Follow our LIVE blog for the latest updates on LIC IPO Issue

CLSA View on TVS Motor Company

CLSA has maintained an outperform rating on TVS Motor Company and raised the target price to Rs 724 per share.

The Q4FY22 EBITDA was 4% lower than our estimate due to lower ASPs, said CLSA.

The company maintained its gross margin & EBITDA margin on a QoQ basis and confident it can achieve double-digit growth in volume in FY23.

The company is confident of expanding its electric vehicle (EV) volume through new launches, reported CNBC-TV18.

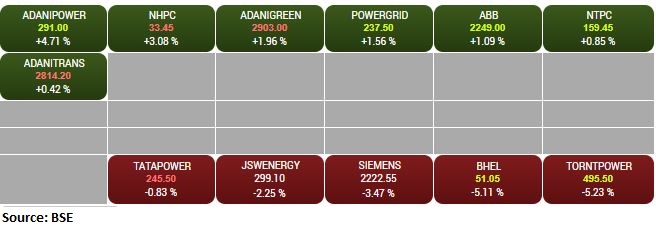

BSE Power index rose 1 percent led by the Adani Power, NHPC, Adani Green:

BSE Capital Goods index fell 1 percent dragged by the BHEL, ELGI Equipments, Schaeffler India

Buzzing:

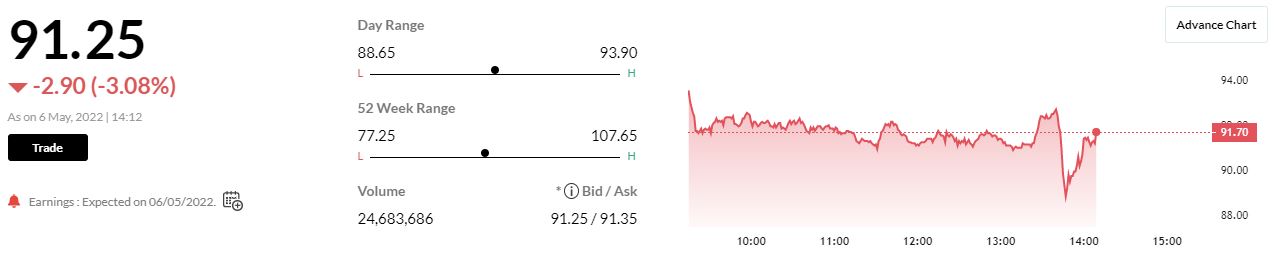

Sona BLW Precision Forgings share price fell despite company’s profit after tax for the March quarter surged 76 percent to Rs 105 crore as compared to Rs 60 crore reported during the same period last year due to lower employee cost and tax credit pertaining to previous years.

The revenues however improved 2 percent on year to Rs 550 crore compared to Rs 539 crore during last year quarter.

For FY22, profit increased by 68 percent to Rs 362 crore from Rs 215 crore in FY21. Full year revenue increased 36 percent to Rs 2,130 crore. The company has declared a dividend of Re 0.77 per equity share for FY22

Sona BLW Precision Forgings was quoting at Rs 604.85, down Rs 8.90, or 1.45 percent on the BSE.

ONGC wins 18 out of 21 oil, gas blocks in OALP-VI bid round, OIL gets 2

State-owned Oil and Natural Gas Corporation (ONGC) has won 18 out of the 21 areas offered for finding and producing oil and gas in the sixth bid round under Open Acreage Licensing Policy, according to the upstream regulator DGH.

Oil India Ltd (OIL) walked away with two blocks and Sun Petrochemicals Pvt Ltd got one block, the Directorate General of Hydrocarbons said announcing the winners of the OALP-VI round. The 21 blocks or areas offered for exploration and production of oil and gas in Open Acreage Licensing Policy (OALP) Bid Round-VI attracted just 3 bidders at the close of bidding on October 6, 2021. Of the 21 blocks on offer, 18 got a single bid and the remaining 3 blocks had two bidders. ONGC, India’s largest oil producer, had bid for 19 blocks while OIL bid for two.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Central bank actions kept domestic and global markets under pressure this week. In line with global markets, BSE Sensex and Nifty 50 index saw profit booking this week and was down by ~4%. Broader indices like BSE Midcap and BSE Small cap also saw meaningful correction. Majority of sectoral indices were down between 3-6%. Sustained high inflation continue to drive monetary tightening measures from Central Banks across different countries. This week markets reacted to interest rate increase by Central Banks like US Federal Reserve, Bank of England and RBI.

In an off-cycle meeting, the RBI MPC hiked the repo rate by 40 bps to 4.4% and increased CRR by 50 bps to 4.5%. Amid rising interest rate, elevated crude oil price and high inflation, the markets will likely remain volatile. Further, stock specific action can be expected based on Q4 results and management commentary.

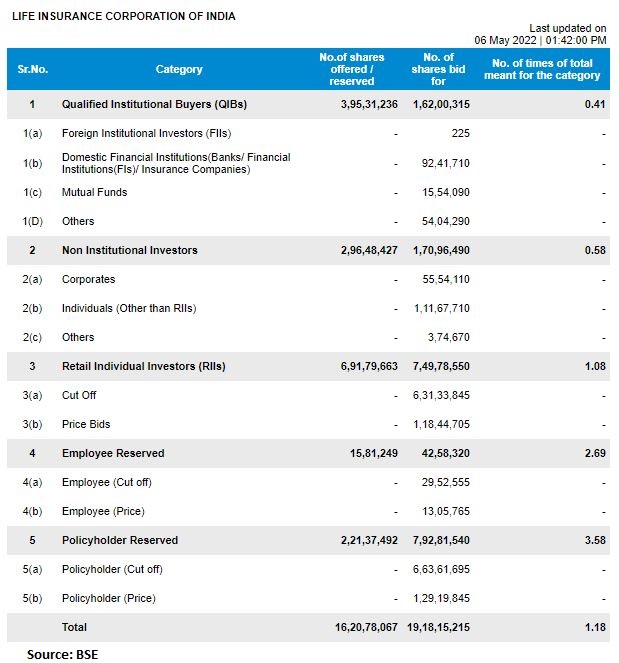

LIC IPO updates:

The initial public offering of country’s largest life insurance company Life Insurance Corporation of India has subscribed 1.20 times, receiving bids for 19.37 crore equity shares against offer size of 16.2 crore equity shares.

The portion set aside for policyholders portion has been subscribed 3.61 times, employees 2.73 times, and retail investors subscribed 1.10 times, while QIBs bid for 41 percent shares of their allotted quota and NII lapped up 58 percent of their portion.

Federal Bank Q4: Net profit grew 13.1% at Rs 540.5 crore against Rs 477.8 crore (YoY). NII was up 7.4% at Rs 1,525.2 crore against Rs 1,420.4 crore (YoY). Gross NPA at 2.80% against 3.06% (QoQ). Net NPA at 0.96% against 1.05% (QoQ). Provisions at Rs 75.2 crore against Rs 213.98 crore (QoQ) and against Rs 254.5 crore (YoY). Loan growth at 9.9% (YoY). Slippages at Rs 399 crore against Rs 453 crore (QoQ). Restructured book at Rs 3,963 crore against Rs 4,181 crore (QoQ). Net interest margin at 3.16% against 3.27% (QoQ).

Market Update at 2 PM: Sensex is down 731 points or 1.31 percent at 54,970.91 while the Nifty shed 234 points or 1.4 percent and is trading at 16,448 level.

LIC IPO Subscription Updates:

Ratnamani Metals bags new domestic orders:

Ratnamani Metals has received new domestic orders aggregating to Rs 206 crore, to be executed within the Financial Year 2022-23.

Ratnamani Metals and Tubes was quoting at Rs 2,172.05, down Rs 28.55, or 1.30 percent on the BSE.