VENUS PIPES & TUBES LIMITED IPO SUBSCRIPTION UPDATES

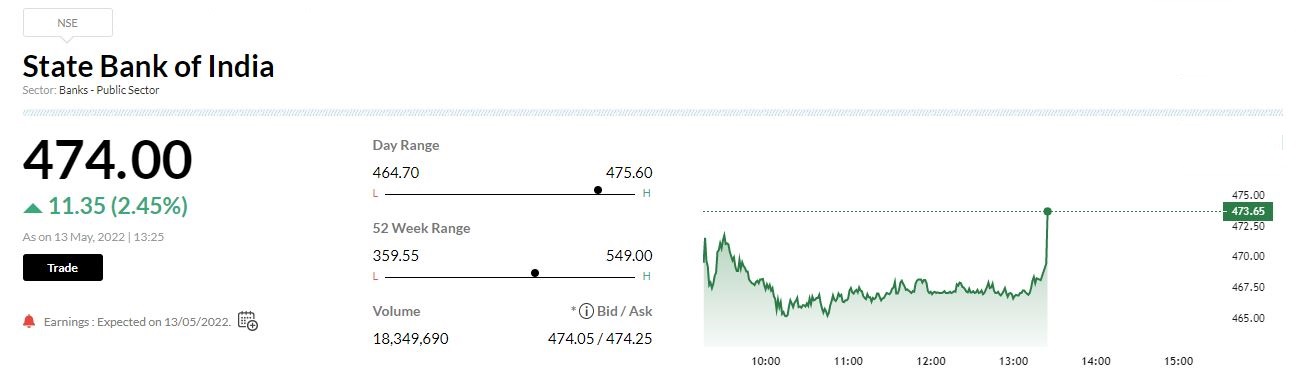

SBI Q4 earnings: SBI Q4 net profit at Rs 9,113.5 crore against Rs 6,450.8 crore and net interest income was at Rs 31,198 crore against Rs 27,067 crore, YoY.Gross NPA was at 3.97% versus 4.50% and net NPA was at 1.02% versus 1.34%, QoQ.

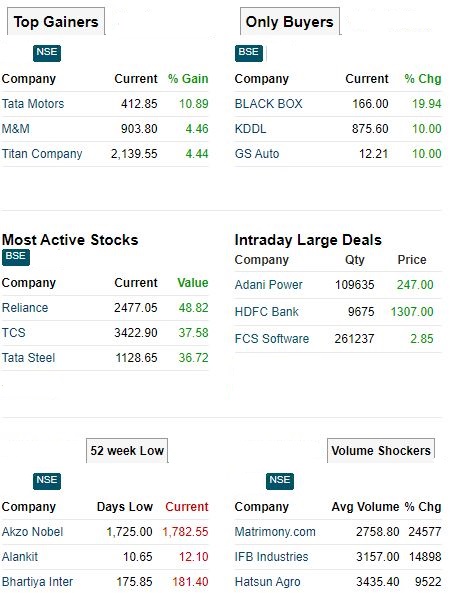

Today’s Stock Market Action

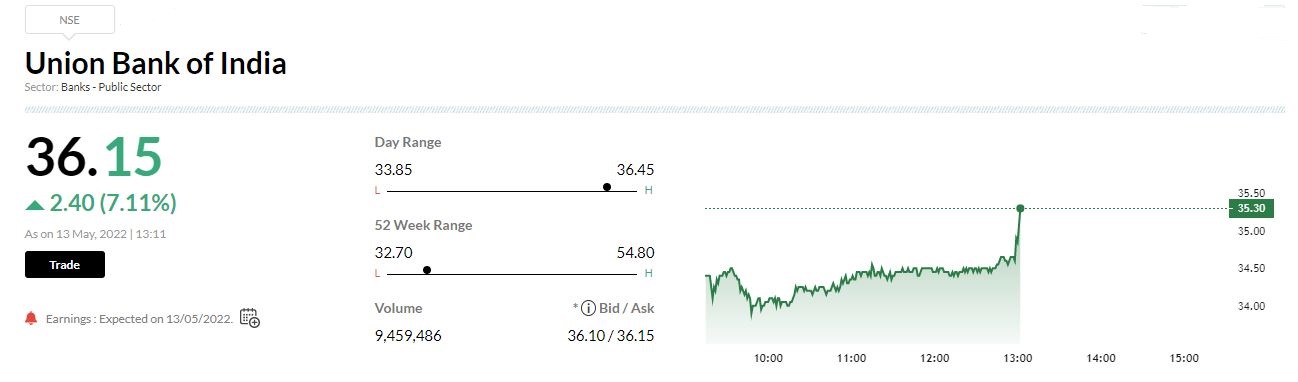

Union Bank of India Q4 Union Bank of India has posted 8.3 percent jump in its Q4 net profit at Rs 1,439.6 crore versus Rs 1,329.8 crore and net interest income was up 25.3% at Rs 6,769.3 crore versus Rs 5,403 crore, YoY.

Rajani Sinha – Chief Economist – CARE Ratings

The IIP growth has improved marginally in March but has broadly remained lacklustre at below 2% in the last five months.

Manufacturing, with biggest share in industrial growth has remained weak. Another concerning aspect is the continued poor performance of consumer durables and non-durables segment that has contracted in March.

For India’s economy to recover, it is very critical for consumption expenditure to start improving, which in turn will help improve capacity utilisation levels and start the private investment cycle. The rising inflation will be a further dampener for consumption spending. The silver lining in this lacklustre IIP data is healthy performance of the infrastructure sector.

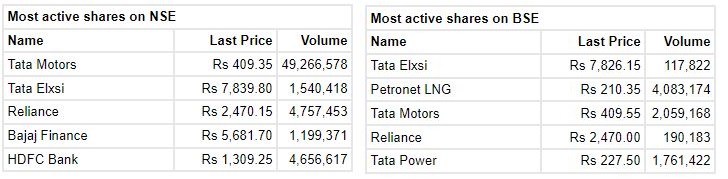

Market at 1 PMBenchmark indices extended the inraday gains and trading at day’s high level.The Sensex was up 702.49 points or 1.33% at 53632.80, and the Nifty was up 230.80 points or 1.46% at 16038.80. About 2458 shares have advanced, 640 shares declined, and 90 shares are unchanged.

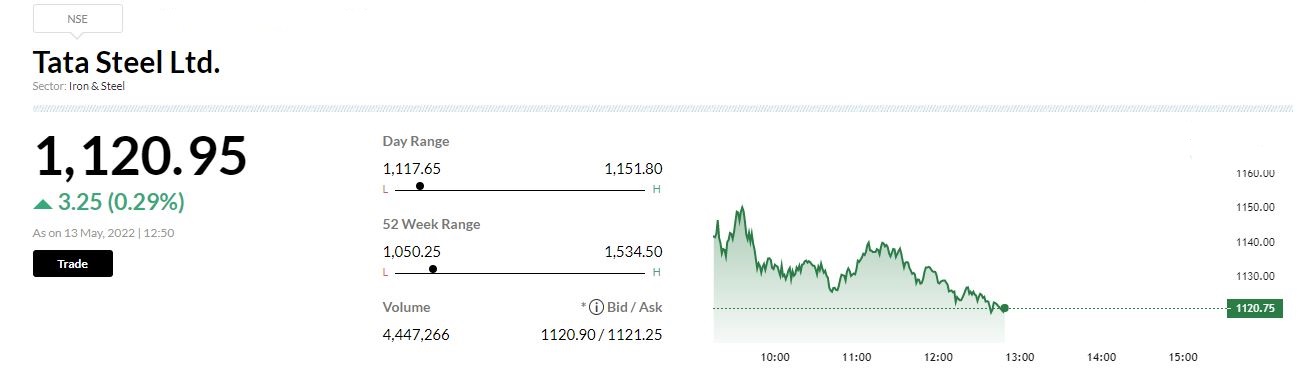

S&P revises Tata Steel outlook to positive, affirms rating at BBB-, reported CNBC-TV18.

Petronet LNG seeks lower price for renewing Qatar deal

India’s top gas importer Petronet LNG Ltd wants Qatar Gas to lower prices for it to renew a long-term liquefied natural gas (LNG) import deal beyond 2028, its CEO Akshay Kumar Singh said on Thursday.

The company in the immediate term is looking to tie up 0.75 to 1 million tonnes of LNG to meet the burgeoning energy demand in the country, particularly of the city gas sector.

In a call with journalists, Singh said Qatar sells 7.5 million tonnes a year of LNG to India at an indexation of 12.67 per cent of the prevailing Brent price plus USD 0.52 per million British thermal unit (At USD 100 per barrel oil price, the LNG price comes for USD 13.19 per mmBtu).

Petronet also buys an additional 1 million tonnes of LNG at a slight variation to this price.

The 8.5 million tonnes a year contract ends in 2028.

Petronet LNG was quoting at Rs 210.15, down Rs 1.30, or 0.61 percent on the BSE.

State Bank of India Q4 Results Preview | Profit may surge 50% on healthy loan growth, asset quality

Experts expect slippages at 2 percent of loans (Rs 13,500 crore) mostly driven by SME and retail, while corporate continues to hold up relatively well

IPO Performance in 2022

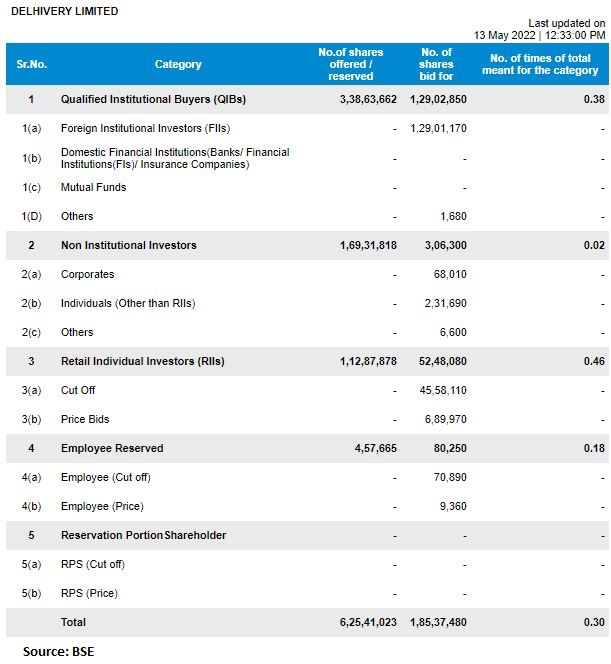

DELHIVERY LIMITED IPO SUBSCRIPTION UPDATES:

Upasna Bhardwaj, Senior Economist at Kotak Mahindra Bank:

The inflation readings came in line with our expectations at elevated levels. While we expect April 2022 to have likely marked the peak for headline CPI inflation, the trajectory will witness a very slow descent, with all CY2022 readings likely to remain above 6%.

This will intensify the pressure on the MPC to aggressively frontload policy rate hikes especially with no near term respite seen on the supply side and geopolitical tensions.

We expect another 90-110bps of repo rate hike in CY2022, with 35-40bps in the June policy. We also expect additional CRR hike of 50bps in order to quickly streamline the monetary policy and liquidity stance.