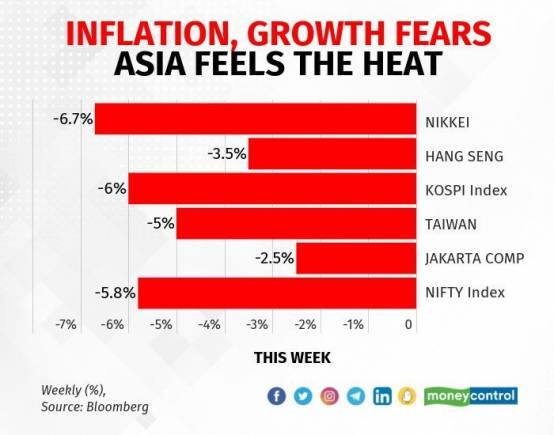

The headline indices suffered losses of over 5% during the week that saw the US Federal Reserve hike interest rates by 75 basis points and the Swiss National Bank deliver its first rate hike in 15 years.

Volatile trade compelled equity indices to post their worst week in over two years on June 17 as weak global cues and concerns over foreign capital outflows, along with rate hikes by central banks around the globe, and stubborn inflation weighed on markets.

The BSE benchmark Sensex ended 135 points or 0.26 percent lower at 51,360.42 levels while the Nifty dipped 67 points or 0.44 percent to 15,277.90, with both indices touching over one-year lows in their sixth straight session of losses.

The headline indexes incurred losses of over 5% during the week that saw the US Federal Reserve hike interest rates by 75 basis points and the Swiss National Bank deliver its first rate hike in 15 years.

In the Sensex pack, the biggest laggards included Asian Paints, Wipro, Dr Reddy’s, Titan, TCS, Tech Mahindra, Sun Pharma, and Maruti while Bajaj Finance, Bajaj Finserv, and Reliance Industries emerged as the top gainers.

On Thursday, the BSE benchmark plummeted 1,045.60 points or 1.99 percent to settle to 51,495.79 and the NSE Nifty plunged 331.55 points or 2.11 percent to 15,360.60. “The dominant theme impacting equity markets globally is synchronised global monetary tightening and consequent fears of economic slowdown,” said VK Vijayakumar, chief investment strategist at Geojit Financial Services.

Foreign institutional investors remained net sellers in the capital market on Thursday as they sold shares worth Rs 3,257.65 crore, going by exchange data.

Meanwhile, the Reserve Bank of India (RBI) on Friday said it has not fallen behind the curve in terms of raising interest rates and is in sync with the realities of growth and inflation.