Concerns over spiralling COVID-19 cases and lockdowns imposed by state governments continued weighing on market sentiment as the key equity indices – the Sensex and the Nifty – ended lower on April 23.

For the week, both the Sensex and the Nifty ended 2 percent lower each.

The market opened lower on April 23 and witnessed bouts of volatility. For some time, it even traded in the green but the gains in the market attracted profit-booking, indicating fragile sentiment of investors.

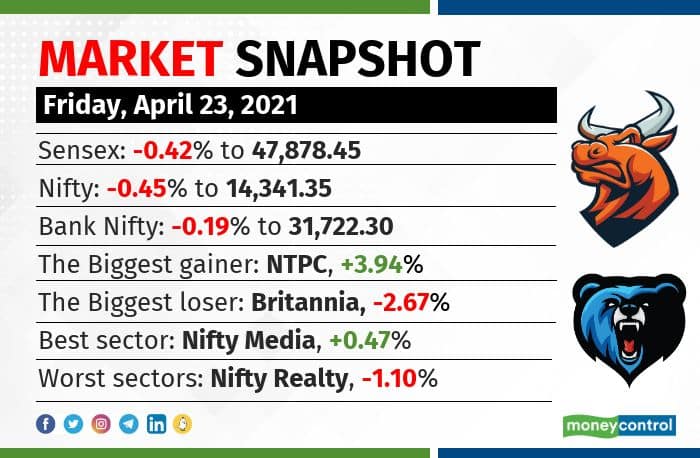

The Sensex closed 202 points, or 0.42 percent, lower at 47,878.45 while the Nifty lost 65 points, or 0.45 percent, at 14,341.35.

Mid and smallcaps outperformed their large-cap peers as the BSE Midcap index closed with a gain of 0.16 percent while the smallcap index closed 0.51 percent higher.

“Following the weakness in the US market, domestic market continued to be under the grip of bears. Reports of a possible increase in capital gains tax in the US took a toll on the global equities. Increasing Covid cases and partial lockdowns also fueled a downward trend in the domestic market,” said Vinod Nair, Head of Research at Geojit Financial Services.

Ajit Mishra, VP – Research, Religare Broking, is of the view that that the announcement from state governments and rising COVID-19 cases would continue to remain the number one factor for investors to watch out for in the near term. Earnings from Nifty majors would induce stock-specific volatility.

“We maintain our cautious stance for the markets in the near term as increasing restrictions would adversely impact economic activity and earnings,” said Mishra.

NTPC (up 3.94 percent), Power Grid (up 3.66 percent) and HDFC Life Insurance (up 1.61 percent) were the top Nifty gainers. On the flip side, Britannia Industries (down 2.67 percent), Mahindra & Mahindra

(down 2.53 percent) and Dr Reddy’s Labs (down 2.40 percent) were the top Nifty laggards.

Sectors and stocks:

With a gain of 2.35 percent, BSE Power index bucked the trend, followed by the utilities index which rose 1.75 percent. BSE Telecom and realty fell over a percent each while FMCG, IT and teck fell almost a percent each.

On the NSE, Nifty Media (up 0.47 percent) and PSU Bank (up 0.30 percent) closed with gains. Nifty Realty ended with a loss of 1.10 percent – the top sectoral loser.

More than 160 stocks, including Cyient, Triveni Engineering & Industries, Balrampur Chini Mills, Dalmia Bharat Sugar and Industries, Dhampur Sugar Mills, Jindal Steel & Power, JSW Steel, Laurus Labs, Navin Fluorine International, Rain Industries and Tata Elxsi, hit their 52-week highs on BSE.

Some 310 stocks, including Tejas Networks, IFCI, Yaarii Digital Integrated Services, Jain Irrigation Systems, Aditya Vision, Jubilant Industries, GP Petroleums, Zeal Aqua, MTNL, Ruchi Soya, Reliance Home Finance and Rattanindia Enterprises, hit their upper circuits on BSE.

Tech view

Nifty formed a Doji kind of formation both on daily as well as weekly charts.

Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in pointed out all intraday dips below 14,300 were bought into by the bulls only to push back the prices above the said level by the end of the day.

Moreover, 62 percent retracement of the entire last leg of the rally from the lows of 13,596 to a high of 15,431 is placed around 14,296. Besides, the 20-week exponential moving average is around 14,229 level whereas 100-day EMA is around 14,172, he said.

“All these points may be acting as a confluence of support zone between 14,300 – 14,150. Hence, as of now dip into this zone can be an opportunity to play for a trading bounce with an initial target of 14,526,” said Mohammad.

“A close below 14,170 shall attract huge selling with an initial downside target of 13,950 but in that scenario, a bigger target towards 13,500 can’t be ruled out,” he added.

Rohit Singre, Senior Technical Analyst at LKP Securities said the index has created a good base near the 14,250-14,200 zone.

“Holding above the said levels, the structure will be positive but any close below these levels can drag the index much lower. On the higher side, a stiff hurdle is at 14,450-14,500 while it may have fresh strength above 14,500,” said Singre.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.