Rail Vikas Nigam signs MoU with Kyrgyz Republic for development of railway corridor projects

“Rail Vikas Nigam has entered into an MoU with Economic Policy Research Institute of KYRGYZ Republic, Government of Kyrgyzstan, for development of railway corridor projects in Kyrgyz Republic specially to connect from Bishkek to Karakechenskoye,” company said in the release.

Both parties will exchange the information(s) and promote the implementation of railway project.

Rail Vikas Nigam was quoting at Rs 34.40, up Rs 0.85, or 2.53 percent on the BSE.

S&P keeps India’s GDP growth forecast unchanged at 9.5%:

S&P Global Ratings on Tuesday kept India’s economic growth forecast for the fiscal year to March 2022 unchanged at 9.5 per cent but raised its predictions for the subsequent year on broadening out of the recovery.

“India is learning to live with the virus. Following the peak in COVID-19 cases around mid-year, the stringency index has declined, mobility has recovered, and consumer and business confidence has improved,” S&P Global Ratings said in a report.

Mohit Ralhan, Managing Partner & Chief Investment Officer of TIW PE:

The GDP growth rate of 8.4% in September quarter indicates a significantly robust economic recovery. It’s better than expected and marked fourth straight quarter of expansion, in spite of a severe second wave of Covid. The growth has also been broad based with most of the economic indicators showing healthy uptick.

Agriculture has maintained the growth rate of 4.5% and services sector picked up pace at 10.2%. The gross fixed capital formation and private consumption both grew at a healthy rate of 11% and 8.6% respectively.

The economy has gained significant momentum now with Real GDP coming ahead of the pre-COVID level. India looks on track to achieve the projected 9.5% GDP growth for the full financial year, retaining its position as one of the fastest growing among major economies.

BSE Metal index added 1 percent supported by the Hindalco Industries, JSW Steel, SAIL, Tata Steel

Fire incident at Zen Technologies

There was a fire incident around 10:00 PM (IST) on November 30, 2021 night at company’s demonstration center located in Maheshwaram Hardware Park near Shamshabad airport. Fortunately, no one was injured during the incident and there was no loss of life, company said in its press release.

Zen Technologies was quoting at Rs 206.50, up Rs 1.50, or 0.73 percent.

Fed may accelerate pullback in economic support: Jerome Powell

Chairman Jerome Powell said on Tuesday that the Federal Reserve will consider acting more quickly to dial back its ultra-low-interest rate policies to counter higher inflation, which he acknowledged will likely persist well into next year.

The Fed is currently reducing its monthly bond purchases, which are intended to lower longer-term borrowing costs, at a pace that would end those purchases in June. But he made clear that Fed officials will discuss paring those purchases more quickly when it meets next mid-December.

Doing so would put the Fed on a path to begin raising its key short-term rate as early as the first half of next year. A higher Fed rate would, in turn, raise borrowing costs for mortgages, credit cards and some business loans.

NMDC fixes/revises prices

NMDC has fixed/revised prices of different grades of Manganese Ore and other products, effective from 01.12.2021.

The prices for the month of December, 2021 for all Ferro grades, SMGR grades (Mn-30% & Mn-25%) and Fines have been continued as prevailing since 01.11.2021 w.e.f. midnight of 30.11.2021/ 01.12.2021.

The prices for the month of December, 2021 for all chemical grades of manganese ore have been reduced by 5% on the prices prevailing since 01.11.2021 w.e.f. midnight of 30.11.2021/01.12.2021.

NMDC was quoting at Rs 135.30, up Rs 2.05, or 1.54 percent on the BSE.

Escorts Agri Machinery sold 7,116 tractors in November 2021

Escorts Agri Machinery (EAM) in November 2021 sold 7,116 tractors as against 10,165 tractors sold in November 2020, a drop of 30 percent year-on-year.

Domestic tractor sales in November 2021 was at 6,492 tractors as against 9,662 tractors in November 2020.

Export tractor sales in November 2021 was at 624 tractors against 503 tractors sold in November 2020, registering a growth of 24.1 percent

Escorts was quoting at Rs 1,853.00, up Rs 7.35, or 0.40 percent on the BSE.

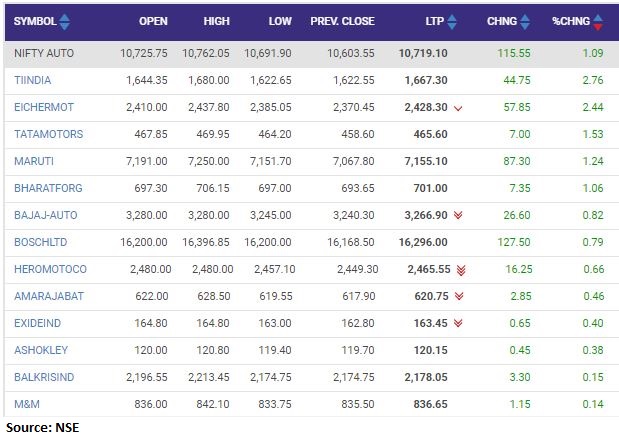

Nifty Auto index rose 1 percent supported by the Tube Investments Of India, Eicher Motors, Tata Motors

Madhavi Arora, Lead Economist, Emkay Global Financial Services:

The continued vaccine drive led mobility ahead and aid the pick-up in the contact-sensitive services sector has helped in a healthy growth print. Even with YoY moderation to 8.4% from 20.1% 1Q reflects largely base effect even as sequential momentum has continued to improve.

The data affirm that the economy is on continuous mend and will likely be back to pre-pandemic levels before end-FY22. We reckon that the nascent recovery ahead may partly still be led by capital and profits and may have traces of a scarred and segmented labor market ( as seen by slowing rural demand) and sub-optimal effective fiscal policy stimulus. However, exogenous demand drivers in the form of exports and sustained government capex will need to create a growth bridge till private investment and consumption recover optimally.

To policymakers’ credit, a public investment push appears key to their growth revival strategy. Policy support in the form of physical and social infra outlays will have a large multiplier effect on jobs (even at the bottom of the economic pyramid) and will eventually catalyze private investment. This, in conjunction with initiatives like privatization, tax reforms and expenditure realignment, will likely create fiscal space to fund public investment.

Centre’s April-October fiscal deficit at 36.3% of Budget estimates for FY22

The Centre’s fiscal deficit during April to October that is the first seven months of the year is well below last year’s at Rs 20,200 crore as against Rs 39,200 crore, CNBC-TV18 reported.

It is also 36.3 percent less than the Budget estimates for FY22, data released by the Controller General of Accounts (CGA) has revealed. The central government had set a fiscal deficit target of Rs 15.07 lakh crore for the financial year.

The revenue receipts were at 70.5 percent of this year Budget estimates as against 34.2 percent last year. At the same time, total expenditure stood at 524 percent of the Budget target versus54.6 percent last year.

Gainers and Losers on the BSE Sensex in the early trade: