The market remained in control of bears for the second consecutive session, falling half a percent on September 22, tracking weakness in global peers after the US Federal Reserve raised interest rate by 75 bps and signalled more rate hikes going ahead. Swiss central bank and Bank of England also increased interest rates by half a percent.

The BSE Sensex fell 337 points to close at 59,120 after recouping half of the losses from the day’s low, while the Nifty50 declined 89 points to 17,630 and formed a small-bodied bullish candle which resembles the Doji or High Wave kind of pattern on the daily charts.

“A small positive candle was formed on the daily chart at the lows, with upper and lower shadows. Technically, this pattern indicates a formation of a high wave-type candle pattern. Normally, such high wave pattern formation after reasonable upmoves or declines more often acts as a reversal pattern, post confirmation. Hence, there is a possibility of an upside bounce in the short term,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels that the short-term trend of the Nifty continues to be choppy.

The formation of the candle pattern at the supports on Thursday and the overall chart pattern signal a possibility of an upside bounce in the short term. Immediate support is placed at 17,530 and the next overhead resistance to be watched is at 17,750 levels, the market expert said.

The broader markets outperformed benchmarks as the Nifty Midcap 100 index rose 0.3 percent and Smallcap 100 index gained 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,534, followed by 17,438. If the index moves up, the key resistance levels to watch out for are 17,724 and 17,819.

Nifty Bank

The Nifty Bank caused the selling pressure in the benchmark indices, falling 573 points to 40,631 on Thursday and forming a bearish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 40,274, followed by 39,918. On the upside, key resistance levels are placed at 41,073 and 41,516 levels.

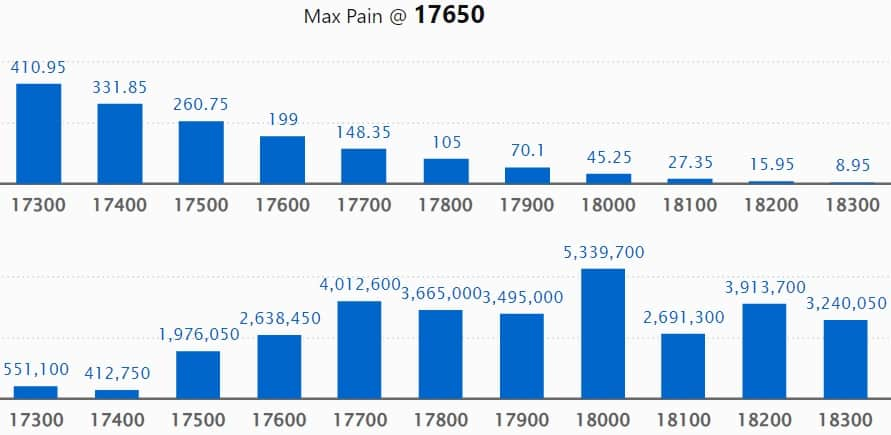

CALL OPTION DATA

Maximum Call open interest of 70.29 lakh contracts was seen at 19,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 18,000 strike, which holds 53.39 lakh contracts, and 18,500 strike, which has 43.91 lakh contracts.

Call writing was seen at 19,000 strike, which added 49.21 lakh contracts, followed by 17,700 strike which added 27.08 lakh contracts, and 18,200 strike which added 20.68 lakh contracts.

Call unwinding was seen at 18,900 strike, which shed 20,100 contracts, followed by 16,600 strike which shed 750 contracts, and 16,800 strike which shed 700 contracts.

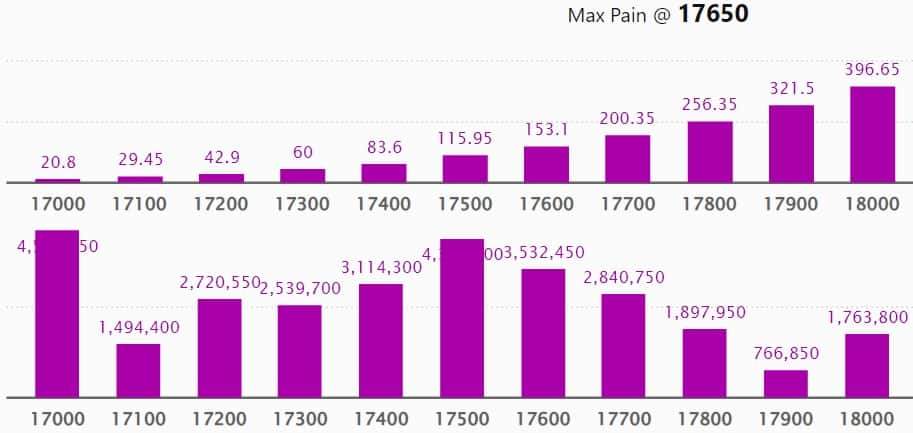

PUT OPTION DATA

Maximum Put open interest of 45.76 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 43.75 lakh contracts, and 17,500 strike, which has accumulated 43.37 lakh contracts.

Put writing was seen at 17,600 strike, which added 16.25 lakh contracts, followed by 16,500 strike, which added 14.13 lakh contracts, and 17,000 strike which added 14.09 lakh contracts.

Put unwinding was seen at 17,800 strike, which shed 1.31 lakh contracts, followed by 17,900 strike which shed 71,300 contracts and 18,000 strike which shed 19,900 contracts.

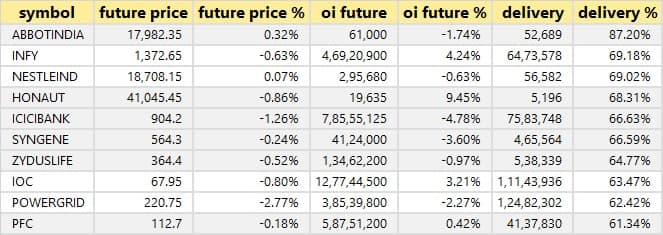

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Abbott India, Infosys, Nestle India, Honeywell Automation, and ICICI Bank, among others.

67 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Punjab National Bank, Bharat Forge, GNFC, L&T Technology Services, and NMDC.

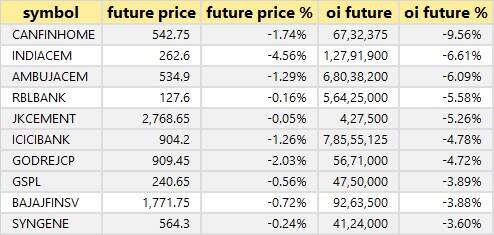

33 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Can Fin Homes, India Cements, Ambuja Cements, RBL Bank, and JK Cement, in which a long unwinding was seen.

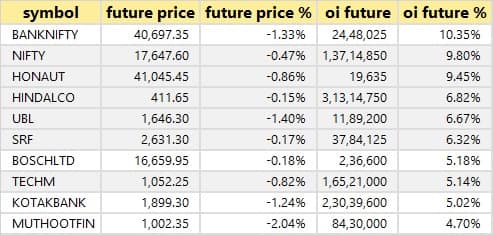

51 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, the top 10 stocks in which a short build-up was seen include Bank Nifty, Nifty, Honeywell Automation, Hindalco Industries, and United Breweries.

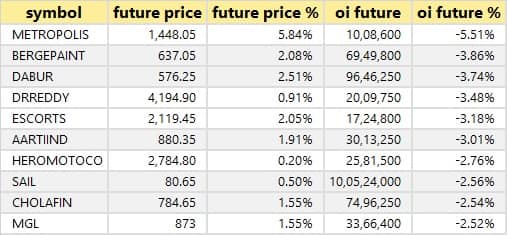

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which a short-covering was seen, including Metropolis Healthcare, Berger Paints, Dabur India, Dr Reddy’s Laboratories, and Escorts.

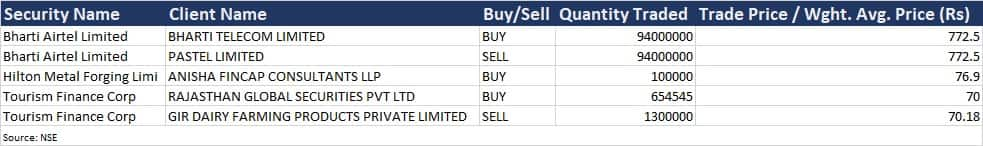

Bulk Deals

Bharti Airtel: Promoter entities changed hands via open market transactions. Bharti Telecom acquired 9.4 crore equity shares in the telecom operator at an average price of Rs 772.5 per share. Pastel was the seller in this deal.

Hilton Metal Forging: Anisha Fincap Consultants LLP bought one lakh shares in the company via open market transactions at an average price of Rs 76.9 per share.

(For more bulk deals, click here)

Investors Meetings on September 23

Tata Consumer Products: Officials of the company will meet Schroders, and MIB Securities India.

Varroc Engineering: Officials of the company will interact with Bajaj Allianz Life.

PPAP Automotive: Officials of the company will interact with Aurum Capital, Equilligence Capital Advisors, Wealthmills Securities, and Arihant Capital Markets.

Symphony: Officials of the company will interact with Taiyo Pacific Partners LP.

Capri Global Capital: Officials of the company will interact with Sell-Side and Buy-Side analysts on gold loan business.

Sobha: Officials of the company will interact with HDFC Securities, and Motilal Oswal.

Stocks in News

Kirloskar Industries: The company announced the proposed divestment of its 17.41 percent stake in Swaraj Engines (SEL) to Mahindra & Mahindra (M&M). The divestment is proposed through inter-se transfer amongst the promoters through an off-market transaction, at a price of Rs 1,400 per share.

Zydus Lifesciences: The company has entered into share purchase, subscription and shareholder’s agreement (SPSSA) to acquire up to 11.86 percent stake in AMP Energy Green Nine. With this, it will set up captive wind-solar hybrid power project in Gujarat.

Hero MotoCorp: The company has raised the ex-showroom prices of its motorcycles and scooters, with immediate effect. The price revision has been necessitated to partially offset the impact of cost inflation. The price revision will be up to Rs 1,000 and the exact quantum of increase will vary by model and market.

Bombay Dyeing & Manufacturing Company: The company said the board of directors has given approval for raising funds up to Rs 940 crore through a rights issue.

Cipla: The pharma company has received the Establishment Inspection Report (EIR) for its Indore plant, indicating closure of the inspection. The United States Food and Drug Administration (USFDA) conducted product-specific pre-approval inspection (PAI) at the Indore plant on June 27 and July 1.

Udaipur Cement Works: The company will raise Rs 350 crore by issuing non-convertible debentures on a private placement basis. The tentative date of allotment for 3,500 NCDs of the face value of Rs 10 lakh each is October 7 and the maturity will be on March 16, 2025, while the initial coupon rate is 7.45 percent per annum.

Shilpa Medicare: The company in its BSE filing said its analytical services division at Nacharam in Telangana has received Establishment Inspection Report from US Food and Drug Administration. The USFDA conducted an inspection from April 26 to April 29. This is the first US FDA inspection of this facility. The facility is identified as a testing laboratory in numerous ANDAs filed by Shilpa Medicare (parent organisation) and its agreed parties. The FDA clearance on the facility will enable the company to test and release batches into the US from this facility.

Century Textiles and Industries: Subsidiary Birla Estates has acquired a 10-acre land parcel in Bengaluru. The company expects a revenue potential of Rs 900 crore through the development of 1 million square feet.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,509.55 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 263.07 crore on September 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks – Ambuja Cements, Can Fin Homes, Delta Corp, Punjab National Bank, and RBL Bank – are on the NSE F&O ban list for September 23. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.