Akshat Garg, Manager-Research at Investica:

In an emerging mutual fund Industry in India, SEBI is leaving no stone unturned to make the financial eco-system more driving & in line with the global standards, as it floated a consultation paper on Tuesday that aims to push the ESG (Environment, Sustainability and Governance) Schemes towards the true label it carries.

AMCs need to make sure that at least 80% of the portion is invested in those companies which are complying with the ESG standards, and the residual also should not be in stark contrast to the theme.

SEBI has also proposed that ESG theme mutual funds must invest in only those companies that are covered under the mandatory Business Responsibility and Sustainability Report (BRSR). ESG as a theme has already been a cherry flavour in the west, it might take some time to gain the same acceptance in Indian markets, as investors are more hooked on returns.

Shree Digvijay Cement Q2 earnings:

Shree Digvijay Cement has reported net profit at Rs 13.4 crore in Q2FY22 versus Rs 2.5 crore and revenue was up 58.7% at Rs 153.9 crore versus Rs 97 crore, YoY.

Earnings before, interest, tax, depreciation (EBITDA) at Rs 27.7 crore versus Rs 10.4 crore and EBITDA margin at 18% versus 10.7%, YoY.

Shree Digvijay Cement Company was quoting at Rs 83.80, up Rs 1.75, or 2.13 percent on the BSE.

Market at 1 PM

Benchmark indices were trading marginally higher with Nifty holding above 18300.

At 13:02 IST, the Sensex was up 119.30 points or 0.19% at 61469.56, and the Nifty was up 41.40 points or 0.23% at 18309.80. About 1841 shares have advanced, 1145 shares declined, and 99 shares are unchanged.

Asian Paints, Divis Labs, Sun Pharma, SBI and Cipla were among major gainers, while losers included Axis Bank, Bajaj Finance, IndusInd Bank, ONGC and Bajaj Finserv.

Motilal Oswal recommends ‘buy’ on Canara Bank:

Canara Bank share price was up over 4 percent intraday on October 27, a day after the state lender reported a three-fold jump in net profit to Rs 1,333 crore for the quarter ending September 2021 on the back of lower bad loan provisioning, rise in non-interest income and higher cash recovery.

The bank’s net profit was Rs 444 crore in the year-ago period.

Domestic research and broking firm Motilal Oswal has initiated “buy” recommendation on the stock with target of Rs 270 a share, an upside of 34 percent from the market price.

Asahi India Glass Q2 earnings:

Asahi India has posted net profit at Rs 81.1 crore in the quarter ended September 2021 versus Rs 37.3 crore and revenue was up 24.7% at Rs 796.5 crore versus Rs 638.8 crore, YoY

Earnings before, interest, tax, depreciation (EBITDA) rose 26% at Rs 186.6 crore versus Rs 148.3 crore and margin was at 23.5% versus 23.2%, YoY.

Asahi India Glass was quoting at Rs 388.75, up Rs 36.40, or 10.33 percent.

Navkar Corporation gets LoI to set up Inland Container Depot

The Inter-Ministerial committee Government of India, Ministry of Finance, Department of Revenue have accorded approval and issued Letter of Intent for setting up of an Inland Container Depot at Manaba District Morbi, Gujarat.

The office of Divisional Railway Manager (operations), Ahmedabad have accorded in-principle approval for construction of Private Freight Terminal at Manaba Taluka Maliya, Dist. Morbi connecting from Wadharwa Station of Ahmedabad Division.

Navkar Corporation was quoting at Rs 42.75, up Rs 2.30, or 5.69 percent.

Ambuja Cements share price gains post September quarter earnings

Ambuja Cements share price trading higher on October 27 after company reported its September quarter earnings.

Ambuja Cements has posted 10.85 percent jump in its consolidated net profit at Rs 890.67 crore for the third quarter ended September 2021.

The company had reported a net profit of Rs 803.50 crore in the same quarter a year ago.

Its revenue from operations was up 7.74 percent at Rs 6,647.13 crore during the quarter against Rs 6,169.47 crore in the corresponding quarter of the previous financial year.

Market at 12 PMBenchmark indices were trading higher with Nifty holding above 18300.The Sensex was up 138.20 points or 0.23% at 61488.46, and the Nifty was up 43.70 points or 0.24% at 18312.10. About 1880 shares have advanced, 1061 shares declined, and 114 shares are unchanged.

Elara Capital on Bajaj Finance:

Credit cost has peaked and traction on loans will continue to be strong driven by digital focus and geographic expansion. Launch of customer engagement apps will result in customer acquisition at negligible cost.

As such we expect RoA to improve to 4.25% in FY23E from 3.6% in Q2FY22. However, we believe the strong profitability is priced in at 9x PBV FY23E.

We revise target multiple to 7.2x from 6.3x earlier on the back of improving operating performance and digital scale up. We roll over base to FY23E. Our new target price is Rs 6,100 from Rs 4,630 earlier. Stock rates a sell at our new target price.

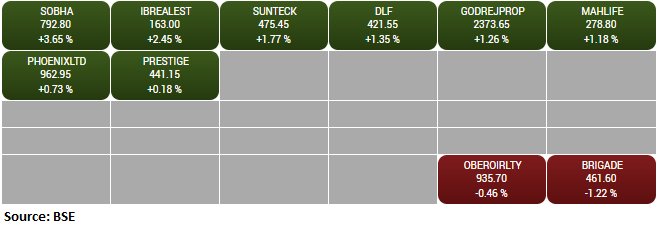

BSE Realty index added 1 percent led by the Sobha, Indiabulls Real Estate, Sunteck Realty

Gold Updates

Gold prices retreated further on Wednesday from a key $1,800/ounce level, as a robust dollar and higher U.S. bond yields dented bullion’s appeal while investors assessed how central banks would address rising inflation pressures.

Spot gold fell 0.2% to $1,788.40 per ounce by 0351 GMT, declining 1.2% since rallying to a more than one-month high late last week. U.S. gold futures dropped 0.2% to $1,789.30.

Benchmark 10-year U.S. Treasury yields rose, increasing the opportunity cost of holding the non-interest bearing metal.

KRChoksey view on Nykaa IPO

We expect Nykaa to benefit from prevailing tailwind in the industry, its strong technology led platform, strong relationship with global brands, diverse portfolio of own brands, content first approach, Omni channel presence, loyal customer base, planned expansion in Middle East and Europe, growth in Tier II & III cities and strong management team.

Considering the prevailing opportunities, investors should look to invest in Nykaa’s IPO for listing gains as well as long term opportunity it presents.