Updated: June 29, 2020 4:12:23 pm

BSE in Dalal Street, Mumbai. (Express photo by Nirmal Harindran)

The benchmark equity indices on the BSE and National Stock Exchange (NSE) ended over 0.5 per cent lower on Monday taking cues from their global peers.

The S&P BSE Sensex slipped 209.75 points (0.60 per cent) to end below the 35,000-mark at 34,961.52, while the broader Nifty 50 dipped 70.60 points (0.68 per cent) to settle at 10,312.40. Both the indices had opened around 0.8 per cent lower earlier in the day and slipped further during the morning trade. However, in the afternoon session of trade, they picked up some steam and recouped some bit of the losses.

HDFC Bank, Hindustan Unilever (HUL), Kotak Mahindra Bank, Bharti Airtel, ITC and Mahindra & Mahindra (M&M) were the biggest gainers of the day. On the other hand, Axis Bank, Tech Mahindra, State Bank of India (SBI), Larsen & Toubro (L&T), IndusInd Bank and Infosys were the top losers on Monday. (see heatmap below)

Gainers and losers of the day on the Sensex. (Source: BSE)

Gainers and losers of the day on the Sensex. (Source: BSE)

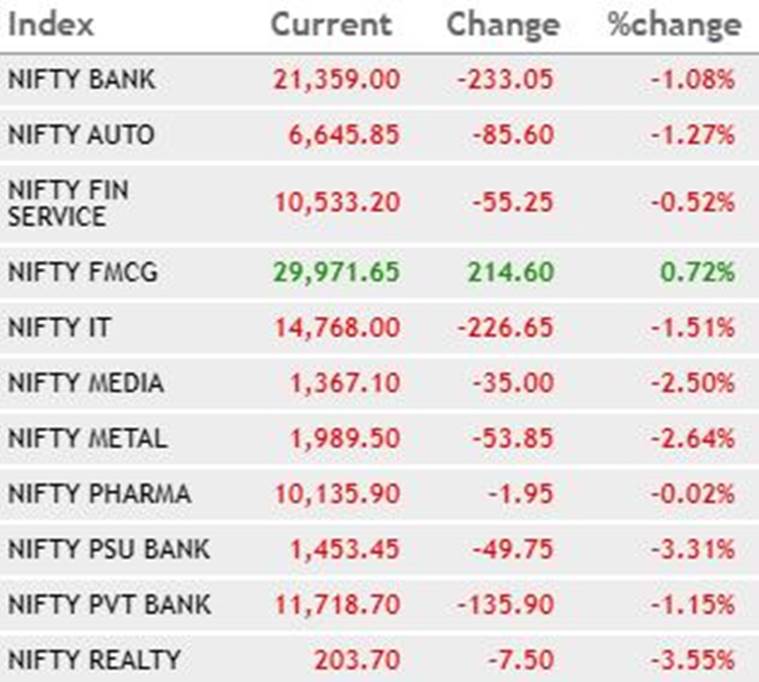

Among the sectoral indices on the NSE, the Nifty Realty index was the worst performer on Monday falling 3.55 per cent weighed by Omaxe and Brigade Enterprises. It was closely followed by the Nifty PSU Bank index which slipped 3.31 per cent dragged by UCO Bank and Bank of Baroda. Apart from these, the Nifty Metal index also dipped 2.64 per cent led by a fall in Coal India and National Aluminium Company.

Here’s how the sectoral indices performed:

Sectoral gainers and losers of the day on the National Stock Exchange. (Source: NSE)

Sectoral gainers and losers of the day on the National Stock Exchange. (Source: NSE)

In the broader market, the S&P BSE MidCap index ended at 13,073.72, down 184.72 points (1.39 per cent), while the S&P BSE SmallCap settled at 12,474.44, down 155.84 points (1.23 per cent).

“Benchmark indices ended on a negative note, on the back of mixed global cues as surging virus cases around the world and especially in the US, threatened to derail the economic recovery hopes. With states in India set to extend lockdown or reconsidering bringing back lockdown measures, markets seem to be weighing the bad news. As before, uptrend remains intact but the upside may be capped,” Vinod Nair, Head of Research at Geojit Financial Services, said in a statement after the market ended on Monday.

Rupee

The rupee settled 7 paise higher at 75.58 (provisional) against the US dollar on Monday supported by weak American currency and easing crude prices even as the equity market was trading in the negative territory.

Forex traders said weak domestic equities, foreign fund outflows and rising COVID-19 cases weighed on investor sentiments. However, weak American dollar supported the local unit and restricted the decline.

The rupee opened on a flat note at the interbank forex market at 75.64 against the US dollar, then gained ground and finally settled for the day at 75.58 against the US dollar, up 7 paise over its last close.

It had settled at 75.65 against the US dollar on Friday.

During the four-hour trading session the domestic unit touched an intra-day high of 75.52 and a low of 75.64 against the US dollar.

Global market

World shares hit two-week lows and oil fell nearly 2 per cent on Monday as the relentless spread of the coronavirus curbed optimism on the global economy, prompting investors to take shelter in safe-haven bonds and gold.

European stocks opened slightly lower, after Asian shares ended deep in the red playing catch up with Wall Street’s ugly close on Friday as some US states reconsidered their reopening plans.

The global death toll from COVID-19 reached half a million people on Sunday, with one quarter of those in the United States, where cases have surged in a handful of southern and western states.

MSCI’s world shares index was off 0.2 per cent, hitting its lowest level since June 15 dragged down by Japan’s Nikkei shedding 2.2 per cent and Chinese blue chips off 0.9 per cent. E-Mini futures for the S&P 500 were up 0.1 per cent.

– rupee input from PTI; global market input from Reuters

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Business News, download Indian Express App.

- Tags:

- BSE Sensex

- Indian stock market

- markets

- NSE Nifty