The market continued to gain for the second consecutive session on June 25, the first day of the July series, backed by banking & financials, metals, auto and select tech stocks.

The BSE Sensex climbed 226.04 points to 52,925.04, while the Nifty50 jumped 69.90 points to 15,860.40 and formed a bullish candle, resembling a Hanging Man pattern on the daily charts. During the week, the index formed a bullish candle on the weekly scale as it gained 1.1 percent.

“A small positive candle was formed with lower shadow as per daily timeframe chart. Technically, this action indicates a buy on minor dips opportunity in the market. Though this pattern resembles the negative Hanging many type formation, but having this pattern formed at the wrong place, the negative implication is ruled out,” said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

“The Nifty made a swing high of around 15,870 on Friday and this possibly signals repeated testing of key overhead resistance around 15,900 levels. Technically, such repeated testing of overhead resistances could eventually result in an upside breakout of the said hurdle. Hence, a decisive move above 15,900 could open more upside in the short term,” he said.

He feels the underlying short-term trend for the Nifty continues to be positive with rangebound action. “The market is now placed to show upside momentum above the hurdle of 15,900 levels in the coming few sessions. A sustainable move above this area could open further upside towards 16,200 in the near term. Immediate support is placed at 15,770,” he said.

The broader markets also gained strength with the Nifty Midcap 100 and Smallcap 100 indices rising 1.1 percent and 0.54 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,798.13, followed by 15,735.97. If the index moves up, the key resistance levels to watch out for are 15,896.63 and 15,932.97.

Nifty Bank

The Nifty Bank climbed 537.65 points or 1.54 percent to close at 35,364.65 on June 25. The important pivot level, which will act as crucial support for the index, is placed at 35,023.03, followed by 34,681.46. On the upside, key resistance levels are placed at 35,599.03 and 35,833.46 levels.

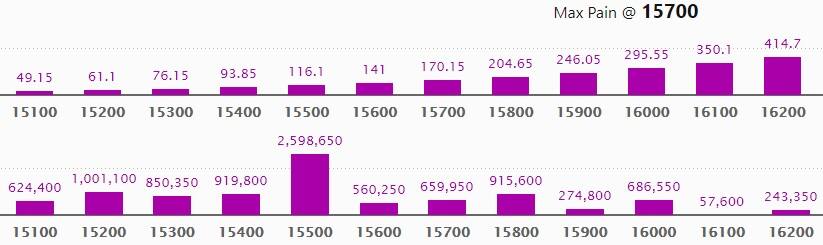

Call option data

Maximum Call open interest of 17.13 lakh contracts was seen at 16500 strike, which will act as a crucial resistance level in the July series.

This is followed by 16000 strike, which holds 16.72 lakh contracts, and 15800 strike, which has accumulated 9.08 lakh contracts.

Call writing was seen at 16400 strike, which added 2.49 lakh contracts, followed by 16500 strike which added 2.12 lakh contracts, and 16000 strike which added 1.07 lakh contracts.

Call unwinding was seen at 15500 strike, which shed 44,350 contracts, followed by 15700 strike which shed 5,550 contracts, and 15600 strike which shed 4,850 contracts.

Put option data

Maximum Put open interest of 25.98 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15200 strike, which holds 10.01 lakh contracts, and 15400 strike, which has accumulated 9.19 lakh contracts.

Put writing was seen at 15800 strike, which added 2.17 lakh contracts, followed by 15400 strike which added 1.98 lakh contracts, and 15200 strike which added 1.84 lakh contracts.

There was hardly any Put unwinding seen on June 25.

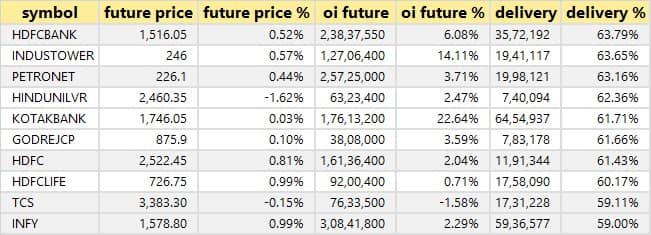

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

95 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

6 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the six stocks in which long unwinding was seen.

26 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

31 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

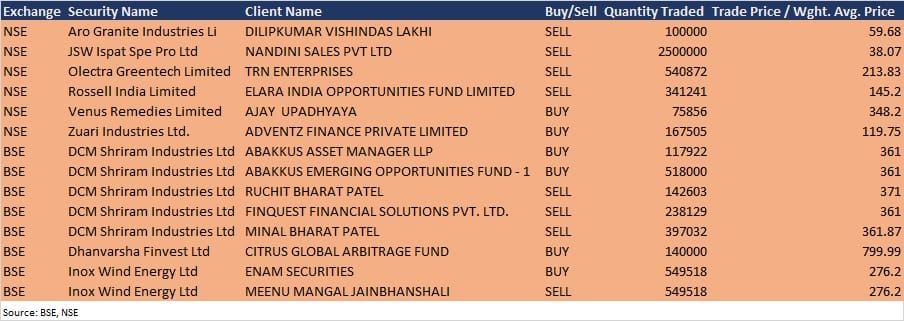

Bulk deals

DCM Shriram Industries: Sunil Singhania-owned Abakkus Asset Manager LLP acquired 1,17,922 equity shares and Abakkus Emerging Opportunities Fund-1 bought 5.18 lakh equity shares in the company at Rs 361 per equity share. However, Ruchit Bharat Patel sold 1,42,603 equity shares at Rs 371 apiece, Finquest Financial Solutions sold 2,38,129 equity shares at Rs 361 per share, and Minal Bharat Patel sold 3,97,032 shares at Rs 361.87 per share on the BSE, the bulk deals data showed.

Dhanvarsha Finvest: Citrus Global Arbitrage Fund bought 1.4 lakh shares in non-banking finance company Dhanvarsha Finvest at Rs 799.99 per share on the BSE.

Inox Wind Energy: Enam Securities acquired 5,49,518 equity shares in the company at Rs 276.2 per share, whereas Meenu Mangal Jainbhanshali sold 5,49,518 equity shares at Rs 276.2 per share on the BSE, the bulk deals data showed.

Rossell India: Elara India Opportunities Fund sold 3,41,241 equity shares in the company at Rs 145.2 per share on the NSE, the bulk deals data showed.

Venus Remedies: Ajay Upadhyaya acquired 75,856 equity shares in the company at Rs 348.2 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 28 and analysts, investors meeting

Results on June 28: More than 300 companies will release quarterly earnings on June 28 including NALCO, Aarvee Denims, Autoline Industries, Bartronics India, Eros International Media, Future Lifestyle Fashions, Federal-Mogul Goetze, Gammon India, GIC Housing Finance, IFCI, ISGEC Heavy Engineering, KPI Global Infrastructure, NLC India, Premier Explosives, Sadbhav Infrastructure Project, Surya India, Triveni Turbine, V2 Retail, Viceroy Hotels, Vivimed Labs, Welspun Corp, and Zee Media Corporation.

Deepak Fertilisers & Petrochemicals Corporation: The company’s officials will meet SAMEEKSHA India Equity Fund (PMS) on June 28.

Anupam Rasayan India: The company’s officials will meet several investors at an IIFL Conference on June 28.

Jamna Auto Industries: The company’s officials will meet analysts/institutional investors on June 28 and 29.

Garware Hi-Tech Films: The company’s officials will meet Altamount Capital UK, Mavira Investments, Right Time Consultancy, Prikar Investments, Pramesh Wealth, and Alpha Plus Capital Services LLP on June 29.

Sundram Fasteners: The company’s officials will meet Amansa Capital on June 29.

Aimco Pesticides: The company’s officials will meet analysts/investors on June 28.

Sunteck Realty: The company’s officials will meet analysts/investors on June 30.

Welspun Corp: The company’s officials will meet analysts/investors on June 29.

Premier Explosives: The company’s officials will meet analysts/investors on June 29.

Subros: The company’s officials will meet analysts/investors on June 30.

Gati: The company’s officials will meet analysts/investors in a B&K Securities ‘Trinity’ Conference on June 30.

RACL Geartech: The company’s officials will meet investors on July 2.

Stocks in news

Thyrocare Technologies: Docon Technologies along with API Holdings, the parent company of unicorn Pharmeasy (online medical platform) to acquire 66.1 percent equity stake in Thyrocare Technologies, for Rs 4,546 crore. They also made an open offer for the acquisition of an additional 26 percent stake in Thyrocare at a price of Rs 1,300 per share for Rs 1,788.16 crore.

Brigade Enterprises: The company raised Rs 500 crore from qualified institutional buyers at a price of Rs 268 per share. Goldman Sachs, SBI Mutual Fund, ICICI Prudential, Axis Mutual Fund, Nippon Life, Abu Dhabi Investment Authority and UTI Mutual Fund participated the QIB issue.

Zuari Agro Chemicals: The Competition Commission of India (CCI) has approved the acquisition of the Goa plant of the company by Paradeep Phosphates.

Jindal Drilling & Industries: The company reported profit at Rs 44.56 crore in Q4FY21 against loss of Rs 546.80 crore in Q4FY20, revenue rose to Rs 112.36 crore from Rs 90.34 crore YoY.

Finolex Industries: The company reported a higher consolidated profit at Rs 298.84 crore in Q4FY21 against Rs 58.66 crore in Q4FY20, revenue jumped to Rs 1,249.34 crore from Rs 768.66 crore YoY.

India Glycols: The company reported a higher consolidated profit at Rs 70.99 crore in Q4FY21 against Rs 17.91 crore in Q4FY20, revenue rose to Rs 1,604.14 crore from Rs 1,350.4 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 678.84 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,832.76 crore in the Indian equity market on June 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for June 28 as we are at the beginning of the July series. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.