The benchmark indices ended almost 2 percent lower and broke the four-day winning momentum on April 30, dragged by banking and auto names.

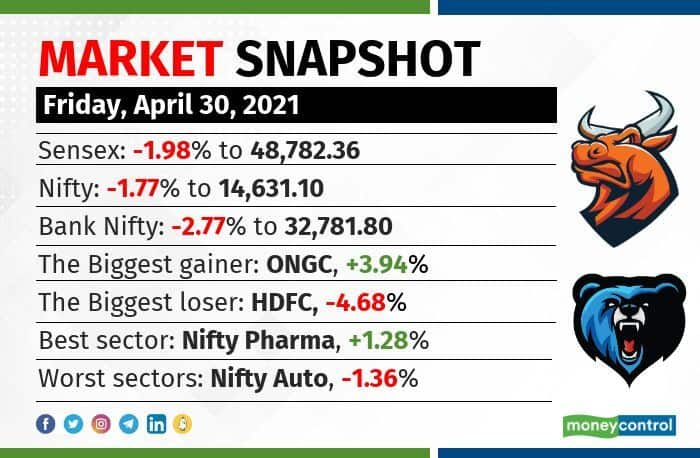

At close, the Sensex was down 983.58 points, or 1.98 percent, at 48,782.36, and the Nifty was down 263.80 points, or 1.77 percent, at 14,631.10. The indices, however, gained 2 percent for the week.

Among sectors, bank, auto, IT, PSU bank and FMCG indices fell 1-2 percent, while the pharma index bucked the trend to rise 1 percent.

“Heavy selling in key pivotals, including financials & HDFC twins, kept indices in the red throughout the day, as fears of localised lockdowns manifesting into a slowdown made investors cautious ahead of the state poll outcomes. Pharma and sugar stocks bucked the trend in today’s trade,” said S Ranganathan, Head of Research at LKP Securities.

HDFC, HDFC Bank, ICICI Bank, Kotak Mahindra Bank and Asian Paints were among the top losers on the Nifty. Gainers included ONGC, Coal India, Divis Labs, Grasim, and IOC.

Stocks & sectors

On the BSE, auto, bank, IT and FMCG indices shed 1-2 percent, while oil & gas and healthcare indices ended in the green.

Among individual stocks, a volume spike of more than 100 percent was seen in SAIL, Marico and Apollo Tyres.

A long buildup was seen in ONGC, SAIL and Navin Fluorine, while a short buildup was seen in TCS, Escort and AU Small Finance Bank.

More than 200 stocks, including SAIL, Wipro and Tata Steel, hit a fresh 52-week high on the BSE.

Technical View

The Nifty formed a bearish candle on the daily chart but a bullish candle on the weekly frame with a long upper shadow, indicating it couldn’t sustain at higher zones.

“The Nifty has to cross 14,700 zones to witness an up move towards 14,900 and 15,050 zones, while on the downside, support exists at 14,400 and 14,250 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.