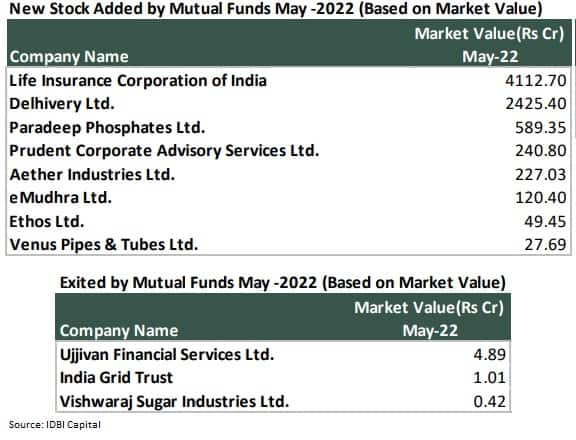

Asset management companies (AMCs) continued to invest strongly in initial public offerings in May, even amid volatility in the equity markets. They put about Rs 7,800 crore into eight IPOs during the month, including those of Life Insurance Corporation of India, Delhivery, and Paradeep Phosphates.

More than half of the investments by mutual funds went into the public issue of Life Insurance Corporation of India, the country’s largest life insurance company. They bought Rs 4,112.7 crore of LIC shares during the IPO, according to an IDBI Capital report.

LIC was the largest public issue in the history of India’s capital markets, with shares worth Rs 21,000 crore sold. However, the stock has declined 29 percent from its issue price of Rs 949 in less than a month of listing.

Logistics services provider Delhivery, the second-largest public issue this year, pulled in Rs 2,425.4 crore from AMCs, which was almost half of its issue size of Rs 5,235 crore.

The third-biggest investment by mutual funds was in the IPO of Paradeep Phosphates, the non-urea fertiliser manufacturer, which attracted Rs 589.35 crore out of its total issue size of Rs 1,501.73 crore.

AMCs invested the remainder Rs 665.37 crore in the five other IPOs – Prudent Corporate Advisory Services, Aether Industries, eMudhra, Ethos, and Venus Pipes & Tubes, IDBI Capital said in its report.

However, mutual funds exited three companies in May–Ujjivan Financial Services, India Grid Trust, and Vishwaraj Sugar Industries.

Higher inflow

Overall, inflows into equity and equity-oriented mutual fund schemes remained strong during May while investments in equity funds through systematic investment plans (SIP) continued to be robust, despite volatility in the market.

The total net inflow into equity mutual fund schemes stood at Rs 18,529 crore, against Rs 15,890 crore in April, continuing a trend for 15 months.

“The Indian equity market remains an attractive choice for investors across emerging markets despite valuations still being at a premium,” said Kavita Krishnan, senior analyst–manager research, at Morningstar India.

A strong underlying structural story supports the consistent inflows, despite the challenges at the macro level. The government’s focus on curbing inflation and positive measures in this direction have also led to increased investor confidence, Krishnan added.

Indian stocks fell about 3 percent in May due to geopolitical tensions, inflation worries, a faster policy-tightening approach adopted by central banks to tame inflation, and fear of recession.

Foreign institutional investors continued to offload Indian equities due to these reasons, but domestic investors, including retail investors, remained confident about India’s growth story.

“Relatively lower returns from traditional investments have also led to an increased (retail investors) interest in equity markets,” Krishnan said.

FIIs sold a net Rs 54,292.5 crore worth of shares in May, the highest monthly outflow since March 2020. DIIs bought more than Rs 50,000 crore worth of shares during the same month.

The inflow into equity schemes through SIPs remained strong at Rs 12,286 crore in May, up from Rs 11,863 crore in the previous month, staying above the Rs 10,000 crore mark for the ninth consecutive month in May.

“The consistent SIP flows are supporting the net positive sales numbers in equities. Through the ongoing volatility, we see continued interest among retail investors to allocate to equity MFs,” said Akhil Chaturvedi, chief business officer at Motilal Oswal AMC. “The spread of new flows is well diversified across categories (large cap/midcap/flexi-cap). Dynamic/balanced advantage fund category also continues to be positive and this is very good for retail investors in managing risks and volatility.”

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.