Benchmark indices regained previous session losses and ended near the day’s high on May 4 after RBI Governor Shaktikanta Das launched the second round of loan restructuring and other relief measures to counter covid second wave.

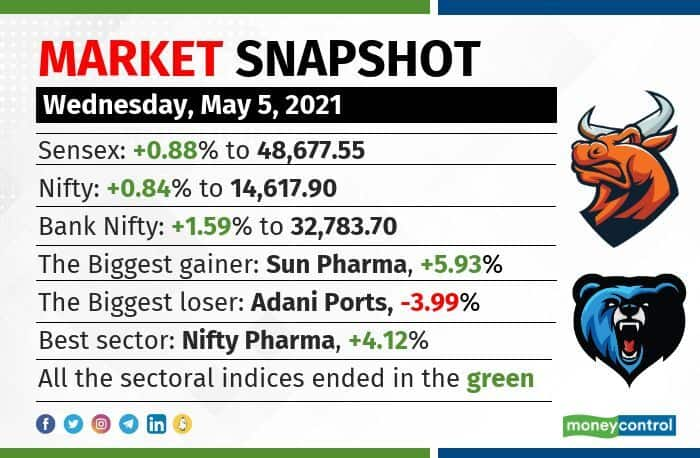

At close, the Sensex was up 424.04 points or 0.88% at 48,677.55, and the Nifty was up 121.40 points or 0.84% at 14,617.90.

Except for realty, all other sectoral indices ended in the green with Nifty Bank, IT, pharma and PSU bank indices rising 1-4 percent.

“Domestic market edged up boosted by pharma and financial stocks following RBI Governor’s announcement and positive global markets. While reassuring RBI’s policy aid, the Governor announced an array of support to the COVID-hit sectors through restructuring schemes and liquidity measures,” said Vinod Nair, head of Research at Geojit financial services.

“India’s Service PMI index reported a marginal decline in April to 54.0 from 54.6 in March 2021 owing to slowdown in external demand and escalation of the pandemic, but is expected to improve on a QoQ basis from Q2 FY21 onwards,” Nair added.

Sun Pharma, UPL, Axis Bank, IndusInd Bank and Kotak Mahindra Bank were among the top gainers on the Nifty. Losers included Adani Ports, Bajaj Finance, SBI Life Insurance, Asian Paints and HUL.

Stocks & sectors

On the BSE, except realty, all other sectoral indices ended in the green. BSE Midcap and Smallcap indices rose 0.7-1 percent.

Among individual stocks, a volume spike of more than 100 percent was seen in Lupin, Alkem Laboratories and Apollo Hospital.

Long buildup was seen in Vedanta, Aarti Industries and Lupin, while short buildup was seen in Bandhan Bank, PNB and Godrej Properties.

More than 250 stocks, including SRF, BHEL, Vedanta and JSW Energy hit a fresh 52-week high on the BSE.

Technical View

Nifty formed an inside bar and a harami cross sort of candle on the daily scale which indicates tug of war between bulls and bears.

“Nifty has to hold above 14,600 zones to witness an up move towards 14,700 and 14,880 zones, while on the downside support exists at 14,500 and 14,400 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.