Sansera Engineering, an automotive components manufacturer, will be the 41st company coming out with an initial public offering in 2021.

Here are 10 key things to know about the Sansera Engineering share sale:

1) IPO Dates

The public offer opens for subscription on September 14 and closes on September 16. The anchor book, if any, will open for one day on September 13, a day before the issue opens.

2) Public Issue

The issue is a complete offer for sale of 17.2 million shares by the company’s investors and promoters.

Investor Client Ebene (CEL) will sell 8.63 million shares and investor CVCIGP II Employee Ebene is offering 4.83 million shares.

Among the promoters, Subramonia Sekhar Vasan will sell up to 2.05 million shares; and Unni Rajagopal Kothenath, Fatheraj Singhvi and Devappa Devaraj will offload 571,376 equity shares each.

Up to Rs 9 crore of shares are reserved for employees.

3) Price Band

The price band has been set at Rs 734-744 per share.

Eligible employees will get a discount of Rs 36 per share on the final offer price.

4) Objectives Of Issue

The public issue is a complete offer for sale, so all the money, excluding issue expenses, will go to the selling shareholders. The company will not receive any funds.

The sale will fetch the selling shareholders Rs 1,265.73 crore at the lower end of the price band and Rs 1,282.97 crore at the upper end.

5) Lot Size and Categorywise Reserved Portion

Investors can bid for a minimum of 20 shares each and in multiples of 20 shares thereafter. The minimum amount that retail investors need to invest is Rs 14,880 per lot and their maximum is Rs 1,93,440 for 13 lots. Retail investors are allowed to invest up to Rs 2 lakh in the issue.

The offer is being made through the book-building process. Half the offer size is reserved for qualified institutional buyers, 15 percent for non-institutional investors, and 35 percent for retail investors.

6) Company Profile & Industry Outlook

Sansera Engineering is a Bengaluru-based integrated manufacturer of complex and critical precision-engineered components across automotive (two-wheeler, passenger vehicle and commercial vehicle verticals) and non-automotive sectors (aerospace, off-road, agriculture and other segments, including engineering and capital goods).

The company supplies most of its products directly to original equipment manufacturers in finished (forged and machined) condition. The automotive sector contributed 88.45 percent of its revenue in FY21 and the remaining 11.55 percent was contributed by the non-automotive sector.

It received 64.98 percent of its revenue from India in FY21 and the remainder from Europe, the US and other countries.

In India, it is a leading manufacturer of connecting rods, crankshafts, rocker arms and gear shifter forks for two-wheelers, and connecting rods and rocker arms for passenger vehicles. It is the largest supplier of connecting rods, rocker arms and gear shifter forks to two-wheeler OEMs in India and the largest supplier of connecting rods and rocker arms to passenger vehicle OEMs in India.

The company had 16 manufacturing facilities as of July 31, 2021, of which 15 are in India and one is in Trollhättan, Sweden.

Sansera has had long-standing relationships with two-wheeler and car makers. In the two-wheeler vertical, it has had a 25-year relationship with Bajaj Auto, while with Honda Motorcycle & Scooter India and Yamaha, the relationship has spanned over 20 years.

In the passenger vehicle vertical, it has had relationships spanning more than 30 years with Maruti Suzuki and over 10 years with Stellantis NV (formerly Fiat Chrysler Automobiles) and a leading North American OEM.

It was supplier to 71 customers during FY21 as compared to 64 during FY19, which helped to decrease its reliance on Bajaj, its top customer.

Sansera Engineering owns a 100 percent stake in Sansera Engineering (Mauritius) and a 70 percent stake in Fitwel Tools & Forging Private Ltd. (India). Sansera Engineering (Mauritius) owns 100 percent in Sansera Sweden AB.

CRISIL Research expects the auto component industry’s revenue to be led by OEM demand, which is expected to log a CAGR of 11.9 percent over FY21-FY26 to reach Rs 5,28,400 crore. Production growth and higher outsourcing to auto component players by OEMs will drive OEM demand.

7) Strengths & Strategies

a) Leading supplier of complex, high-quality precision-engineered components that is gaining market share across automotive and non-automotive sectors.

b) Business model well-diversified by customer base, end-segment, geographical spread of revenue and product portfolio.

c) Advanced capabilities in design and engineering, machine building and automation, resulting in continuous new product development and improved productivity, with fungibility of equipment, machinery and production lines across product families and sectors.

d) Long-standing relationships with Indian and global OEM customers.

e) Financial performance above industry trends, with industry-leading metrics.

f) Skilled and experienced board of directors and management team, with employee culture that emphasises teamwork and collaboration across functions.

Strategies

a) Consolidate and strengthen global market share in the automotive product portfolio and diversify into new products to cater to the expected increase in electrification of vehicles.

b) Continue to leverage existing capabilities to diversify into non-automotive businesses and expand addressable market.

c) Retain and strengthen technological leadership through continued focus on engineering capabilities.

d) Focus on operational efficiencies to improve returns.

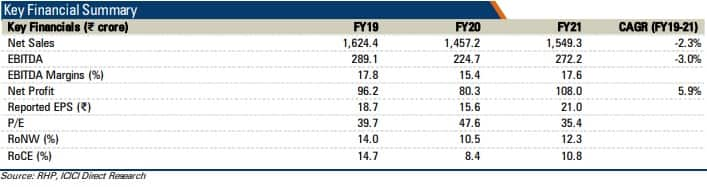

8) Financials

Sansera Engineering reported a profit of Rs 109.86 crore in FY21 compared with earnings of Rs 79.9 crore in FY20 and Rs 98.06 crore in FY19. Revenue was Rs 1,549.27 crore in FY21 compared with Rs 1,457.17 crore in FY20 and Rs 1,624.43 crore in FY19.

Earnings before interest, tax, depreciation and amortisation were Rs 272.12 crore in FY21 from Rs 224.7 crore in FY20 and Rs 289.09 crore in FY19. The EBITDA margin was 17.56 percent in FY21, 15.42 percent in FY20 and 17.79 percent in FY19.

The company has been able to deliver return on capital employed (RoCE) of 15.11 percent, 12.88 percent and 19.36 percent for FY21, FY20 and FY19, respectively, in challenging market conditions.

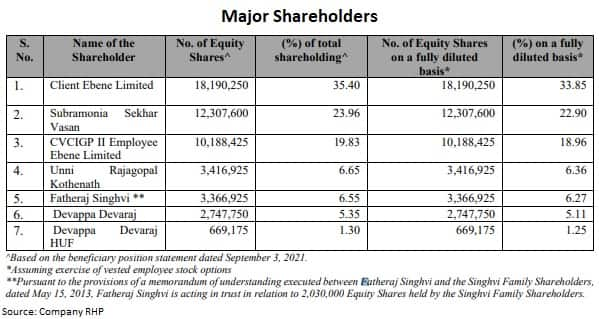

9) Promoters and Management

Subramonia Sekhar Vasan, Fatheraj Singhvi, Unni Rajagopal Kothenath and Devappa Devaraj are the promoters, owning a combined 40.64 percent stake in the company. The total promoter and promoter group shareholding in the company stood at 43.91 percent.

Investors Client Ebene and CVCIGP II Employee Ebene hold 35.4 percent and 19.83 percent, respectively.

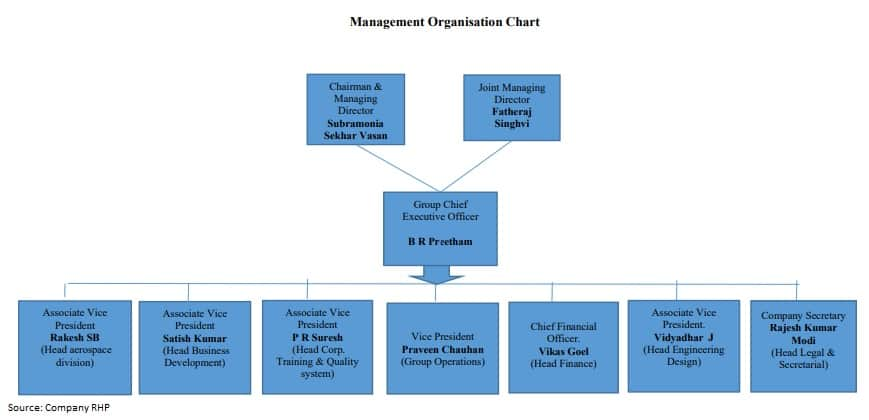

Subramonia Sekhar Vasan is chairman and managing director of the company. He holds a bachelor’s degree in technology from the Indian Institute of Technology, Madras, and a post-graduate diploma in management from the Indian Institute of Management, Bangalore. He has over 39 years of professional experience.

Fatheraj Singhvi is joint managing director. He is a member of the Institute of Chartered Accountants of India and has over 39 years of experience.

Raunak Gupta is non-executive nominee director on the board. Muthuswami Lakshminarayan, Revathy Ashok, and Sylvain Bilaine are non-executive independent directors.

BR Preetham is group chief executive officer and has been associated with the company since September 28, 1992. He has over 28 years of experience and has oversight across all areas of the company’s business including developing and maintaining relationships with companies and suppliers.

Vikas Goel is chief financial officer. He has been associated with the company since July 2019. He was previously associated with Ingersoll-Rand (India), Stanley Black & Decker India, and Weir India. He also worked at Motherson Sumi Systems and Delton Cables.

10) Allotment, refunds and listing dates

The IPO share allotment will get finalised on September 21 and funds to unsuccessful investors will be refunded around September 22, 2021.

The company will credit shares to eligible investors’ demat accounts around September 23. Trading in shares will start on September 24 on the BSE and the NSE.

ICICI Securities, IIFL Securities and Nomura Financial Advisory and Securities (India) are the bookrunning lead managers to the offer.