PSU banks are in focus after the government on March 31 announced capital infusion totalling Rs 14,500 crore in four public sector banks (PSBs) through zero-coupon bonds. With this, the government has completed capital infusion in PSBs for this fiscal.

These non-interest bearing bonds have been issued to the Central Bank of India, Indian Overseas Bank, Bank of India and UCO Bank. The government will infuse Rs 4,800 crore in Central Bank of India, Rs 4,100 crore in Indian Overseas Bank, Rs 3,000 crore in Bank of India and Rs 2,600 crore in UCO Bank.

Also Read: Government announces Rs 14,500-crore capital infusion in 4 PSBs

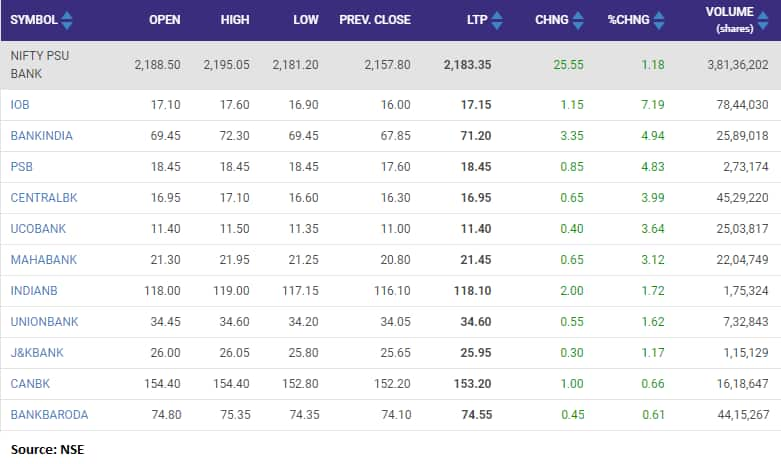

Nifty PSU Bank gained over a percent led by gains from Indian Overseas Bank, Bank of India, Punjab & Sind Bank, Central Bank of India, UCO Bank and Bank of Maharashtra among others.

Union Finance Minister Nirmala Sitharaman on February 1 announced a capital infusion of Rs 20,000 crore in state-owned banks for the financial year 2021-2022. The public sector banks (PSBs) account for 60 percent of the assets in the Indian banking system and are under government ownership. These banks also account for about 90 percent of the stressed assets in the banking system.

Nifty PSU Bank at 09:41 hours

Nifty PSU Bank at 09:41 hours

Banks require capital to meet the mandatory reserve requirements laid out by the Reserve Bank of India (RBI), make provisions for bad loans and kick-start the lending cycle when demand revives in the economy.

Vishal Balabhadruni, Senior Research Analyst at CapitalVia Global Research believes the PSU bank space may progress with mixed notes during the year, with the government’s decision to privatise two banks and recapitalisation of these PSBs.

“The decision of the government to not privatise SBI, PNB, Union Bank, Canara Bank, Bank of Baroda, Indian bank has brought certain positivity. The concerns of RBI regarding the severe stress scenarios materialising and the possible deterioration of asset quality suggests a bumpy path ahead,” said Balabhadruni.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.