 2021.

Company has reported degrowth in revenue since the last 2 years, 2021 the company reported revenue of Rs 501 crores down by 20.7% from Rs 631.8 crores in 2020.

Market at 1 PMMarket erased some of the intraday losses but still trading lower with Nifty below 17100.The Sensex was down 390.74 points or 0.68% at 57305.72, and the Nifty was down 119.20 points or 0.69% at 17077.50. About 1573 shares have advanced, 1544 shares declined, and 141 shares are unchanged.

Inox Wind subsidiary to raise up to Rs 500 crore via IPO:

The board of directors of Inox Wind’s material subsidiary, Inox Green Energy Services (Earlier known as Inox Wind Infrastructure Services Limited) (IGESL) in their meeting held today i.e. 6 December, 2021, has approved fund raising, by way of an initial public offer of its Equity Shares comprising of fresh issue of equity shares aggregating upto Rs 500 crore (fresh issue) and/ or an offer of sale of equity shares by certain existing and eligible shareholders of the company, the company said in a stock exchange filing.

Inox Wind was quoting at Rs 143.20, down Rs 3.10, or 2.12 percent on the BSE.