Morgan Stanley View on Tech MahindraResearch firm Morgan Stanley has kept overweight rating on Tech Mahindra and cut target price to Rs 1,650 from Rs 1,800 per share.The attractive valuation keeps company as our top pick in IT pack, said Morgan StanleyThere is a robust broad-based revenue growth outlook and have levers to mitigate cost headwinds through FY23, reported CNBC-TV18.Tech Mahindra was quoting at Rs 1,193.65, down Rs 8.65, or 0.72 percent on the BSE.

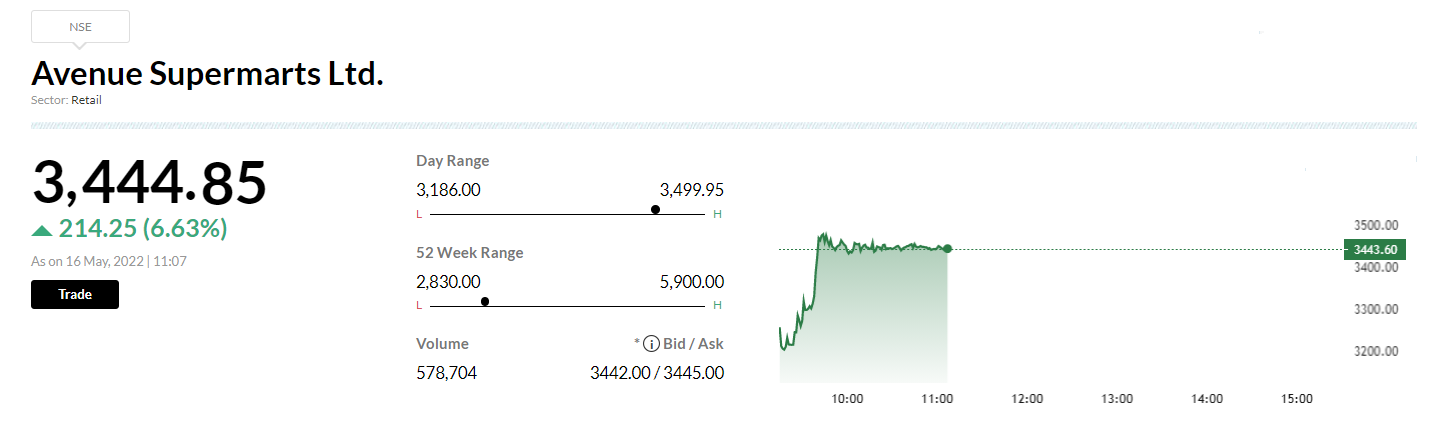

Buzzing: Shares of Avenue Supermarts advanced 6.5 percent on May 16 after the company posted a 3 percent rise in net profit year-on-year on Saturday. However, sequentially, the consolidated net profit declined 22 percent to Rs 427 crore for the fourth quarter ended March 2022.At 10:45 am, the scrip traded at Rs 3448.85 apiece on the BSE, up 6.61 percent, while the benchmark Sensex was up 467.05 points or 0.88 percent at 53,260.67.Revenue fell 5 percent quarter-on-quarter to Rs 8,787 crore from Rs 9,218 crore. Year on year, revenue rose 19 percent.

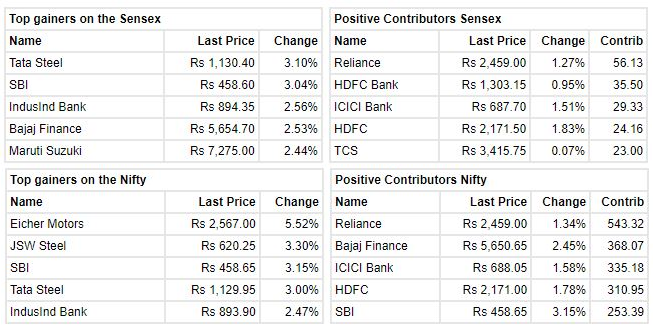

Market at 11 AMBenchmark indices were trading higher with Nifty above 15900.The Sensex was up 431.72 points or 0.82% at 53225.34, and the Nifty was up 132.30 points or 0.84% at 15914.50. About 2099 shares have advanced, 925 shares declined, and 137 shares are unchanged.

Aditya Birla Capital share price touched 52-week low after a letter from a whistleblower, levelling serious allegations of corruption and mismanagement, according to report.

Aditya Birla Capital touched 52-week low of Rs 90.05 and was quoting at Rs 90.05, down Rs 10.00, or 10.00 percent.

Aditya Birla Sun Life AMC was quoting at Rs 475.80, down Rs 12.85, or 2.63 percent.

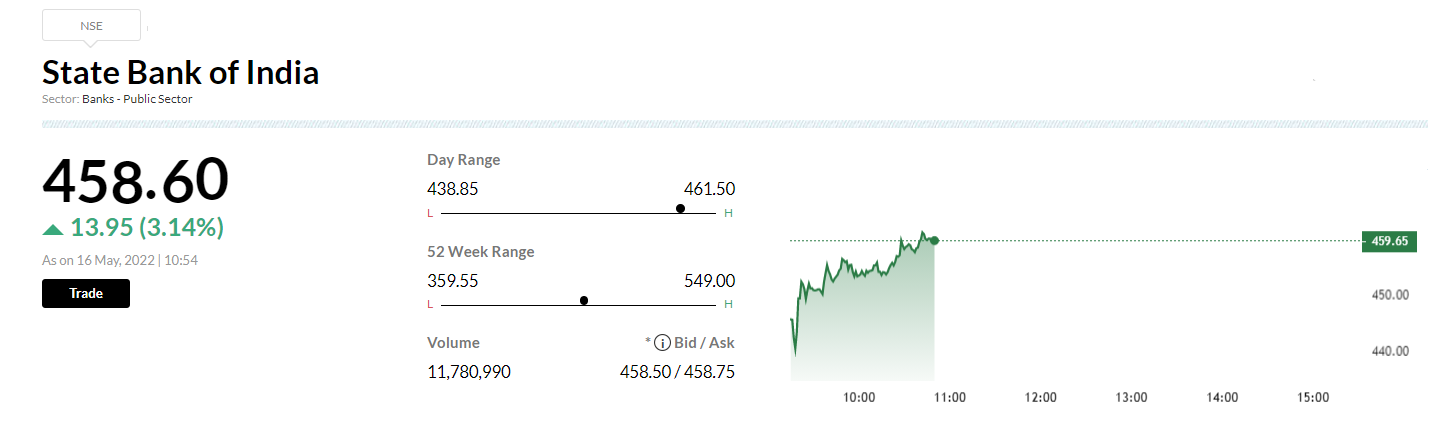

Nomura View on State Bank of IndiaThe broking firm Nomura has maintained a buy rating on State Bank of India with a target of Rs 615.The credit cost is near historical lows, net interest margin or NIM is steady and growth is picking up.FY23 should reflect a normalised RoA and RoE (return on asset and equity) at 0.8 and 15 percent respectively, CNBC-TV18 reported.State Bank of India was quoting at Rs 459.00, up Rs 13.95, or 3.13 percent on the BSE.

Rising interest rates to positively impact net interest margin: SBI chairman

Also, why Dinesh Kumar Khara sees inflation as positive to some extent for economy, and more

Adani Group stocks rise post $10.6-billion Holcim deal

Shares of Adani Group companies were the flavor of the day on May 16 following the Group’s acquisition of HolcimLafarge’s India cement business on May 15 for more than $10.6 billion. Adani Group will acquire HolcimLafarge’s 63.2 percent stake in Ambuja Cements and 54.53 percent stake (of which Ambuja Cements holds 50.05 percent) in ACC. The deal is the largest for the coal-to-media conglomerate and marks the Group’s foray into the cement sector as the second-largest player behind Aditya Birla Group-owned UltraTech Cement.

Shares of Adani Enterprises, Adani Ports and Special Economic Zone, Adani Power, Adani Transmission, Adani Green Energy, and Adani Total Gas were up 1-5 percent in trade on the National Stock Exchange.

“Combined with the several adjacencies of our existing businesses that include the Adani Group’s ports and logistics business, energy business, and real estate business, we believe that we will be able to build a uniquely integrated and differentiated business model and set ourselves up for significant capacity expansion,” Adani Group Chairman Gautam Adani said in a press statement.

Market update: Sensex is up 431.98 points or 0.82% at 53225.60, and the Nifty rose 137.10 points or 0.87% at 15919.30.

Buzzing stock:

Eicher Motors on May 13 declared a consolidated profit after tax (PAT) of Rs 610 crore for the quarter ended March 2022, up 16 percent from Rs 526 crore a year ago. On a sequential basis, the growth in profit was 34 percent from Rs 456 crore in the previous quarter.

The maker of the iconic Royal Enfield reported a year-on-year (YoY) growth of 8.6 percent in its consolidated revenue at Rs 3,193 crore from Rs 2,940 crore in the corresponding period of the previous year. Sequentially, revenues rose 11 percent from Rs 2,881 crore in the December quarter. For the full year, from April 2021–March 2022, PAT jumped 25 percent to Rs 1,677 crore from Rs 1,347 crore in FY21.

Consolidated revenues rose by 18 percent to Rs 10,298 crore from Rs 8,720 in the previous financial year.

Global research firm UBS has a buy rating on Eicher Motors with target at Rs 3,100 per share, an upside of 21 percent from current level. The research firm is of the view that Q4 earnings was an all round beat with volume ramp-up ahead. It expects a sharp rebound in Royal Enfield volumes with 38 percent/12 percent growth over FY23/FY24 and sees upside risks to margin estimates of 22.9 percent/24.4 percent for FY23/FY24. Read more

Ambuja Large Trade | 35.46 lakh shares (0.18% equity) worth ₹130.4 cr change hands pic.twitter.com/JGPer8kafq

— CNBC-TV18 (@CNBCTV18Live) May 16, 2022

Buzzing Stock:

Shares of Amber Enterprises Ltd fell over 17 percent, its biggest fall since listing, after its margins and the bottomline were hit by higher raw material and operating costs. The stock hit a low of Rs 2,790 on the BSE. At 9.50am, the scrip was trading at Rs 2,800 on BSE, down 17.1 percent from its previous close.

Amber Enterprises revenue increased 21 percent year-on-year to Rs 1,937 crore on the back of strong volumes and higher price realisations. Net profit fell 22 percent YoY to Rs 59 crore and operating costs surged 25 percent YoY to Rs 1,804 crore.

Gross margin declined 210 basis points on-year to 13.8 percent as the company was not able to completely pass on the rising raw material prices. EBIT margin contracted 250bps YoY to 4.9 percent as higher operating leverage was negated by lower gross margins as well as increased depreciation, staff cost and other expenses. Read more

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Nifty is down 9% this year and the market is weak. In a bear phase there will be relief rallies, but such rallies are unlikely to sustain, given the relentless selling by FIIs. It is rational to expect more FII selling, particularly when the market stages relief rallies.

It is important to appreciate the fact that FIIs are selling not because they are bearish on India but because US bond yields are attractive and the dollar is strengthening.

Since Nifty is trading at around 18 times FY 23 earnings, valuations are not yet cheap. But there are pockets where earnings visibility is good and valuations are fair like financials, telecom, IT and construction. Long-term investors can start accumulating high quality stocks in these segments