Rare Enterprises, a stock trading firm owned by ace investor Rakesh Jhunjhunwala, on September 14 picked half a percent stake in Zee Entertainment Enterprises, a day when the stock spiked 40 percent after shareholders have demanded the removal three directors including Punit Goenka, the elder son of Essel Group Chairman Subhash Chandra.

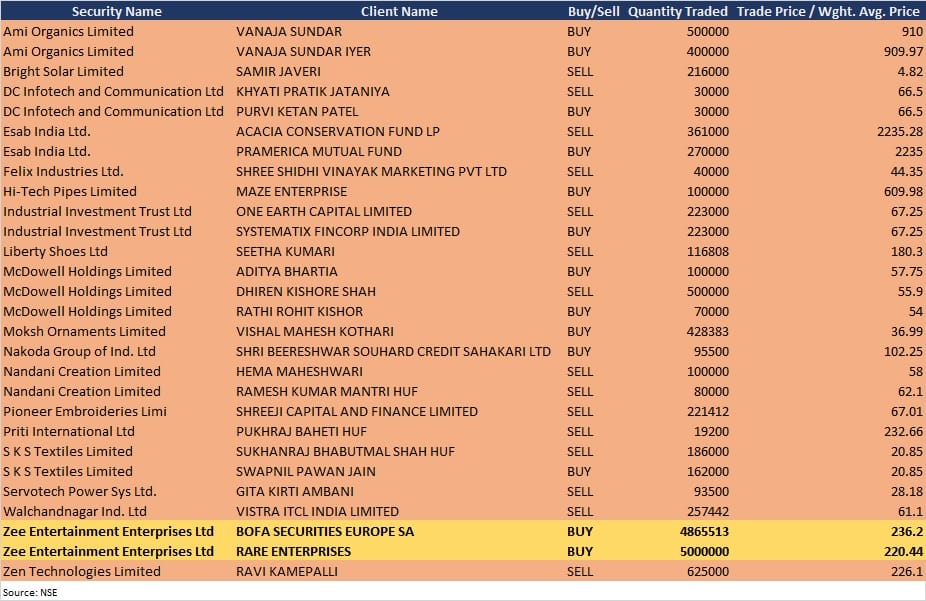

Rare Enterpises has bought 50 lakh equity shares in the company, representing 0.52 percent of total paid-up equity, at a price of Rs 220.44 per share on the NSE, the bulk deals data showed. The stake is valued at Rs 110.22 crore.

BofA Securities Europe SA also acquired 48,65,513 equity shares in Zee at Rs 236.2 per share.

The concerns over corporate governance after key shareholders Invesco Developing Markets Fund and OFI Global China Fund LLC’s demand to remove three directors in the company’s extraordinary general meeting seems to have built up confidence among investors, as the stock rallied 40 percent to close at Rs 261.50 on the BSE, the highest level seen since February 2020.

Likhita Chepa, Senior Research Analyst at CapitalVia Global Research, said appointing new directors would improve corporate governance in the company, provided the new directors have better understanding of the business.

Invesco and OFI Global China Fund LLC are the largest shareholders of Zee Entertainment Enterprises, together owning 17.88 percent stake in the company. They have demanded the removal of Goenka, Manish Chokhani and Ashok Kurien as directors of the firm, the company said in a regulatory filing on September 13. The company said Chokhani and Kurien had resigned with immediate effect.

The two funds have also sought to appoint six new independent directors, the filing added. The proposed directors are Surendra Singh Sirohi, Naina Krishna Murthy, Rohan Dhamija, Aruna Sharma, Srinivasa Rao Addepalli, and Gaurav Mehta.

Promoters currently held 3.99 percent stake in the company, while mutual funds including Nippon Life, Mirae Asset, Kotak MF and ICICI Prudential have 8.1 percent shareholding in the company as of June 2021, and insurance companies have 10 percent stake.

Amongst them, foreign portfolio investors are the largest shareholders with 57.46 percent stake including Amansa Holdings, HSBC, Vangyard International, Government Pension Fund Global and City of New York Group Trust.

Among other bulk deals, specialty chemical company Ami Organics also witnessed lot of demand from investors on September 14 as it was the first day of trade after the public issue. Vanaja Sundar acquired 5 lakh shares in Ami at Rs 910 per equity share and Vanaja Sundar Iyer bought 4 lakh shares at Rs 909.97 per share on the NSE.

Ami Organics had a debut with 48 percent premium and finally settled at Rs 934.55, up 53.20 percent amid healthy volumes, on the listing day. The Rs 570-crore public issue was oversubscribed 64.54 times.

Acacia Conservation Fund LP sold 3.61 lakh equity shares in welding and cutting equipment manufacturer Esab India at Rs 2,235.28 per share. Pramerica Mutual Fund was the buyer for some of shares, acquiring 2.7 lakh equity shares at Rs 2,235 per share.

Vishal Mahesh Kothari bought 4,28,383 equity shares in Moksh Ornaments at Rs 36.99 per share, while Hema Maheshwari sold 1 lakh shares in Nandani Creation at Rs 58 per share and Ramesh Kumar Mantri HUF sold 80,000 shares at Rs 62.1 per share.

Shreeji Capital and Finance sold 2,21,412 equity shares in Pioneer Embroideries at Rs 67.01 per share, while Vistra ITCL India offloaded 2,57,442 equity shares in Walchandnagar Industries at Rs 61.1 per share. Ravi Kamepalli sold 6.25 lakh shares in Zen Technologies at Rs 226.1 per share on the NSE.