BSE Bankex index shed 2 percent dragged by the IndusInd Bank, Federal Bank, Bank of India

Anindya Banerjee, VP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities:

USDINR spot touched a fresh all time high of 77.62, after higher than expected inflation print in US pushed US Dollar Index to a fresh 20 year high. Weakness in equities was an add on force for the US Dollar.

We suspect RBI may have sold dollar to stem the decline in the Indian Rupee. Overall view is of a range, between 77.20 and 78.20 on spot.

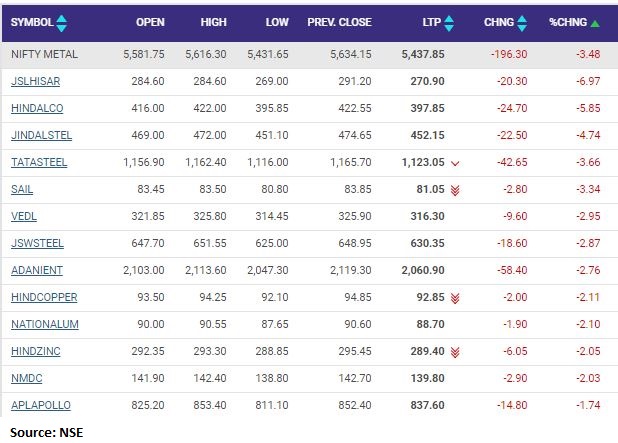

Nifty Metal index fell 3 percent dragged by Jindal Stainless (Hisar), Hindalco Industries, Jindal Steel

Prudent Corporate Advisory Services IPO Updates:

The public issue of Prudent Corporate Advisory Services has received bids for 36.67 lakh equity shares against an offer size of 60.18 lakh equity shares, subscribing 61 percent on May 12, the final day of bidding.

Retail investors have bought 1.12 times of the allotted quota and employees bid for 75 percent shares of the reserved portion.

The part set aside for non-institutional investors has been booked 23 percent, while qualified institutional buyers have purchased 966 equity shares against 16.87 lakh shares set aside for them.

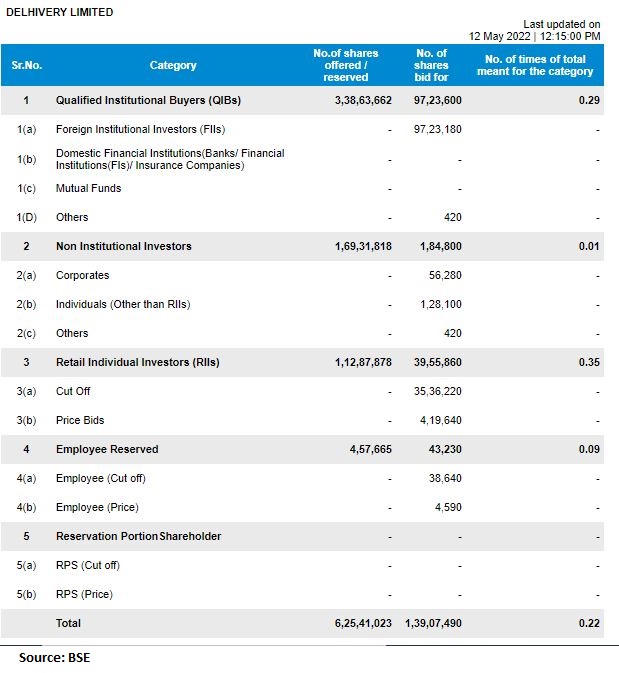

Delhivery IPO Subscription Updates:

Venus Pipes and Tubes IPO Updates:

The initial public offering of Venus Pipes and Tubes had been subscribed 3.11 times by the morning of May 12, Day 2 of the bidding, with investors sending in bids for 1 .1 crore shares against an IPO size of 35.51 lakh shares.

The stainless steel pipes and tubes maker raised Rs 49.62 crore from three anchor investors a day ahead of the opening of the issue, reducing the offer size from 50.74 to 35.51 lakh shares.

Anchor investors bid at the higher end of the IPO price band of Rs 310-326 a share.

Retail investors have bid 5.36 times of the shares set aside for them, while non-institutional investors’ portion has been subscribed 1.5 times. Qualified institutional buyers have subscribed 36 percent of their quota of 10.14 lakh shares.

Jefferies View On Polycab India

Research firm Jefferies has reiterated buy call on Polycab India and raised the target price to Rs 3,325 from Rs 3,300 per share.

It tweak FY23-25 EPS by 1-2% & expect +27% EPS CAGR over FY22-26, reported CNBC-TV18.

Polycab India was quoting at Rs 2,401.05, down Rs 31.10, or 1.28 percent on the BSE.

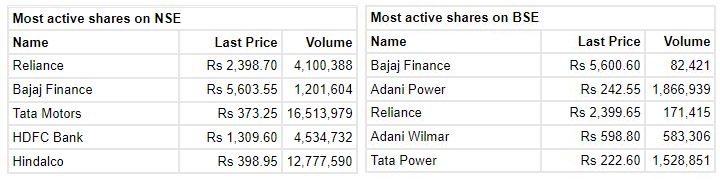

Market at 12 PMBenchmark indices continued to trade weak on May 12 with Nifty below 15900.The Sensex was down 981.52 points or 1.81% at 53106.87, and the Nifty was down 303.90 points or 1.88% at 15863.20. About 641 shares have advanced, 2416 shares declined, and 66 shares are unchanged.

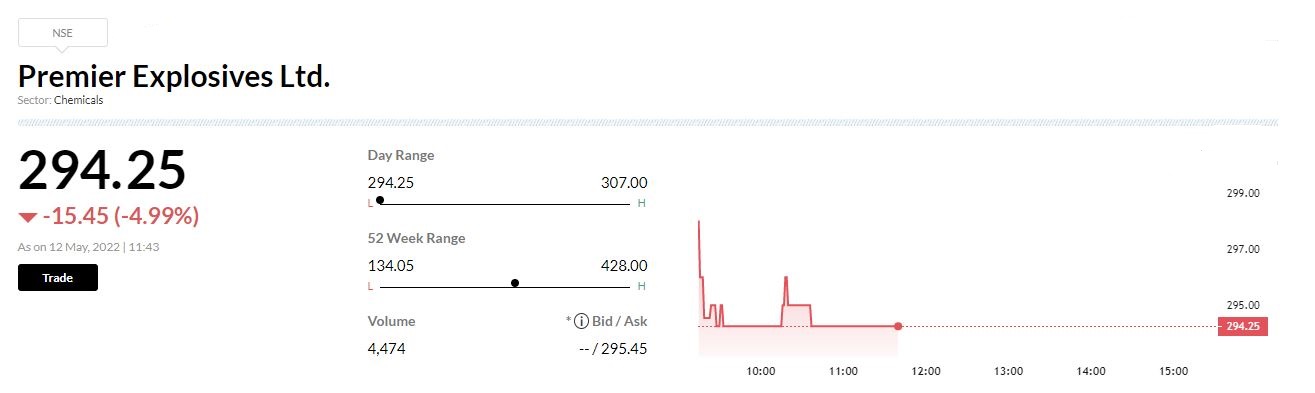

Premier Explosives bags order worth Rs 44.58 crorePremier Explosives has signed a contract with Ministry of Defence (Army) at New Delhi for supply of NFM – new family of Munitions for a total value of Rs 44.58 crores (including GST), to be delivered within twenty four months from the effective date of contract. The production of these items will be done from company’s facility at Katepally, company said in its release.

Adani Green approves allotment of 2 crore shares to Green Energy Investment

The management committee of Adani Green Total, at its meeting held today approved allotment of the equity shares of the company by way of private placement on a preferential issue basis to Green Energy Investment Holding RSC.

The Equity Shares will be listed on BSE Limited and the National Stock Exchange of India Limited.

Adani Total Gas was quoting at Rs 2,229.00, down Rs 110.10, or 4.71 percent on the BSE.

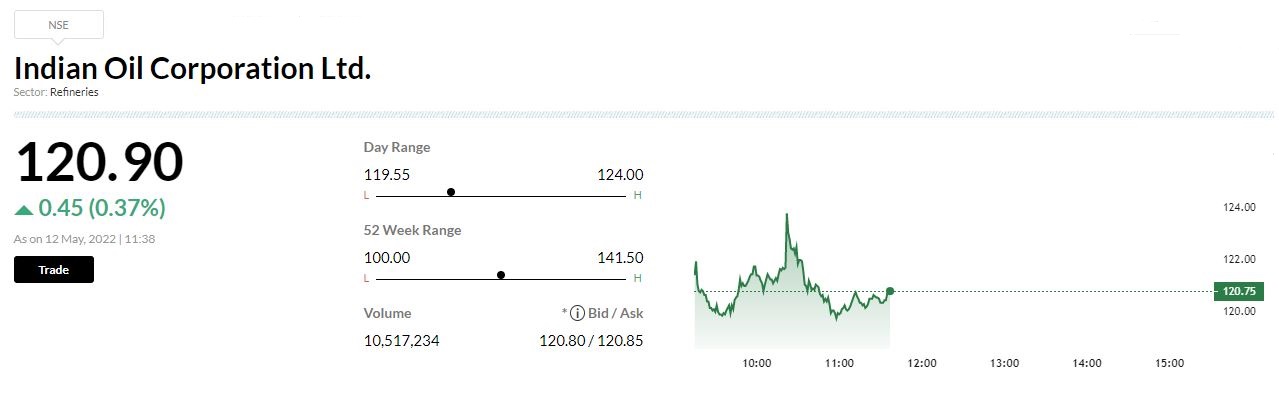

Indian Oil Corporation to consider bonus issue on May 17The board meeting of Indian Oil Corporation (IOC) is scheduled on May 17, 2022, to consider and approve standalone as well as consolidated audited financial results of the company for the quarter and year ended March 31, 2022 and declaration of final dividend for the financial year 2021-22.Indian Oil Corporation Ltd has now informed BSE that the Board of Directors of the ompany may consider issue of bonus shares in the aforesaid board meeting.

Gold Prices Today: Strong US dollar, further interest rate hikes to cap yellow metal’s gains

Higher inflation makes safe havens more appealing, driving up demand for precious metals. However, rising interest rates will limit gold’s gains, and selling pressure is predicted in today’s session…