Nifty snapped its six-week winning streak, falling over a percent in the week gone by.

However, for the entire month of July, the benchmark index jumped 7.49 percent even as concerns over rising coronavirus cases, souring US-China relations and deteriorating macroeconomic indicators persisted.

On the previous trading session (July 31), Nifty closed 29 points, or 0.26 percent, lower at 11,073.45 while Sensex finished 129 points, or 0.34 percent, down at 37,606.89.

“Nifty has major support of 200-DMA which is placed at 10,870 levels. As long as Nifty trades above 10,870 levels, we can expect some consolidation and also a pullback towards 11,200 levels can’t be ruled out,” said Nilesh Ramesh Jain, Derivative and Technical Analyst at Anand Rathi Shares and Stock Brokers.

related news

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,016.67, followed by 10,959.83. If the index moves up, the key resistance levels to watch out for are 11,140.37 and 11,207.23.

Nifty Bank

The Nifty Bank index closed 0.03 percent lower at 21,640.05 on July 31. The important pivot level, which will act as crucial support for the index, is placed at 21,407.77, followed by 21,175.43. On the upside, key resistance levels are placed at 21,839.67 and 22,039.23.

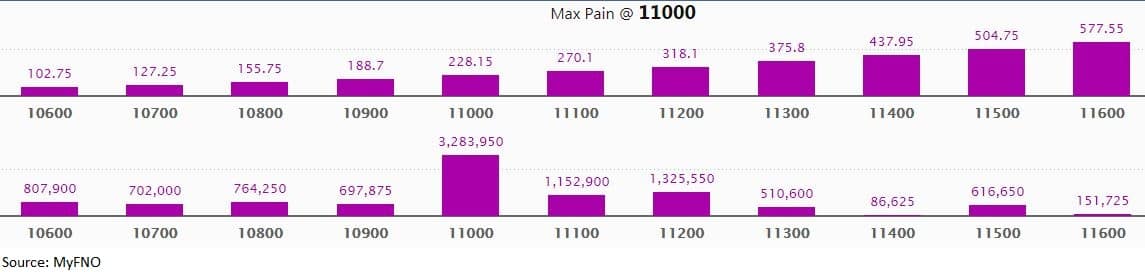

Call option data

Maximum call OI of nearly 20.03 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 11,000, which holds 10.91 lakh contracts, and 11,200 strikes, which has accumulated 10.04 lakh contracts.

Call writing was seen at 11,500, which added 2.05 lakh contracts, followed by 11,100, which added 1.87 lakh contracts.

Call unwinding was seen at 11,300, which shed 26,550 contracts, followed by 11,200 strikes, which shed 5,250 contracts.

Put option data

Maximum put OI of 32.84 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,200, which holds nearly 13.26 lakh contracts, and 11,100 strikes, which has accumulated 11.53 lakh contracts.

Put writing was seen at 11,100, which added 2.2 lakh contracts, followed by 11,000, which added 1.8 lakh contracts.

Put unwinding was witnessed at 11,200, which shed 1.30 lakh contracts, followed by 10,700, which shed 33,375 contracts and 11,300, which shed 33,300 contracts.

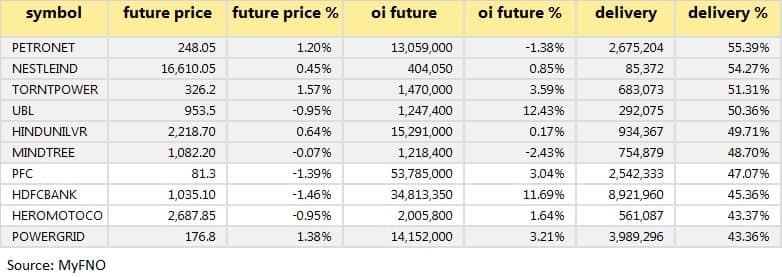

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

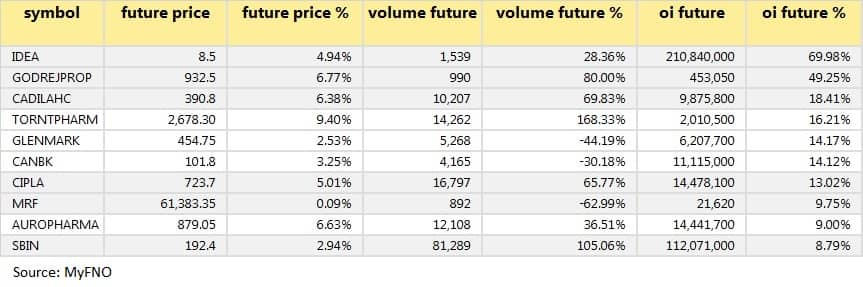

63 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

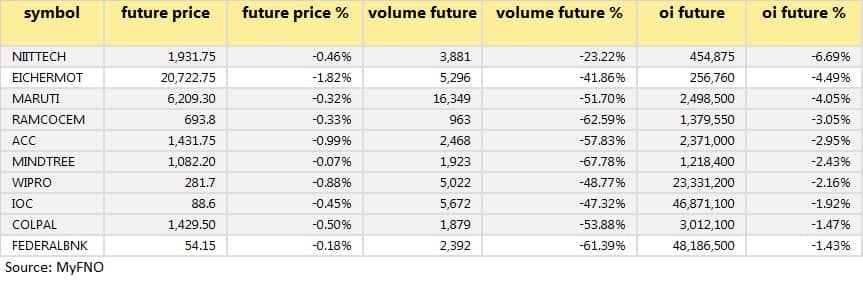

16 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

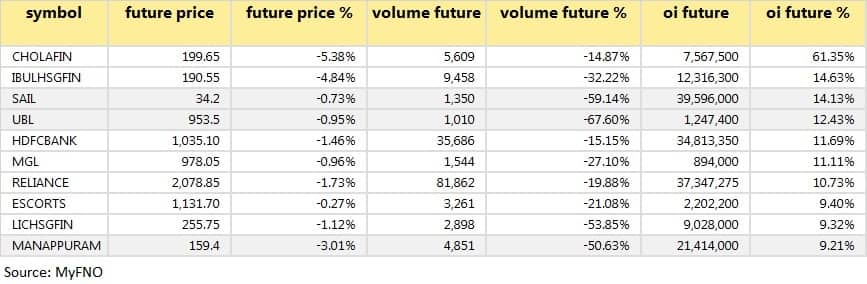

34 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

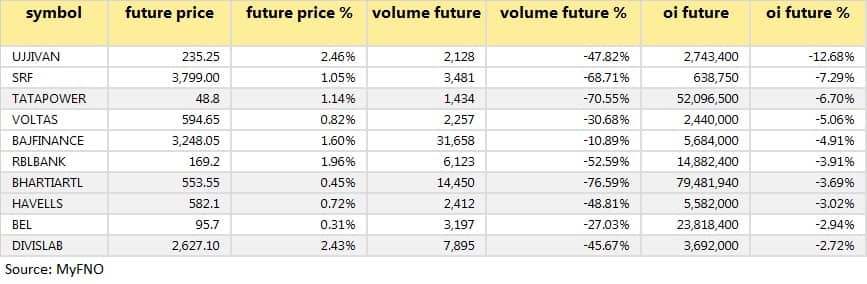

26 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

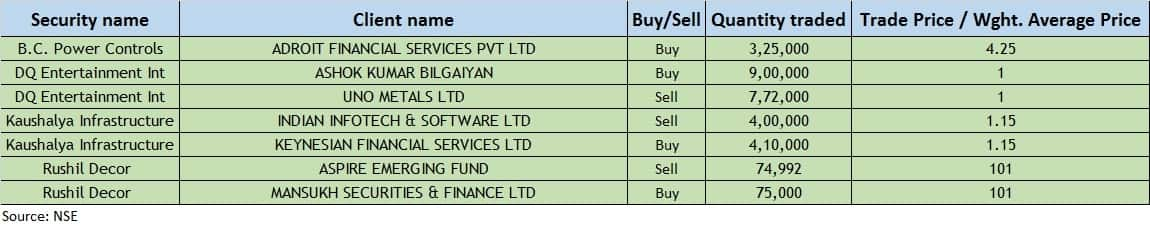

Bulk deals

(For more bulk deals, click here)

Results on August 3

Dhanlaxmi Bank, Exide Industries, Kansai Nerolac Paints, KPIT Technologies, Nava Bharat Ventures, Solara Active Pharma Sciences, TRF, VST Industries, etc.

Stocks in the news

Tata Motors Q1: Loss at Rs 8,434 crore versus loss of Rs 3,698 crore, revenue at Rs 31,983 crore versus Rs 61,467 crore YoY.

Ujjivan Small Finance Bank Q1: Profit at Rs 54.6 crore versus Rs 94 crore, NII at Rs 458 crore versus Rs 352 crore YoY.

Punjab National Bank: Bank will cut lending rate by 25 bps across tenures w.e.f August 1.

UPL Q1: Profit at Rs Rs 551 crore versus Rs 285 crore, revenue at Rs 7,833 crore versus Rs 7,906 crore YoY.

SMS Pharmaceuticals: Sanatan Financial Advisory Services sold 4,27,533 shares in the company at Rs 75.65 per share.

TCI Finance: Company appointed Amit Kumar Ray as Chief Financial Officer. Board approved the proposal of voluntary delisting of equity shares from the National Stock Exchange of India. Equity shares would remain listed on BSE.

Liberty Shoes Q4: Profit at Rs 1.58 crore versus Rs 1.35 crore, revenue at Rs 199.8 crore versus Rs 143.88 crore YoY.

Future Lifestyle Fashions Q4: Loss at Rs 148.65 crore versus profit at Rs 74.67 crore, revenue at Rs 1,442.96 crore versus Rs 1,381.19 crore YoY.

IOL Chemicals & Pharmaceuticals Q1: Profit at Rs 127.54 crore versus Rs 85.32 crore, revenue at Rs 460.11 crore versus Rs 492.80 crore YoY.

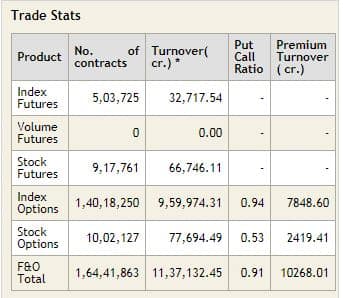

Fund flow

Source: NSE

Source: NSE

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 958.64 crore while domestic institutional investors (DIIs) bought shares worth Rs 442.73 crore in the Indian equity market on July 31, as per provisional data available on the NSE.

Stock under F&O ban on NSE

There is no stock under the F&O ban for August 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.