The six-member monetary policy committee (MPC) of the Reserve Bank of India (RBI) was deeply concerned about the economic wreck that the Covid-19 pandemic has caused, which would take several years to repair.

RBI Governor Shaktikanta Das warned of a severe impact on the economy due to the two months of lockdown, a collapse in demand as gauged by the high frequency indicators, and fall in private consumption and investment, as can be seen through tepid bank credit growth. The hit in demand will continue to weigh heavily on economic activity for some time to come, governor Das said. But he was optimistic about a revival in rural economy due to good harvest in agriculture.

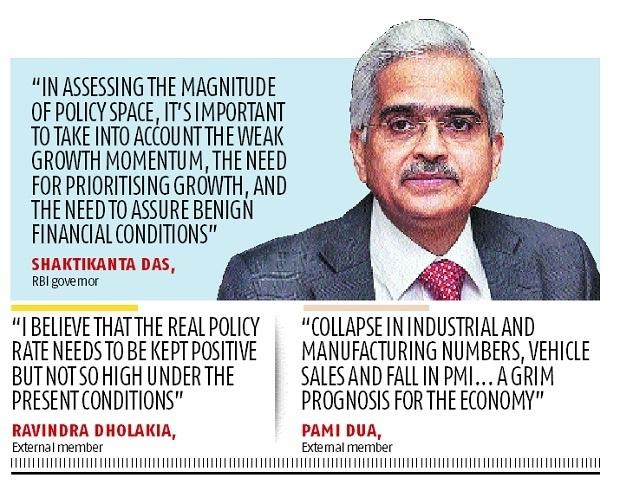

“In assessing the magnitude of policy space, it is important to take into account the weak growth momentum, the need for prioritising growth in view of the less risky inflation outlook, and the need to assure benign financial conditions ahead of the recovery taking hold so that confidence is sustained,” Das said.

ALSO READ: How an inherently collaborative film industry will adapt to the time

Other members were also very concerned about the hit in consumer sentiment, demand, and private investment.

“In fact, my view is that the damage is so deep and extensive that India’s potential output has been pushed down, and it will take years to repair,” said deputy governor Michael Debabrata Patra, minutes of the MPC deliberations, that led to a 40 basis points out of turn repo rate cut on May 22, revealed.

The edited minutes were released on RBI website on Friday.

Executive director in charge of monetary policy Janak Raj was concerned about the collapse of demand in private investment.

“Within aggregate demand, while private consumption is likely to slowdown from the pre-COVID-19 levels, what worries me more is investment demand, which is likely to be impacted severely for a variety of reasons,” Raj said.

ALSO READ: The honeymooners who organised a train that helped others get home too

Excess capacity has been created in many sectors, which, combined with huge uncertainty about future demand, both domestic and external, is likely to hamper new investments in the private sector. Financing of investment activity will also be a challenge due to weak balance sheets. Third, the focus of government spending, both by the Centre and the States, will also be on revenue expenditure than on capital expenditure.

Therefore, investment activity, which contracted in last two quarters, “is expected to be severely hit, going forward.”

Economic activity will likely contract in 2020-21. While supply lines are likely to be restored as lockdown is relaxed, “demand would take far longer to revive to pre-COVID levels,” Raj said, adding, the fall in investment demand “may be a huge drag on economic activity in the near future with attendant implications for potential growth.”

External member Ravindra Dholakia, said India’s real interest rates are still very high at around 1.2 to 1.6 per cent.

“I believe that the real policy rate needs to be kept positive but not so high under the present conditions,” Dholakia said, rooting for a 40-basis points rate cut.

According to Dholakia, once the situation returns back to normal and the fiscal and monetary boost measures start generating impacts, the economy may require some further boost. Therefore, there should remain some more space for the future, Dholakia said.

ALSO READ: Ola commits Rs 500 cr for safe mobility drive globally due to Covid-19

The RBI governor had said in his media address that there would be room for more rate cuts in the future, contingent on inflation coming under control. The central bank had hoped that inflation would start tapering off from the end of the calendar year. But the RBI did not give any guidance on inflation and growth due to deficient data.

External member Pami Dua was concerned about the “grim prognosis for the economy.” She cited collapse in industrial and manufacturing numbers, passenger vehicle sales, standstill in economic activities due to lockdown, and fall in purchasing manager index.

Dua was concerned about the consumer confidence survey conducted by the RBI in May, which painted a “grim picture, showing that the overall Current Situation Index is at a historic low, while the Future Expectations Index reflects high pessimism for the year ahead. Thus, consumer sentiment has plunged to abysmally low levels.”

Another external member Chetan Ghate, who was also the only person who voted for a 25 basis points cut and no more, as he was concerned about inflation going forward.

ALSO READ: Education shifts online, leaving behind a disadvantaged segment of students

“It is not entirely clear to me that Covid-19 constitutes a large disinflationary shock. Inflationary pressures fall with economic slack (the output gap), but rise with expected future inflation and factors related to production costs,” Ghate said.

In this context, Ghate cited inflationary expectations survey, which has spiked by 190 and 120 basis points for three months and one-year ahead inflation respectively.

“This is worrisome. I continue to be concerned about declining market arrivals of food commodities because of COVID related supply side bottle-necks and their inflationary impact,” Ghate said, adding, when the economy turns to the upside, the recovery in demand will be swift.

“There has already been a severe dislocation in domestic and global supply chains. It will take some time to for these to get resolved, and it is therefore likely that demand will recover faster than supply,” said Ghate.