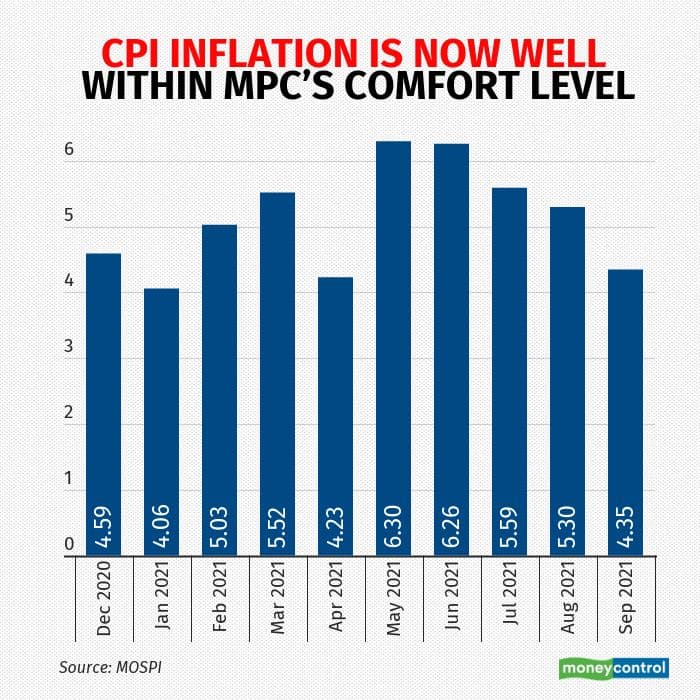

The Consumer Price Index-based (CPI) inflation for September 2021 came in at 4.35 percent, compared with 5.30 percent in August, data released by the National Statistical Office (NSO) showed on October 12. This is the lowest retail inflation print since April 2021.

The fall in headline retail inflation was primarily on the back of a sharp cooling in food inflation. Consumer Food Price Inflation (CFPI) for September stood at 0.68 percent in September, compared with 3.11 percent in August.

CPI inflation has been well within the Monetary Policy Committee’s inflation targeting range of 4 (+/-2) percent since December 2020, except the months of May and June, when it crossed the 6 percent mark.

“Price pressure remain contained and surprised pleasantly helped by base effects and a drop in food prices. We maintain inflation Is likely to average a tad lower than RBI’s newly revised 5.3 percent for FY22,” said Madhavi Arora, Lead Economist, Emkay Global Financial Services.

In spite of record petrol and diesel prices, headline retail inflation has not crossed the proverbial danger mark, as far as policymakers are concerned. This is because almost 50 percent of CPI inflation is food inflation, which has more or less been under control.

The only concern is edible oil. Edible oil inflation rose 34.19 percent year-on-year (YoY) in September compared with 33 percent in August.

Vegetable inflation registered a massive 22.5 percent fall year-on-year fall in September, compared with a deflation of 11.7 percent in August. Cereals and products deflated by 0.61 percent versus 1.42 percent deflation in August.

Year-on-year inflation for fruits fell sharply to 3.70 percent, compared with 6.69 percent in August.

The high petroleum product prices did reflect in some sub-groups and in core inflation. For example, fuel and light inflation rose to 13.63 percent year-on-year in September, compared with 12.95 percent in August.

“CPI inflation moderated, as food inflation moderated materially, driving the downside surprise. The drop comes amid divergent signals from core inflation, which rose to 5.99 percent on account of a number of higher input cost shocks,” said Rahul Bajoria, India Chief Economist at Barclays.

Bajoria said that prices of healthcare expenditure and education remain sticky, while moderation in gold prices helped keep the personal care and effects segment flat.

“Overall, we expect elevated global commodity prices to continue to exert upward pressure on India’s import basket, which in turn we expect to gradually spill over into CPI inflation in the coming month,”he said.

“In our view, the MPC will choose to continue to ignore supply side risks to inflation, especially if they emanate from a global surge in commodity prices, on which monetary policy has little impact, and change the stance only after a durable domestic demand revival emboldens producers to raise prices,” said Aditi Nayar, Chief Economist, Icra Ltd.

On October 8, the monetary policy committee (MPC) kept the key lending rate unchanged at 4 percent and retained the monetary stance as ‘accommodative’. This is the eighth consecutive time the MPC maintained a status quo in rates.