It’s almost impossible to make a Big fortune in the stock market, without ever having lost a ( then) big fortune.

( PS: Only paper/ Excel “investors”, who’ve never risked any capital, think otherwise)— Shankar Sharma (@1shankarsharma) November 26, 2021

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments

The index has opened with a gap down this morning. If we sustain the gap and break the lows, we can slide further to 17100 which is the next level of support.

However, it is well established now that the current trend is down and all up moves are opportunities to short the Nifty. The upside is capped by multiple levels of resistance, the most important one being 17600.

Real cause of concern.

The New Covid Variant. pic.twitter.com/OuWgI5YPR3— Nilesh Shah (@NileshShah68) November 26, 2021

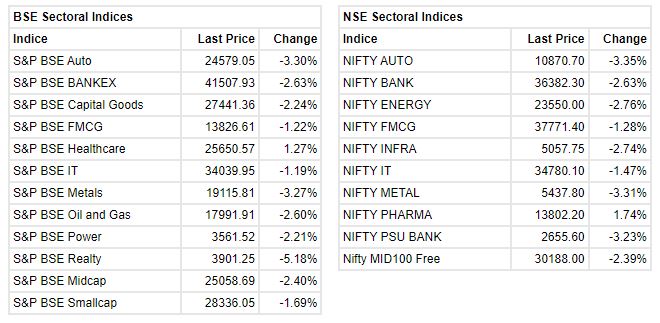

Nifty PSU Bank index fell 3 percent dragged by the Canara Bank, SBI, Bank of Baroda, Union Bank of India

Santosh Meena, Head of Research, Swastika Investmart:

Tarsons Products saw a good response from the investors and the IPO was subscribed 77 times. The IPO was priced at 34x on annualized Q1FY22 at the upper price band of Rs 662. However, the company’s share price got settled at Rs 682 with a minor gain of 3%.

Tarsons Products is backed by a strong management team with great brand awareness and high-quality goods. It is one of the leading life sciences suppliers in India. The company aims to be debt fee post the IPO and is planning for CAPEX which will further increase the revenues.

We may see profit booking in the stock eyeing the global cues on the concerns of New variant of Covid-19. However, it is expected that we may see demand for the products of Tarsons.

The investors who applied for listing gain can keep a stop loss of Rs 590 while long-term investors can hold the stock. Risk-taking investors can also buy the stock with the same stop loss.

BSE Realty index fell 5 percent dragged by the Phoenix Mills, DLF, Oberoi Realty

Buzzing:

Indiabulls Housing Finance share price added over 2 percent intraday on November 26. The stock has been on the radar after Brickwork Ratings India revised its outlook to ‘stable’ from ‘negative’.

In a regulatory filing, Indiabulls Housing Finance announced that the credit rating agency has reaffirmed its long-term rating at ‘BWR AA+’. The housing finance company’s perpetual debt rating has also been reaffirmed at ‘BWR AA’.

Foreign portfolio investors BNP Paribas Arbitrage and Societe Generale, however, offloaded a 1.1 percent equity stake in Indiabulls Housing Finance through open market transactions on November 25.

Market Update:Benchmark indices recovered from the day’s low point but still trading lower with Nifty below 17200.The Sensex was down 1,236.98 points or 2.10% at 57558.11, and the Nifty was down 374.20 points or 2.13% at 17162.10. About 842 shares have advanced, 2093 shares declined, and 94 shares are unchanged.

Airline and hotel stocks remained under pressure on November 26 on worries over a new coronavirus variant that has been detected in South Africa.

The hotel and airline stocks fell 3-6 percent intraday on November 26 on fears of this new vaccine-resistant variant. It may be noted that both these sectors were badly affected during the pandemic period as there were restrictions to travel between the countries.

The Centre, on November 25, asked all states and union territories to conduct rigorous screening and testing of all international travelers coming from or transiting through South Africa, Hong Kong and Botswana, where a new COVID-19 variant of serious public health implications has been reported.

Interglobe aviation is down 7.3%, Spicejet is trading down 6.5% while Indian Hotels Comonay is down 8.3%.

Likhita Chepa, Senior Research Analyst, Capitalvia Global Research:

The Indian benchmarks has a gap down opening today tracking weak Asian markets. Traders will be concerned as WHO flags new Covid-19 strain. Foreign portfolio investors (FPIs) remained net sellers for Rs 2300.65 crore in the Indian markets.

There will be some cautiousness as ICRA report said that Reserve Bank of India’s revision of bad loan recognition and upgradation norms could bring a sharp spike in non-performing assets of non-banking finance companies (NBFCs) in the country.

Some support may come as investments in Indian capital through participatory notes (P-notes) rose to Rs 1.02 lakh crore till October end.

The levels of 17200 may act as an important support level in the market. If the market sustained above the support of 17200, we can expect it to trade in the range of 17200-17500.

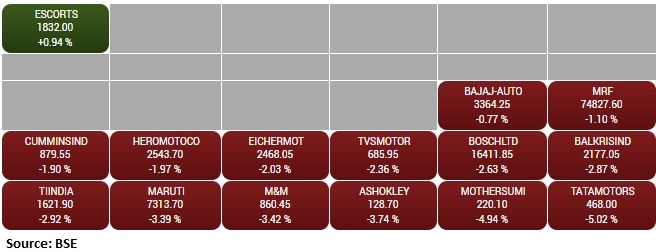

BSE Auto index slipped 3 percent dragged by the Tata Motors, Motherson Sumi, Ashok Leyland

Rupee Opens:

Indian rupee opened marginally lower at 74.58 per dollar on against previous close of 74.51.

US dollar declined 0.09% yesterday but remained near its 16- month high on expectations the US Federal Reserve will hike rates sooner to tackle inflation. Further, a sharp fall was cushioned on hawkish FOMC meeting minutes and robust economic data from the US, said ICICI Direct.

Rupee future maturing on November 26 depreciated by 0.10% yesterday on strong dollar and persistent FII outflows. However, a sharp fall was prevented on softening of crude oil prices and positive domestic markets, it added.