Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Cadila received DCGI approval for a COVID-19 drug: Shares of Cadila Healthcare climbed almost 4 percent in afternoon trade on April 23 after it said Zydus Cadila had received emergency use approval from DCGI for the use of ‘Virafin’, Pegylated Interferon alpha-2b (PegIFN) in treating moderate COVID-19 infection in adults.

“A single dose subcutaneous regimen of the antiviral Virafin will make the treatment more convenient for the patients. When administered early on during COVID, Virafin will help patients recover faster and avoid much of the complications. Virafin will be available on the prescription of a medical specialist for use in

hospital/institutional setup,” the company said in a BSE filing.

Market update: Mid, smallcaps outperform the large-caps

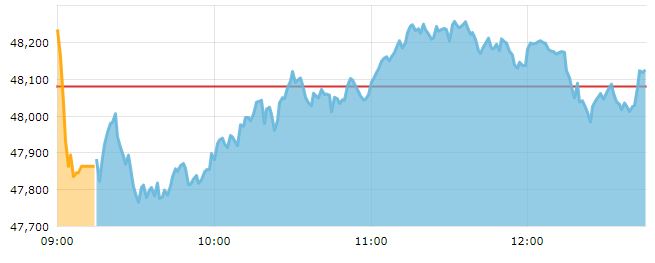

Market benchmarks the Sensex and the Nifty traded lower by half a percent each, with ICICI Bank, Infosys, Hindustan Unilever, HDFC Bank and Bharti Airtel among the top drags.

At 1440 hours, Sensex was 281 points, or 0.59 percent, down at 47,799 while Nifty was 94 points, or 0.65 percent, down at 14,312.

Mid and smallcaps were doing better, The BSE Midcap index was 0.11 percent down while the smallcap index was 0.22 percent up at that time.

Likhita Chepa, Senior Research analyst at CapitalVia Global Research: We have seen the recovery in the market from the level of 14,200 yesterday and we expect the market to continue to sustain the level and continue the rally till the level of 14,500-14,550. The market could range in between the levels of 14,200-14,550 as the uncertainty looms in the market. On the sectoral front, the market has been mixed with no clear direction though the power sector has gained some momentum and has helped the market to stay positive.

Hemant Kanawala, Head – Equity, Kotak Mahindra Life Insurance: The focus of the investors and nation has shifted to sudden rise in Covid cases. The central government has said that they don’t intend to announce national lockdown to control the Covid infection and has also advised State governments to use lockdown as last measure. However, many states have announced varied degrees of restriction on movement of people depending on the severity of the situation in their region. This is expected to impact the economy in this quarter and there have been downgrades to India’s growth in FY22 by upto 1%.

The pace of vaccination will be crucial for quicker normalisation of economic activity. The corporate have started announcing results for the March quarter and there are no major disappointments so far. Consensus is expecting sharp increase in net profit due to the Covid-led disruption in the base quarter. It will be important to observe comments of Banking and domestic consumer oriented companies about impact of recent surge in Covid infection on their business.

Nifty is trading at 21 times 1 year forward EPS, which is close to all time high. Hence upside from valuation rerating is limited and one needs to watch if there are any earnings downgrade due to emerging Covid situation.

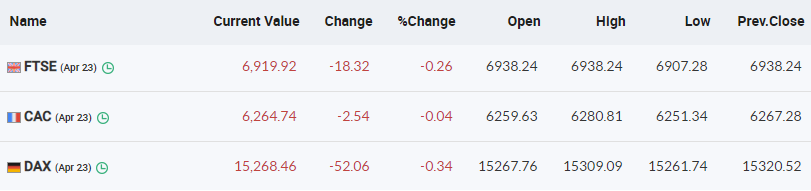

European markets are trading in the red with FTSE and DAX down half a percent

Rakesh Jhunjhunwala-backed Nazara Technologies Clocks 84% Revenue Growth In FY21, EBITDA Grows 470%

Esports business more than doubled to Rs 170.1 crore in FY21 compared to Rs 84.2 crore in FY20.

Bitcoin falls 7% as cryptocurrencies stumble over Joe Biden tax plans: Bitcoin and other cryptocurrencies suffered hefty losses on Friday amid fears that U.S. President Joe Biden’s plan to raise capital gains taxes will curb investment in digital assets. Bitcoin slumped 7% to $48,176 in a third straight session of losses while Ether and XPR suffered double digit tumbles.

Ind Ra revises down India’s FY22 GDP growth forecast to 10.1%

India Ratings and Research on Friday revised down India’s FY22 real GDP growth forecast to 10.1 percent, from earlier projection of 10.4 per cent, citing the second wave of COVID-19 infections and slower pace of vaccination.

India Ratings said the impact of the second wave will not be as disruptive as the first one, despite the daily case load touching three times of the first wave’s peak, as lockdowns are set to be localised ones. Read more

KR Choksey on Nestle India: Nestle India has performed relatively better with sustained growth in the volume and product mix. Amidst lockdown, we expect the growth momentum to continue in the near term, especially for its ready to cook products. However, the management foresees higher commodity prices to continue which might affect the margins which we feel is the area of concern. We expect the topline to grow at CAGR of 9.4% in CY20/CY22E and PAT to increase by CAGR 15.5% in CY20/CY22E.

Overall we remain positive on the back of resilient business, strong brand presence with diversified product mix and high ROE. Since our last update, the shares of Nestle India Ltd. has largely remained unchanged. We continue to apply a P/E multiple of 62x on CY22E EPS of Rs 318 to reflect the continued strong growth and resilience amid COVID-19 and maintain our target price of Rs 19,640 per share; an upside potential of 16.9% to CMP. Accordingly, we reiterate buy on the shares of Nestle India.

Sensex in today’s session so far

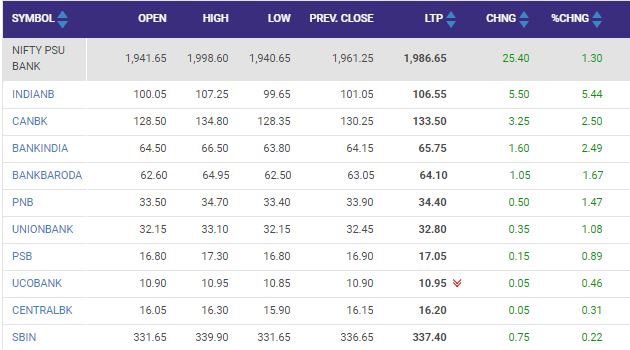

Market update: Nifty PSU Bank index is up with gains of over a percent