Nirmala sitaraman

On March 31, the Finance Ministry announced substantial interest rate cuts in small savings schemes for the April-June 2021 quarter. This action is routine—typically done to align small savings interest rates with bank lending deposit rates, which have fallen sharply.

But the blowback, especially on social media sites like Twitter, was instant. On the morning of April 1, the government rolled back the interest rate cuts. “Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn,” tweeted Finance Minister Nirmala Sitharaman.

The word ‘oversight’, caught the attention of twitterati and triggered an avalanche of potshots. #Oversight was soon trending on Twitter.

Really @nsitharaman “oversight” in issuing the order to decrease interest rates on GOI schemes or election driven “hindsight” in withdrawing it? https://t.co/Duimt8daZu

— Priyanka Gandhi Vadra (@priyankagandhi) April 1, 2021

Kids: Sight

Adults: ForesightLegends: Oversight

— Ramesh Srivats (@rameshsrivats) April 1, 2021

“Orders issued by oversight shall be withdrawn”

Let’s take a close look at this line to put the episode into context. Whose oversight was it exactly?

In any ministry or department, where the buck stops depends on how routine or big, or for that matter small or unusual, a matter is. Some files reach the level of Joint Secretary or Additional Secretary and go no further. Some matters require clearance from the Secretary, the senior-most bureaucrat. And some files need to be cleared by the ministers themselves.

What about announcing the interest rate on small savings schemes? This falls under the ‘routine’ category because a new notification either tweaking the rates or keeping them unchanged is issued every quarter. That is not to say it is not important —any decision that impacts the financial lives of millions of Indians who deposit their hard-earned money under such schemes is critical.

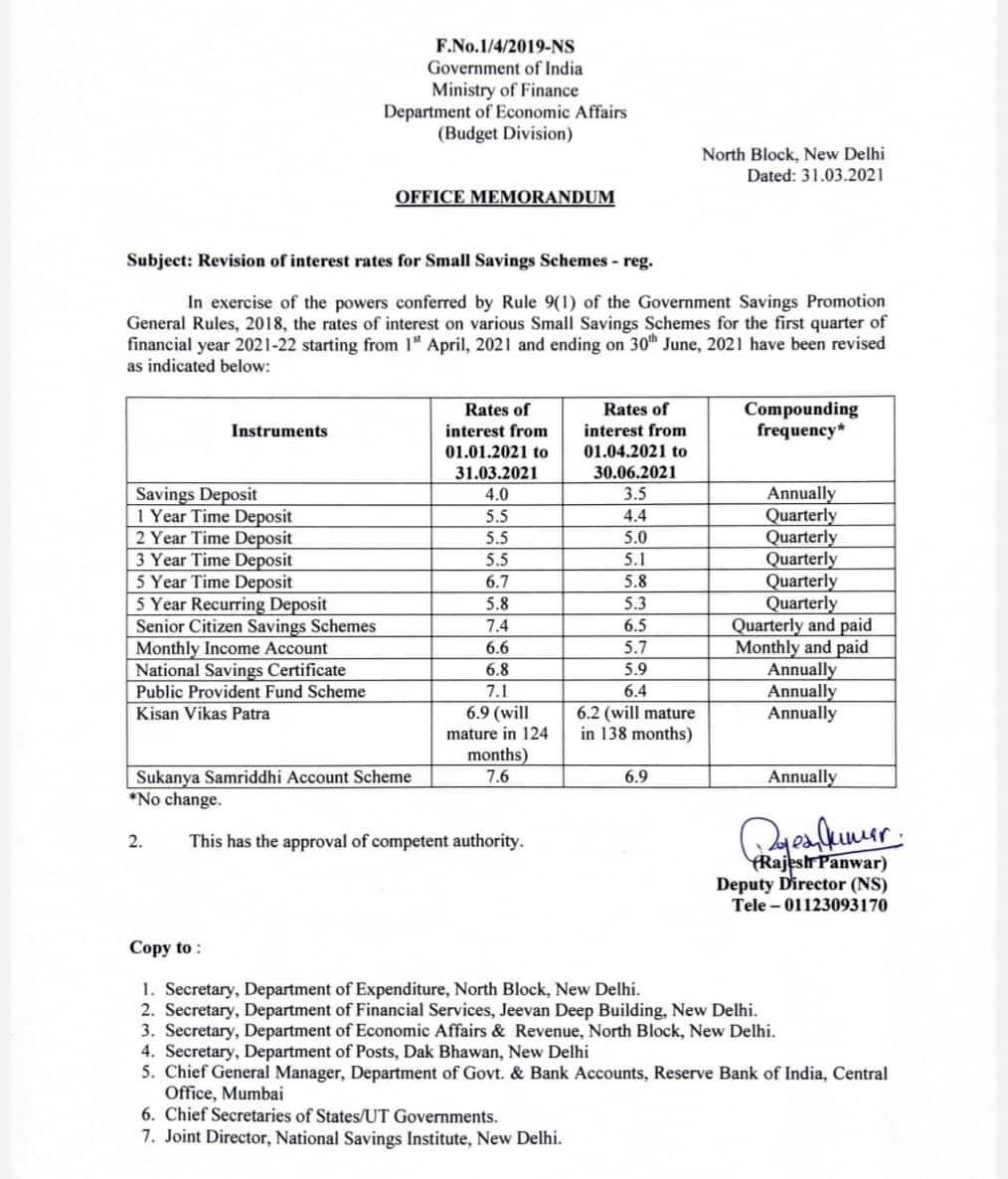

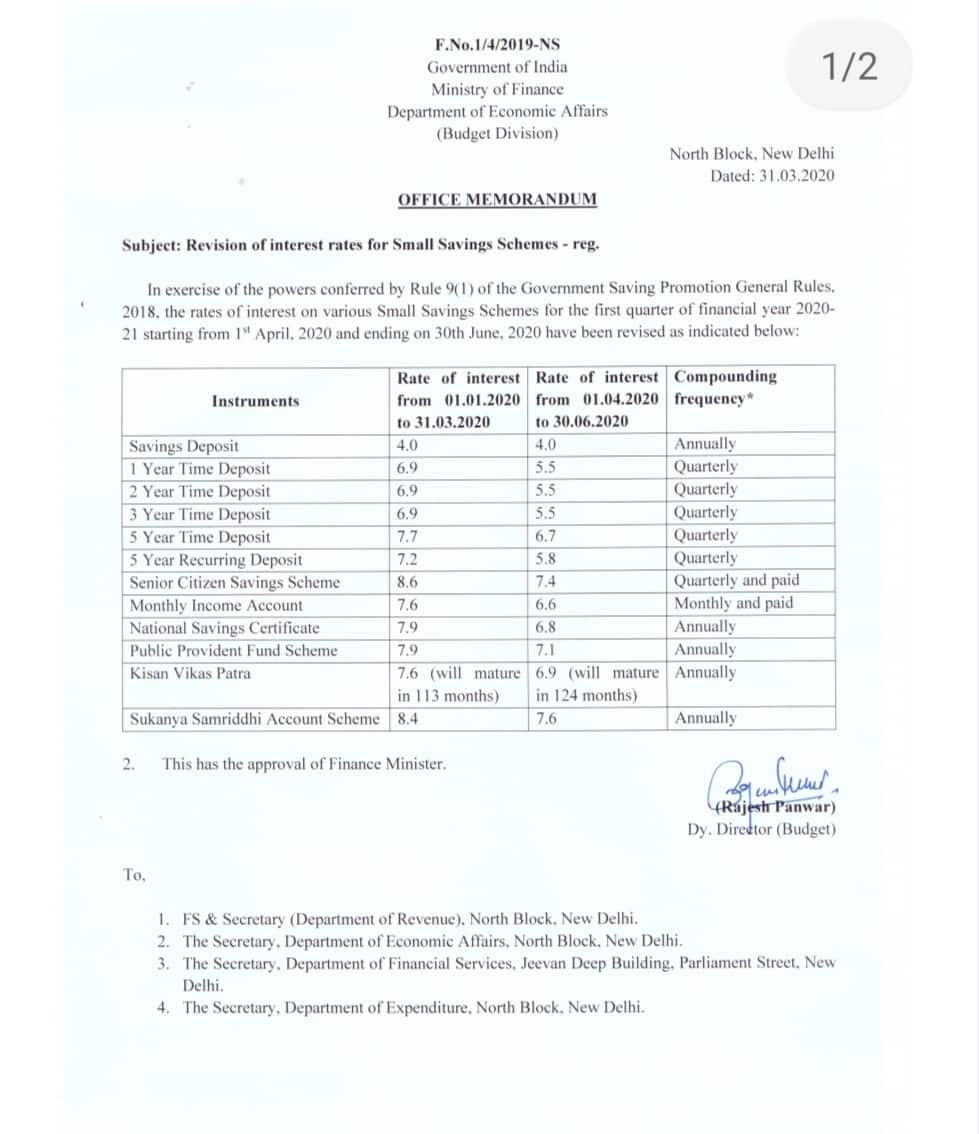

Take a look at the latest notification:

The line before an official’s signature says “This has the approval of competent authority”. Multiple calls and messages to Finance Ministry officials on who the ‘competent authority’ is, went unanswered.

In fact, the notifications for small savings rates in January-March 2021, October-December 2020 and July-September 2020 have the identical line on ‘competent authority.’

However, the notification for April-June 2020, issued exactly a year ago has this line: “This has the approval of the Finance Minister”. Every quarterly notification before that on small savings interest rates has that line, indicating that the final approval is with the Finance Minister.

So if one leaves aside the past three quarters, the levels of approval for such decisions follow the following pattern: From the Budget Division of the Department of Economic Affairs, it goes to the Joint Secretary of the division, an Additional Secretary in the department, the Secretary heading the department, and then the Finance Minister.

What Happens Next?

Two questions arise here. Since the second quarter of 2020-21, has the terminology changed while the chain of approval remained the same, with only ‘Finance Minister’ being replaced by ‘competent authority’? Or does this matter not reach the Finance Minister’s office anymore, and is being approved only till the level of Secretary, Economic Affairs?

We can only speculate here because the finance ministry is silent.

What we do know— after talking to people familiar with the matter—is that the decision to roll back the announcement was taken on the morning of April 1. The rate cut would have given ammunition to the opposition parties in high-stakes electoral battles in West Bengal, Tamil Nadu, Assam and Kerala. Together, these states contribute nearly a fourth of the total national small savings.

There are concerns that the small savings rates will be immediately reduced after the elections in key states. However, that is unlikely. Since 2016, small savings rates are reviewed every quarter, as opposed to every year before that.

The next review will be on June 30 for the July-September quarter. Given that it will still be bad politics (but good economics) for the rates to be cut so steeply even after the elections, the government may want to side-step any revision.