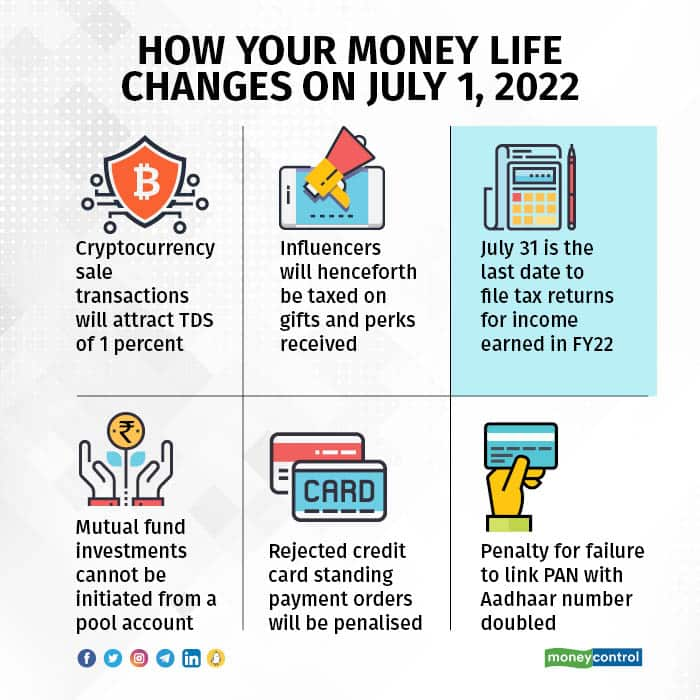

Whether you’re an investor in a mutual fund or a cryptomaniac or an income-tax payer, there are a number of important money changes that will affect your money box in July. Read on to find out what they are.

TDS on cryptocurrency transfers

From July 1, your cryptocurrency sale transactions will attract TDS (Tax Deducted at Source) of 1 percent. The purpose of levying TDS on crypto transfers is to capture the details of all the transactions related to virtual digital assets (VDAs).

TDS at the rate of 1 percent will be deducted on the payment of a sale consideration of VDA, if the cumulative sale consideration exceeds Rs 10,000 in any financial year. This will be applicable to all VDA transfers — cryptocurrencies, non-fungible tokens (NFTs).

The threshold limit for TDS is Rs 50,000 for specified persons, which includes individuals and Hindu Undivided Family (HUFs). TDS needs to be deducted at the time of making payment or transferring the consideration to the seller. For instance, if someone is buying VDA valued at Rs 1 lakh, Rs 1,000 (1 percent of Rs 1 lakh) needs to be deducted and the remaining Rs 99,000 should be transferred to the seller of the VDA.

The onus of withholding the TDS lies with the person making the payment to the seller — it can be a buyer, an exchange or a broker. That means TDS needs to be deducted from the selling price and, after deducting the TDS amount, they can transfer the rest to the seller.

Also read: Selling cryptocurrencies bypassing exchange? Here’s how to do 1% TDS deduction

Influencers to be taxed on freebies

Often, companies remunerate social media influencers in kind. Such gifts or perks will be taxed from July 1. However, if an influencer returns a gift, there will be no tax on the item.

Social media influencers could be celebrities, persons with expertise or authority in a particular field, or those having a social relationship with their audience. These influencers typically get to retain the products they endorse or review. These products could be of substantial value; examples include an expensive smartphone, a piece of jewellery, or even a car.

Some influencers also get free flight tickets and holiday packages.

The new section 194R covers all such transactions. This section provides for TDS at the rate of 10 percent on any benefit or perquisite provided if such a benefit or perquisite arises from business or profession and the total value of such a benefit or perquisite exceeds Rs 20,000 in a year.

The CBDT does not restrict the new tax provision to social media influencers, but it has a wider application. For instance, many companies provide incentives in the form of holiday packages to dealers who achieve sales targets or to top-performing distributors. The companies will have to comply with TDS provisions under the new section and the dealers and distributors have to include the value of these benefits in their tax returns.

File your tax returns now

The due date for filing income tax returns for financial year 2021-22 (assessment year 2022-23) is July 31. Get started with the exercise right away instead of waiting until the last minute.

If you miss the due date but complete the process by December 31, you will have to shell out a penalty of Rs 5,000. However, if your income is less than Rs 5 lakh, the late filing fee will be restricted to Rs 1,000.

New rules to invest in mutual funds

From July 1, mutual fund investments cannot be initiated from a pool account. The money has to go from the investor’s bank account to the bank account of the mutual fund house, as mandated by regulator Securities and Exchange Board of India (SEBI). All transaction platforms backed by stock exchanges will implement this.

Earlier, mutual fund investors and distributors had been vocal about issues such as delayed confirmations about allotment of units, inability to pay using cheque, RTGS and NEFT, and failed SIP transactions, among others.

Now, all SIPs will stop where your broker used to transfer funds from your broking account balance to the mutual fund house. You have to sign up for fresh National Automated Clearing House (NACH) mandates in favour of the clearing corporation, which can be done online. Ensure that the right bank accounts are linked with your mutual fund folios as the sale proceeds will now be hitting your bank accounts, and won’t get credited to your broking account. Two-factor authentication is a must for all transactions involving sale of units.

HDFC Bank credit cards introduce standing instruction return charges

HDFC Bank will now impose a penalty if the standing instruction to pay your bills fails, effective July 1. Standing instruction return charges will be levied on the cardholder on the net payable amount post the payment attempt. The bank has informed about it to the cardholders.

Say an HDFC Bank cardholder has opted for the standing instruction facility on the total amount due. Now, assume that the standing instruction amount (the card bill for the month) due is Rs 10,000 and system recovers only Rs 500 (minimum amount due) due to insufficient funds in the nominated account, payment return fee will be levied on the net payable amount Rs 9,500 (Rs 10,000 less Rs 500).

Similarly, if the system is able to recover only a partial amount, for example, Rs 200, which is less than the minimum amount due, then a payment return fee will be levied on the net payable amount of Rs 9,800 (i.e. Rs 10,000 less Rs 200).

Interest will be levied on the full outstanding amount, even if you pay the minimum amount due.

Fine for failure to link PAN with Aadhaar number doubled

The Central Board of Direct Taxes has doubled the fine on those who missed the March deadline to link their permanent account number (PAN) with their Aadhaar number. The penalty has increased to Rs 1,000 from July 1. In June the penalty was Rs 500.