The Indian stock market traded in the red on March 30 following Asian peers, with the Sensex down 1,375.27 points, or 4.61 percent, at 28440.32, and the Nifty ended 379.15 points, or 4.38 lower, at 8281.10.

The IMF has said the global economy had entered into a recession, which could be worse than the one that followed the 2008-09 financial crisis.

“It is clear that we have entered a recession” that will be worse than the one witnessed in 2009 following the global financial crisis, IMF chief Kristalina Georgieva said in an online press briefing.

related news

Among the sectors, the Bank Nifty tanked 6 percent dragged by HDFC Bank, ICICI Bank, IDFC First Bank and Kotak Mahindra Bank which shed 6-8 percent each followed by RBL Bank, State Bank of India, Federal Bank and YES Bank.

Retail and MSME growth, especially that of the private banks and NBFCs has most likely come to an abrupt halt. “We are likely to see significant revisions to underwriting policies which would consequently have an impact on growth, NIM and profitability. We should ideally expect lenders to scale down growth expectations in the more profitable unsecured books and non-salaried segments,” research firm Kotak Institutional Equities said.

The restructuring or moratorium window usually tends to be much longer as regulators address the near-term challenges. A prolonged moratorium or restructuring window tends to be negative for the sector as the ability to understand the true loan book status or profitability comes under discussion, it said.

“We expect a struggle to get the re-rating for lenders, especially those with the high risk product segments like unsecured loans, MSME as we see risk in growth, NIM, operating costs and provisions,” it added.

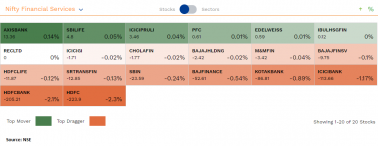

The Nifty Financial Services fell over 7 percent dragged by Bajaj Finance, HDFC, HDFC Life, M&M Financial Services and Shriram Transport Finance.

“Part of the sell-off that we are seeing in the market is re-balancing in the FII books considering the selling pressure we have in some of the emerging market portfolio. The kind of selloff that we are seeing in names like HDFC Bank and Bajaj Finance is due to the impact of lockdown, which will have an impact on asset quality and the growth projection. The selloff is also driven technically. We would take this opportunity to build up positions. Market volatility is not going to go up anytime soon. We are recommending to start nibbling at specific levels, don’t rush to allocate full amount,” said Amit Khurana, Head of Equities & Research of Dolat Capital.

“We believe that HDFC Bank will withstand the economic reverberation in a better way than others,” he added.

The index formed an Inverted Hammer or Shooting Star candle on the daily chart, which indicates a pause in bounce back if follow-up supply happens in the next trading sessions. However, it still requires confirmation.

“8,000 would be seen as a key support. Traders are advised not to take aggressive / leveraged bets and should ideally keep booking profits on a regular basis. For a time being, the strategy would be to take one step at a time and keep focusing on quality names,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel Broking told Moneycontrol.

Time to show-off your poker skills and win Rs.25 lakhs with no investment. Register Now!