Six straight days of selloff put bears in the driver’s seat ahead of Budget 2021. The market capitalisation of BSE-listed companies has fell by over Rs 11 lakh crore from the closing of January 20 while the S&P BSE Sensex has tumbled nearly 4000 points from the life high (intraday) of 50,184, recorded on January 21.

The average market-capitalisation of BSE-listed companies fell from Rs 197.70 lakh crore registered on January 20 to Rs 186.12 lakh crore as of January 29.

The Nifty50 lost over 1,100 points from the high of 14,753 recorded on January 21. However, broader markets have performed relatively better. The S&P BSE Midcap index fell 5.6 percent while the S&P BSE Smallcap index was down a little over 4 percent since January 20.

Catch our live coverage of Union Budget 2021 here

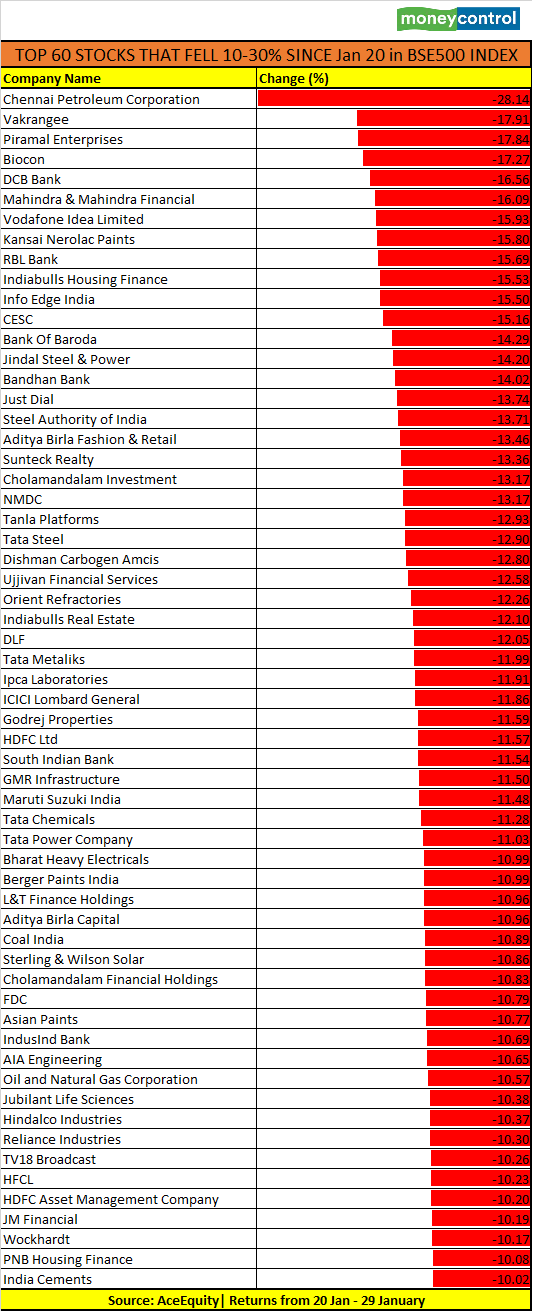

There are as many as 60 stocks in the S&P BSE 500 index that have fallen 10-30 percent in the run-up to the Budget that include names like Maruti Suzuki, GMR Infra, HDFC Ltd, DLF, M&M Financial, RBL Bank, Vakrangee, and Chennai Petro, etc. among others.

Experts feel that the market could swing in either direction. Considering the fact that the market has seen six consecutive days of fall – a move on the upside is more likely if Budget 2021 meets expectations.

Weak global cues, selling by foreign institutional investors (FIIs) which only increased in the run-up to the Budget weighed on sentiment. FIIs have pulled out more than Rs 12,000 crore in the cash segment of the Indian equity markets.

You can catch our live coverage of market action on Budget Day here

“On a monthly basis, Nifty/Sensex has formed hammer candlestick formation, supported by FIIs’ selling. It clearly suggests to us that the hot money is exiting from the market ahead of the major event of the Union Budget,” Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

“FIIs have sold more than Rs 6,000 crore in the cash segment and reduced positions on the Index futures significantly. The volatility is increasing and the index of volatility (India VIX) moved upward to 25.31, which is nearly a 12 percent jump in the fear index,” he said.

Chouhan further added that the crucial supports would be at 13,570 levels on the Nifty, and 46,100 on the Sensex. If the market slips further, then support for Nifty is placed at 13,440-13,20, and for Sensex, it is at 45,700-45,000 levels.

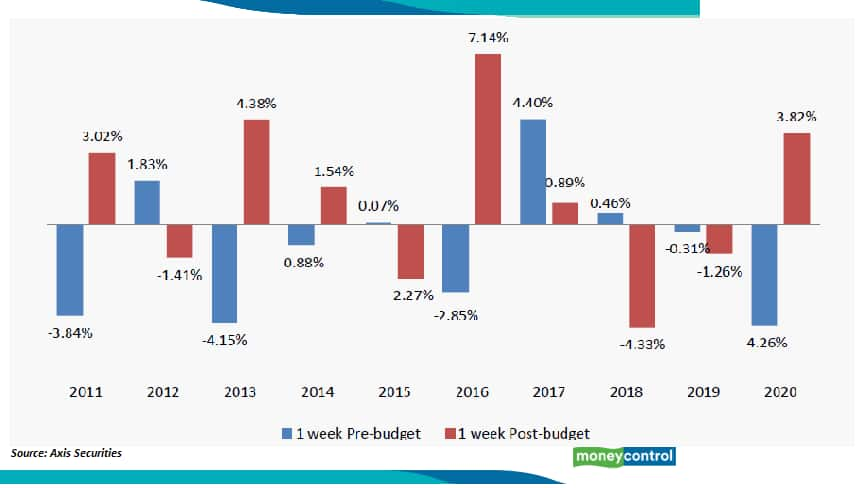

Wild gyrations on Budget Day cannot be ruled out. Historical data suggest that the market rallied in at least six out of the last 10 years in the week post Budget. In the year 2020, the index rose by about 4 percent, data from Axis Securities showed while in 2016 it rose by over 7 percent.

What should investors do?

Experts advise investors to stay neutral and pick up positions on declines towards 13,200-13,400 levels on the Nifty50 in specific stocks.

“Buying is advisable if Nifty drops to 13,500/46,000 with a final stop loss at 13,200/45,000 levels. The focus should be specifically on Financials, Pharmaceuticals and Commercial Vehicles,” suggests Chouhan.

The short-term trend in Nifty continues to be weak. The negation of the upside bounce attempt and the downside break of weekly support could signal more declines ahead for the Nifty.

“The key economic event of Union Budget could play a vital role to show the direction for the market. Any rise from here could encounter resistance around 13,750-13,800 levels,” Nagaraj Shetti, Technical Research Analyst, HDFC Securities told Moneyconrol.

“The near term downside targets to be watched for Nifty around 13,050 (20-weeks EMA) for the next few weeks,” he said.

What to expect from Budget:

R Venkataraman, MD, IIFL Securities Ltd

While we appreciate the pressure on the government to raise revenue, higher taxes could derail the nascent recovery momentum after a prolonged slowdown in the Indian economy, and hence the government should avoid raising tax rates.

While the government has been making efforts to raise revenue via disinvestments, the delays are hurting the credibility of this effort. A time-bound plan to sell public sector assets could help maintain a lower fiscal deficit without raising taxes.

The government should also take advantage of low-interest rates and issue longer-term bonds (say 30 years or 50-year bonds).

Yogesh Patil, Fund Manager – Equity, LIC Mutual Fund

Given the weak revenue collections during the pandemic year, focus on boosting spends towards development expenditure and health keeping an eye on fiscal consolidation.

We believe the focus of the Government would be on accelerating economic recovery despite challenging revenue collections. Emphasis will be on the financial, healthcare, and infrastructure sector to strengthen the AtmaNirbhar Vision.

Kunj Bansal, Business Head, PMS – Equity – Karvy Capital Ltd

The expectation is that government should increase the spending significantly and not look at the fiscal deficit. The more is the spend from the government, the higher will be the recovery in the economy.

Needless to mention that large part of this spending should be in long-tern productive assets such as infrastructure, housing, and health.

Prathit Bhobe, CEO&MD, Tata Mutual Fund.

Government’s focus in the upcoming Budget is likely to be on providing acceleration to the economic recovery which has been underway over the past few months. Government spending target will be the key and aided by i) the strong recovery in nominal GDP growth in FY22 and (ii) relatively higher tolerance for fiscal deficit (though it will be materially lower than the FY21 levels).

We expect the focus of spending to be on healthcare, housing, and infrastructure. On the reform front, government is likely to target PSU reforms (including banks) and privatisation as one of the key areas to raise capital over the medium term.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.