Buy / Sell Tata Motors share

Shares of Tata Motors have been falling for five straight days now as the Street expects the automobile manufacturing company’s operating margin to be under pressure due to higher raw material costs.

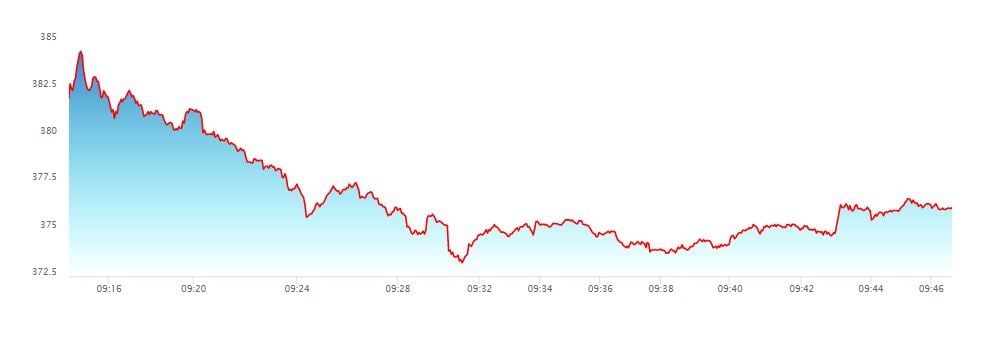

The stock slumped nearly four percent today to touch an intraday low of Rs 373.10 on NSE.

At 0952 IST, the scrip was down 3 percent at Rs 376.45 on NSE.

(Source: NSE)

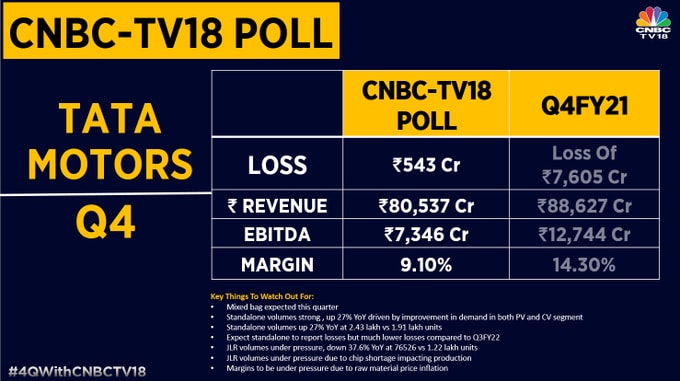

(Source: NSE)According to CNBC-TV18 Poll, the company is expected to report losses, on a standalone basis, but much lower losses compared to the third quarter of FY22. Standalone volumes are likely to be strong driven by improvement in demand in both Passenger Vehicles and Commercial Vehicles segments.

Jaguar Land Rover (JLR) volumes are also expected to be under pressure, down 37.6 percent YoY at 76,526 units. Chip shortage is seen hurting production.

A snapshot of Street’s earnings expectation for Tata Motors

A snapshot of Street’s earnings expectation for Tata MotorsThere are some key factors that market participants will watch out for in the results of the automobile manufacturer.

Some of those monitorable factors are the production situation at JLR, demand and inventory situation across JLR’s key markets, growth outlook for domestic business, inflationary impact on both the businesses going ahead and new product launches with timelines.

(With inputs from Sonia Shenoy)

First Published: IST