The much-awaited milestone of 13,000 is finally here. The Nifty50 surged to a fresh record high above 13,000 for the first time in history to hit a high of 13,064.20. It completed the journey from 12,000-13,000 in just 13 sessions.

Strong global liquidity, weakness in the dollar, vaccine news, hopes of stimulus announcement from central bankers across the globe, recent policy reforms initiated by the government, robust earnings outlook, as well as green shoots in the economy triggered a risk-on rally in Indian markets.

The S&P BSE Sensex also hit a fresh record high of 44,571.96 on November 24. The index has already rallied by over 12 percent so far in the month of November. Experts are of the view that investors can take some profits off the table, but it would not be wise to go underweight on equities at the current juncture.

“Indian economy is past its worst having clocked almost 25% decline in the April-June quarter of 2020. Activity is improving sequentially, reflected in better-than-expected corporate performance also boosted by cost containment efforts,” Harshad Patwardhan, CIO – Equity of Edelweiss AMC told Moneycontrol.

related news

“After a long wait, corporate earnings growth is moving to a higher trajectory. Tail risks in the sensitive banking & finance sector seem well contained. Big structural reforms undertaken over the past few years will likely elevate potential medium-term growth rate,” he said.

Patwardhan further added that there seems a global “risk on’’ rally reflecting in strong FII inflows. Lastly, the recent positive news flow on COVID-19 vaccine means the beginning of the end of the healthcare crisis. All this suggests it’s risky to be underweight on Indian equities now.

The overall sentiments are strong and the market outlook is positive going forward. If the foreign fund inflows continue we can see higher levels on Nifty in the coming days/weeks suggest experts.

“Nifty can possibly touch 13200-13400 levels also. But it also depends on the sustainability of the economic growth over the next few months post-festive season,” Hemang Jani, Head – Equity Strategy, Broking & Distribution, Motilal Oswal Financial Services Ltd told Moneycontrol.

“Hence, at the current market levels, it is advisable to partially book profits and sit on 15-20% Cash in the portfolio. Any corrections in the market can be used to deploy funds at lower levels,” he said.

Here are 5 reasons that explain why investors should not go underweight on Indian equity markets:

Economy seems to have bottomed out:

After contracting by over 20 percent in the June quarter, the second quarter growth expectations are significantly better than that in Q1 with the unlocking mode being on across the country.

While Unlock-1 began in June, it gained pace mainly in October. “Our expectation is that GDP degrowth this quarter will be -9.9% with the forecast for the year being – 8.2%. Degrowth in value addition will be -9.4% for this quarter,” CARE Ratings said in a report.

Growth is expected to be positive in agriculture, forestry, etc. and financial services, real estate, professional services, said the report.

“The pandemic has played the role of a catalyst by bringing cost efficiencies and balance sheet discipline across sectors/companies,” Sachin Shah, Fund Manager, Emkay Investment Managers Ltd told Moneycontrol.

“A slight tailwind in the economic growth (for which green shoots are already visible) and an uptick in aggregate demand will set India Inc. for multi-year very strong earnings growth trajectory. This will start showing up in economy linked sectors as this momentum unfolds itself,” he said.

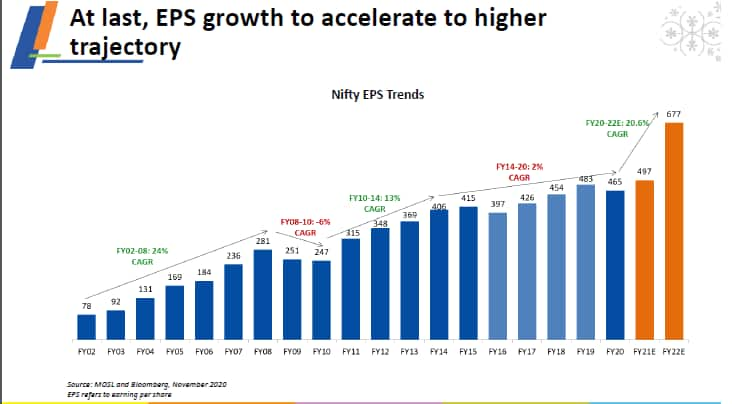

EPS Growth to accelerate higher:

After a stable June quarter, September quarter numbers were better than analyst expectations where upgrades exceeded downgrades.

The Sep-quarter (2QFY21) corporate earnings season was a blockbuster one, with big beats and upgrades across Motilal Coverage Universe. “With an upgrade (>5%) to downgrade ratio (<-5%) of 4:1, this has by far been the best earnings season in many years,” said the brokerage note.

63% of the companies in our MOFSL Coverage Universe beat 2QFY21 estimates, while 18% reported below-est. results. This has resulted in the first material earnings upgrade for Nifty EPS estimates in many years.

“Our FY21/FY22E Nifty EPS estimates have been revised up 9%/3.9% to INR497/INR677 (prior: INR456/INR651). We now expect FY21 Nifty EPS to grow 6.9% YoY,” said the Motilal Oswal note.

Financials, Telecom, Technology, Healthcare, and Automobiles are expected to contribute to incremental growth in FY21. On the other hand, Utilities, Capital Goods, O&G, and Retail are expected to trail.

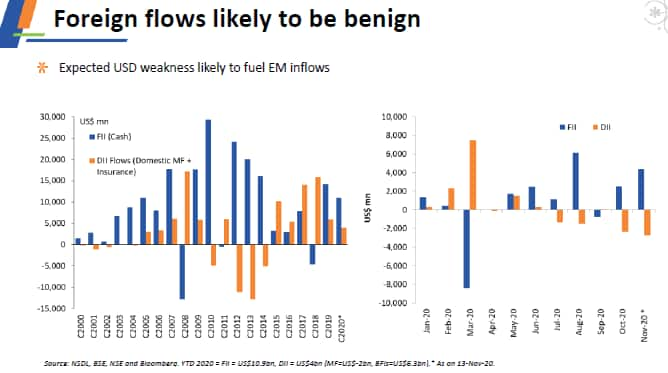

Foreign Flows:

Foreign institutional investors (FIIs) have, so far, pumped in more than Rs 50,000 crore in Indian markets in November, the highest in a single month.

As per the provisional data available on the NSE, FIIs net bought Rs 55,552.64 crore worth of shares till November 24. The actual data available with the Sebi shows that FIIs had invested Rs 54,521.68 crore till November 23.

The net FII buying in 2020 has been Rs 96,766 crore so far.

The inflow increased considerably especially after the end of the election in the United States and weakness in the dollar index.

On the other hand, DIIs net sold over Rs 32,600 crore of shares in November so far, in addition to Rs 17,300 crore of selling in the previous month.

Also read: November reign: FII inflows hit record Rs 55,000 crore, analysts expect more

“With the uncertainty of US elections behind us, one would like to believe the allocations to emerging markets like India should resume, particularly as the opportunities have emerged even bigger in the post-COVID environment for countries like India as the world is looking for credible & scalable sourcing alternative to China. The best is yet to come,” says Shah of Emkay Investment Managers Ltd.

Vaccine Hopes triggers risk-on rally:

Positive update on vaccine during the weekend reiterated hopes of faster economic recovery next year across the globe which is a positive sign for the bulls.

Moderna, Pfizer and AstraZeneca-University of Oxford — all of them have reported positive data on their vaccine safety and efficacy, raising hopes of availability of a potential safe COVID-19 vaccine by end of December or January next year.

“Favourable news flow regarding Covid-19 vaccine and possibility of additional fiscal stimulus in the USA are supporting the market rally,” Binod Modi, Head Strategy at Reliance Securities told Moneycontrol.

Also Read: What is the latest on COVID-19 vaccine from the manufacturers?

Moderna said the first interim analysis of its COVID-19 vaccine demonstrated 94.5 percent efficacy. Pfizer and its German partner BioNTech reported that their COVID-19 vaccine candidate was 95 percent effective without any major safety concerns.

Brokerage raise target price:

After touching record highs earlier in the month of November, many brokerages have raised their target price for both Sensex and Nifty.

Brokerage firm Prabhudas Lilladher in a recent report said that it is bullish on the Indian market and expects Nifty to hit 14,407 in a 15-month timeframe from mow.

The brokerage firm values Nifty FY23 22 EPS of Rs 724 at 10-year average PE of 19.9 and arrives at a 15-month target of 14,407 (13,830 based on 19.9 times FY23 EPS of 695).

ICICIdirect expects Nifty earnings to grow at 17.5% CAGR in FY20-23E. From the low base of FY21E, Nifty earnings CAGR is at 22.7% in FY21E-23E.

“We now value the Nifty at 13,350 i.e. 20x P/E on FY22E-23E average EPS of | 668 with corresponding Sensex target at 45,500,” added the report.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.