JP Morgan downgrades Indian IT services sector to underweight

Rising margin headwinds in the near term and revenue headwinds in the medium term from a potential macro slowdown will mean that the sector’s earnings upgrade cycle is behind

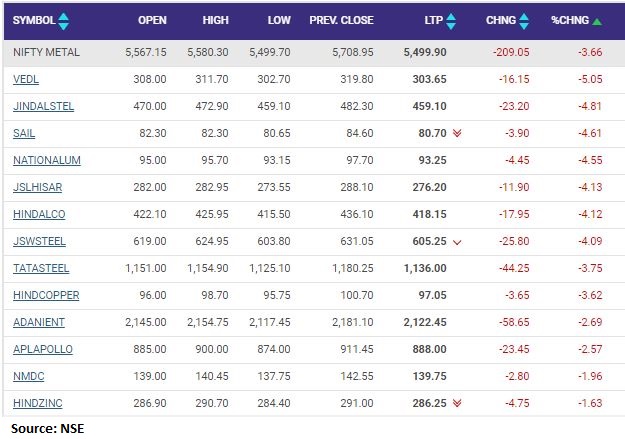

Nifty Metal index shed 3 percent dragged by Vedanta, Jindal Steel, SAIL

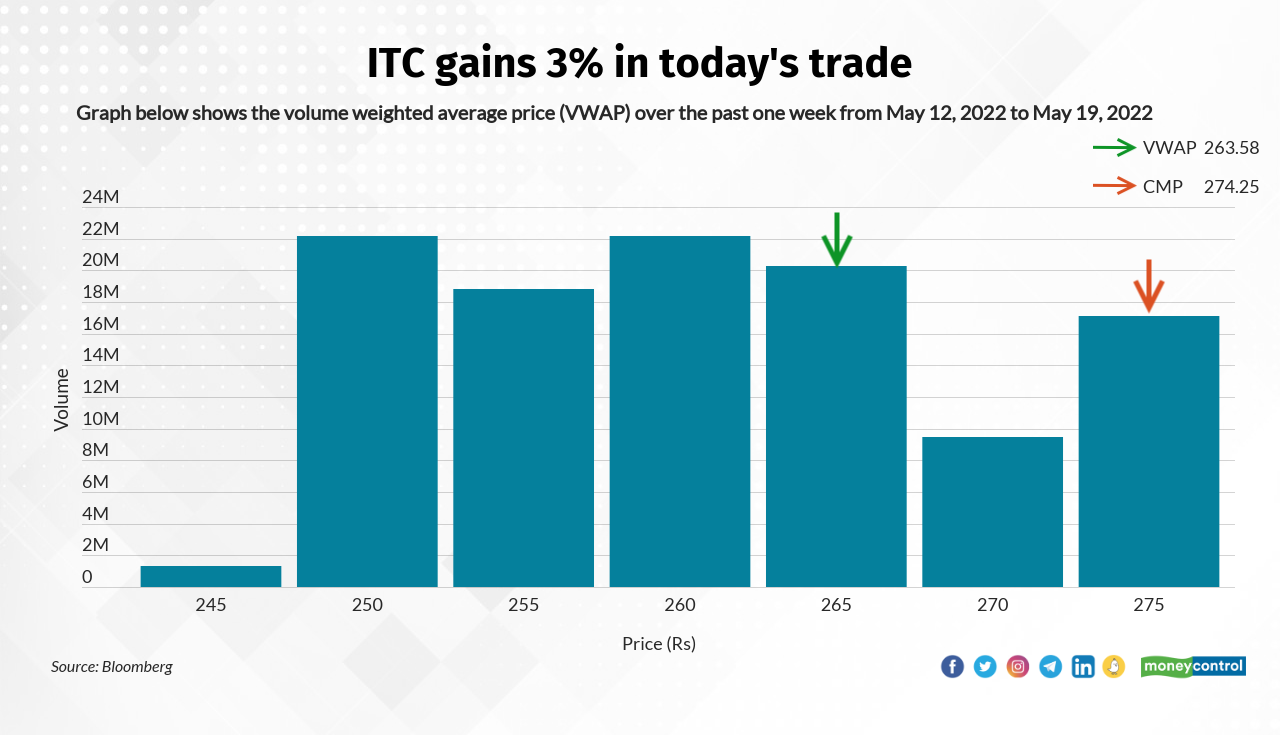

Sharekhan View on ITC

Cigarette sales volume are expected to improve in coming quarters. ITC has enhanced focus and redefined growth strategies for all business verticals to improve prospects in the medium to long term.

Strong earnings visibility with improving prospects of core cigarette business, margin expansion in non-cigarette FMCG business and a high cash generation ability with strong dividend payout (dividend yield of 4.3 percent in FY22) will reduce valuation gap in coming years.

We maintain buy on the stock with a revised price target of Rs 320.

JP Morgan downgrades Indian IT services sector to underweight

Rising margin headwinds in the near term and revenue headwinds in the medium term from a potential macro slowdown will mean that the sector’s earnings upgrade cycle is behind

Paradeep Phosphates IPO updates:

The initial public offering of Paradeep Phosphates, India’s second largest manufacturer of non-urea fertilisers and di-ammonium phosphates (DAP) in the private sector, was subscribed 57 percent on day three or the final day with investors bidding for 15.28 crore shares against the IPO size of 26.86 crore units.

Retail investors have bid for 1.05 times the 13.15 crore shares set aside for them while non-institutional investors’ portion was subscribed 25 percent. Qualified institutional buyers have subscribed to 19,600 shares against their quota of 8.07 crore.

#JustIn | M&M signs binding agreement with #Volkswagen to evaluate scope of collaboration, intends to equip Volkwagen’s ‘born electric platform’ with #MEB electric components.

Binding supply contract planned to be concluded by end of 2022#Mahindra pic.twitter.com/y3q1aOY4W5— CNBC-TV18 (@CNBCTV18Live) May 19, 2022

Market Update at 11 AM: Sensex is down 977.16 points or 1.80% at 53231.37, and the Nifty fell 297.40 points or 1.83% at 15942.90.

ITC has touched a 52-week high of Rs 279.15 and quoting at Rs 273.90, up Rs 7.40, or 2.78 percent.It was trading with volumes of 1,387,593 shares, compared to its five day average of 713,552 shares, an increase of 94.46 percent.The share touched a 52-week high of Rs 273.10 and a 52-week low of Rs 200.85 on 11 April, 2022 and 09 July, 2021, respectively.Currently, it is trading 0.29 percent below its 52-week high and 36.37 percent above its 52-week low.

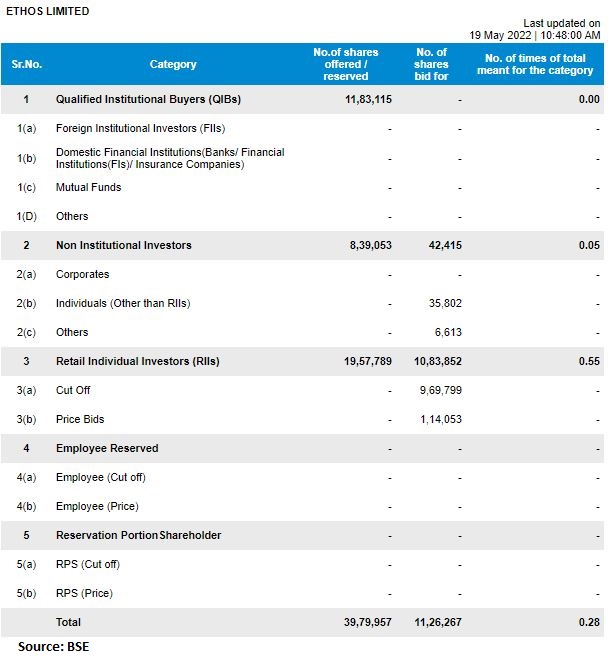

ETHOS IPO SUBSCRIPTION UPDATE

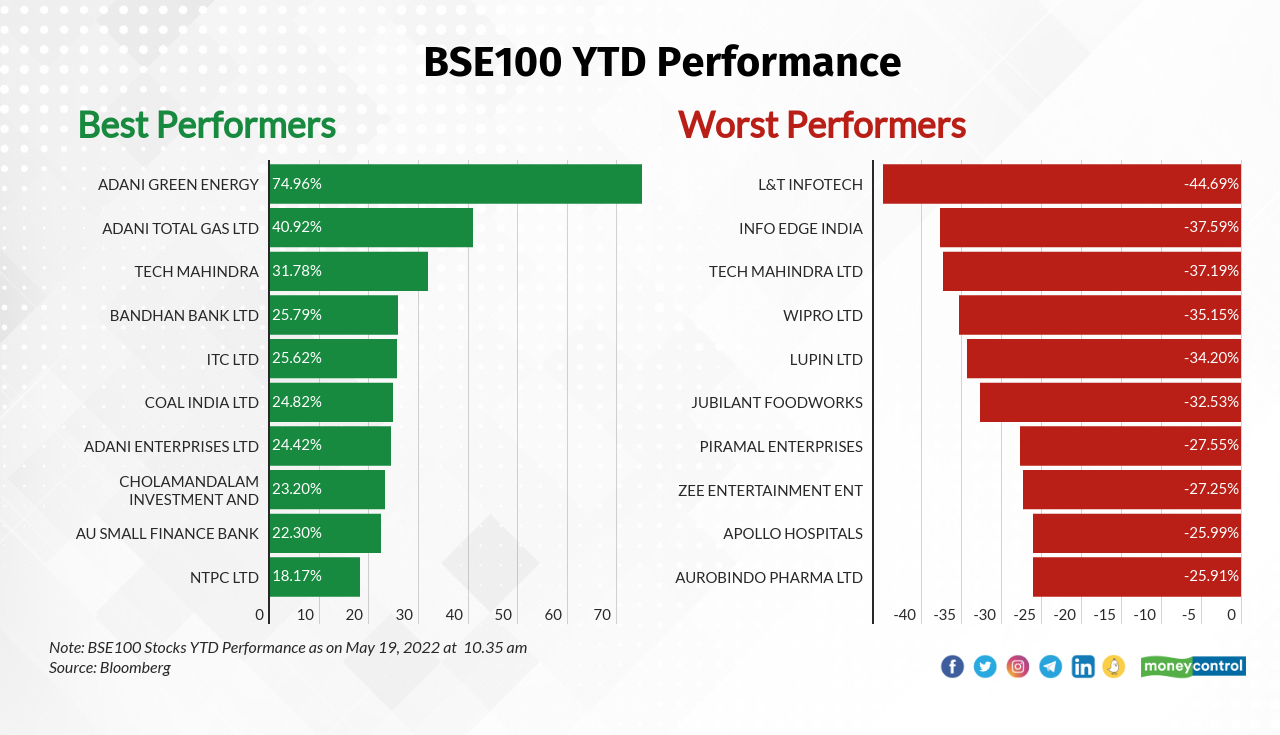

Here are the Best and Worst performer among BSE 100 index

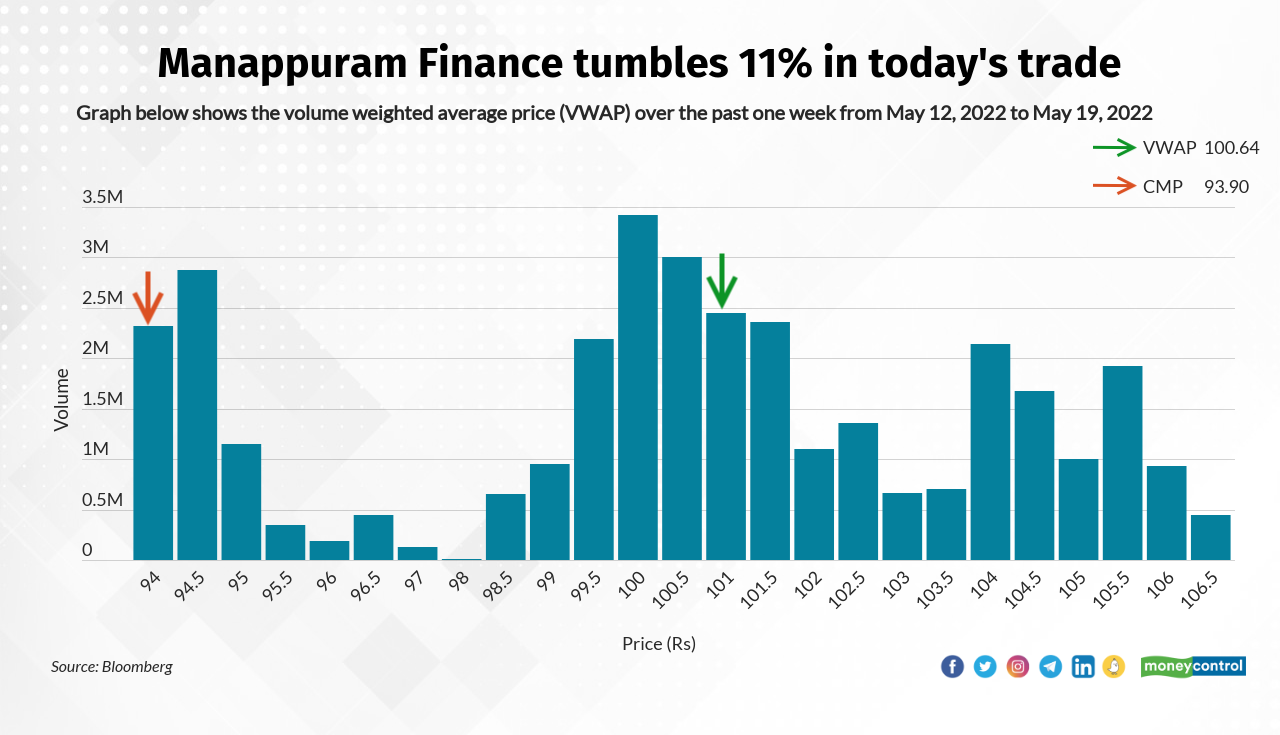

Manappuram Finance reported a 44 percent year on year decline in net profit for the March quarter to Rs 261 crore against analysts’ estimates of Rs 451. Manappuram Finance touched a 52-week low of Rs 91.95 and was quoting at Rs 93.35, down Rs 11.25, or 10.76 percent on the BSE.

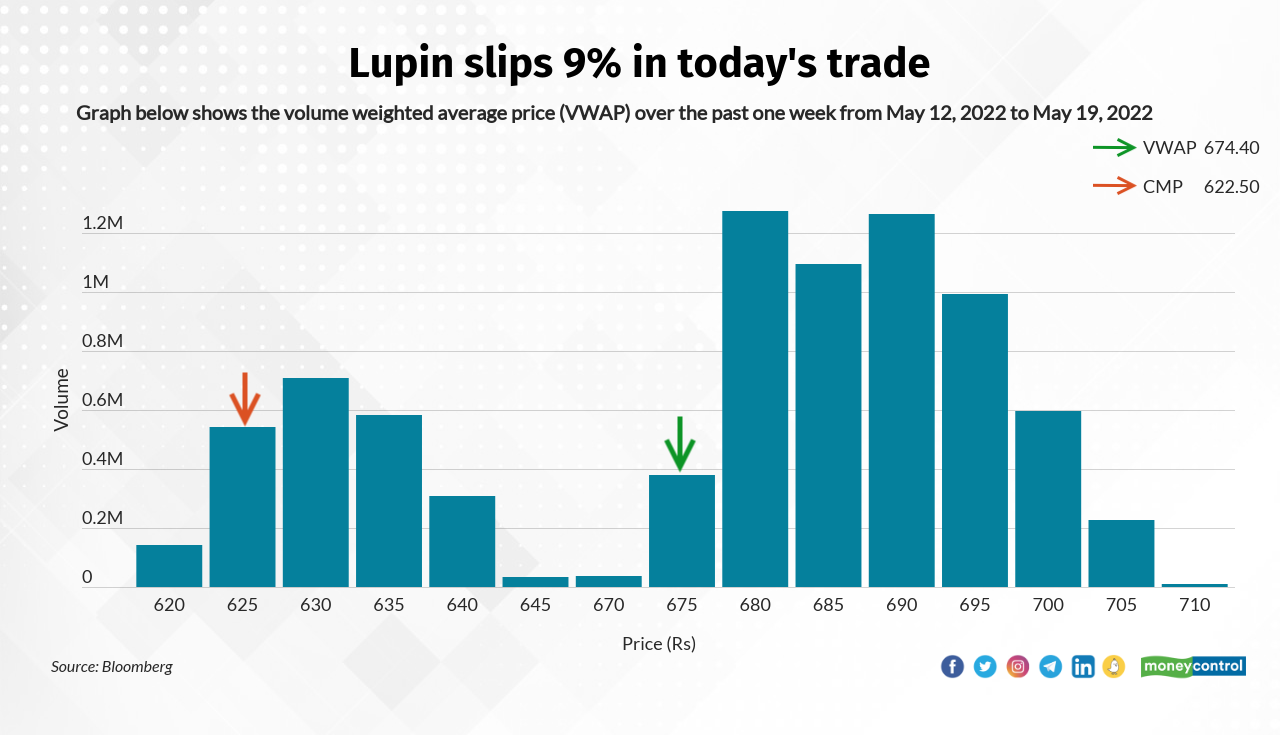

Lupin Ltd reported a loss of Rs 512 crore in the March quarter against a profit of Rs 546 crore a year ago. Revenue rose 3% to Rs 3865 crore. EBITDA declined 63% year on year to Rs 282 crore. The company said its current quarter was challenging with headwinds in the U.S. on account of price erosion, and inflation in input materials and freight.Lupin has touched a 52-week low of Rs 620.35 and was quoting at Rs 632.05, down Rs 51.20, or 7.49 percent on the BSE.