Indian equities continued their losing streak for the second straight week ended June 17 as global markets grappled with mounting inflationary pressure.

The Indian market started the week sharply lower, but remained range-bound for the next couple of sessions. However, selling got intensified on Thursday after FOMC meet outcome and finished the week with marginal losses after a highly volatile session.

For the week, BSE Sensex shed 2,943.02 points (5.41 percent) to close at 51,360.42, while the Nifty50 fell 908.3 points (5.6 percent) to end at 15,293.5 levels. Among the broader indices, the BSE Smallcap index declined 6.6 percent, while the Midcap and and Largecap indices shed over 5 percent each.

All sectoral indices ended in the red, with BSE metal and oil and gas losing more than 9 percent each and the BSE Information Technology index down 8 percent.

“The week gone by belonged completely to the bears as the Nifty started the week with a gap down and corrected sharply to end below 15,200 with a weekly loss of over 5 percent,” said Ruchit Jain, Lead Research at 5paisa.com.

“The bears had a firm grip on our markets in the last two weeks wherein the Nifty corrected from 16,800 to 15,200 in a short period of time. In these two weeks, the global markets too have corrected due to which our markets have reacted negatively,” he said.

After the recent correction, the momentum readings on the lower time frame chart reached the extreme oversold zone and such setups have resulted in pullback moves in the recent past. On the daily chart, although the prices have formed a lower low, the ‘RSI Smoothed’ oscillator has not yet breached the previous swing low. “Any pullback move from here would then result in a positive divergence on the RSI with the index,” Jain said.

Foreign institutional investors (FIIs) kept up their selling spree, offloading equities worth of Rs 23,273.67 crore during the week, while domestic institutional investors (DIIs) picked up equities worth Rs 17,226.16 crore. So far in June, FIIs sold equities worth Rs 42,088.63 crore and DIIs bought equities worth Rs 30,312.85 crore.

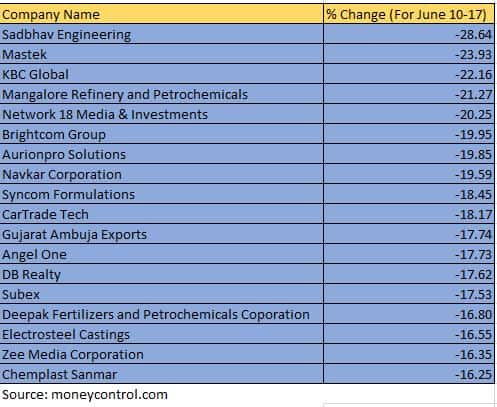

In this week, more than 200 small-cap stocks fell 10-28 percent. These include the likes of Sadbhav Engineering, Mastek, KBC Global, Mangalore Refinery and Petrochemicals, Network 18 Media & Investments, Brightcom Group, Aurionpro Solutions and Navkar Corporation. (Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.)

On the other hand, Ramco System, Apar Industries, VIP Industries, BLS International Services, FIEM Industries, TTK Healthcare added 5-19 percent.

“It was the worst week for our markets in this calendar year; in fact, the Nifty has closed at the lowest level in the last 12 months. There has been no respite in macro factors globally and hence, markets continue to feel the heat as they are now placed at multi-month lows. When this terrifying phase will end, nobody knows about it, and till the time we do not see some convincing relief on the global front, it’s better to stay light on positions,” said Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One.

“Taking a glance at the weekly time frame chart, we can see prices sliding below ’89-EMA’ for the first time after July 2020. So, price-wise it needs to be construed as a breakdown, which does not augur well for the bulls. On the flip side, the Nifty is exactly placed at the previous breakout point of May 2021 which is around 15,400 – 15,300.”

The ‘RSI-Smoothened’ oscillator on the daily chart shows a ‘Positive Divergence’ or lower lows in recent prices and higher lows in the oscillator. “This condition generally happens at the fag end of any downtrend,” Chavan said.

Among Midcaps, RBL Bank, Oil India, JSW Energy, Canara Bank, MphasiS, Aditya Birla Fashion & Retail, Bajaj Holdings & Investment, Jindal Steel & Power, Bharat Heavy Electricals, CRISIL and Vodafone Idea lost 10-28 percent

Among BSE 500 index shed over 5 percent dragged by RBL Bank, Mastek, Mangalore Refinery and Petrochemicals, Network 18 Media & Investments, Brightcom Group, Angel One and Deepak Fertilizers and Petrochemicals Corporation.

“The markets remained sluggish throughout the week as the rate hikes and inflationary pressure continued to be a major drag. The Nifty Index declined around 7% over the past week. Markets reacted to increased risks of a global recession as the US Fed was forced to raise interest rates by 75 bps due to persistently elevated inflation. All sectors ended in loss, with metals losing the most,” said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

“On the economy front, Headline CPI inflation in May dropped to 7.04% compared to 7.79% in April, while April IIP registered a growth of 7.1% yoy (March: 1.8%). FPI outflows stood at US$2 bn over the past five trading sessions, while DIIs bought US$1.75 bn over the same period,” he added.

Where is Nifty50 headed?

Amol Athawale, Deputy Vice President – Technical Research, Kotak Securities

For the traders now, 15400 would act as a trend decider level and above the same, the Nifty could touch the level of 15600-15700. On the other hand, below 15400, the index could retest the level of 15200.

Further down side may also continue which could drag the index till 15000. Meanwhile, after a long time, on weekly charts the Bank Nifty closed below the important support level of 33000. The structure suggests below 33000 it could slip up to 32000-31500.

Ajit Mishra, VP – Research, Religare Broking:

Markets are largely taking cues from the global markets, in absence of any major domestic event. And, going ahead, the US Fed chairman’s speech and China’s interest rate decision would be important triggers for the markets.

On the domestic front, the COVID trend and the progress of the monsoon will also be in focus. We reiterate our negative view on markets and suggest continuing with the “sell on rise” approach.

Yesha Shah, Head of Equity Research, Samco Securities.

The S&P 500 and our banking index have officially entered the bear market territory and the fear witnessed this week is expected to continue. The movement of the dollar index, crude oil prices, and the evolving Covid situation in China and India will be closely watched.

As there are no other major domestic or international macro events in the coming week, Indian indices are expected to be jittery, moving in tandem with in the global peers. Investors should therefore remain cautious and begin making small, selective investments in fundamentally superior companies that are available at reasonable valuations.

We recommend that traders maintain a negative to neutral outlook in the coming week and use any bounce as an exit opportunity. The immediate support and resistance levels are now placed at 15,200 and 16,200 levels respectively.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.