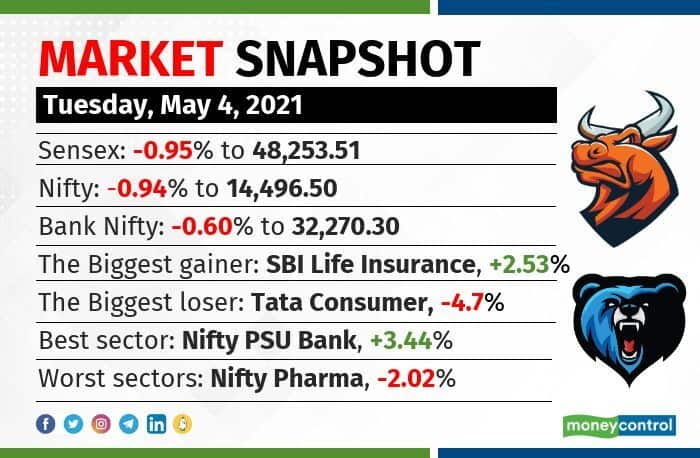

Benchmark indices failed to hold the initial gains and ended near the day’s low in a highly volatile session on May 4. At close, the Sensex was down 465.01 points or 0.95% at 48,253.51, and the Nifty was down 137.70 points or 0.94% at 14,496.50.

Except for PSU Bank, all other sectoral indices ended in the red. BSE Midcap and Smallcap indices also ended lower.

“The markets have not broken the 14400 level on a closing basis which means the support still holds. If we crack this level, we could see levels closer to 14000-14100,” said Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments.

“On the upside, there is stiff resistance at 14700 and until we do not get past that, we will not enter a bullish trend. It is a tight range and traders need to be cautious in their approach,” he added.

Tata Consumer Products, Cipla, Dr Reddy’s Labs, Divis Labs and Reliance Industries were among the top losers on the Nifty. Gainers included SBI Life Insurance, ONGC, BPCL, Bajaj Finance and Adani Ports.

Stocks & sectors

Except for PSU Bank, all other sectoral indices ended in the red.

Among individual stocks, a volume spike of more than 100 percent was seen in SRF, Bharat Forge and Tata Consumer Products.

Long buildup was seen in RBL Bank, SRF and SBI Life, while short buildup was seen in Tata Chemicals, Tata Consumer and Mphasis.

More than 250 stocks, including Tata Steel, Tata Coffee, Marico and JSW Energy, hit a fresh 52-week high on the BSE.

Technical View

The Nifty formed a bearish candle on the daily time frame and wiped out the recovery of the last session.

“The Nifty has to hold above 14,500 zones to witness an up move towards 14,700 and 14,800 zones while on the downside support exists at 14,400 and 14,250 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.