The market extended losses for a third consecutive session on September 23, with the benchmark indices falling 1.7 percent as rising recession fears amid expectations of aggressive policy tightening by the US Federal Reserve and FII selling weighed on the sentiment.

The BSE Sensex plunged 1,021 points to 58,099, while the Nifty50 fell 302 points to 17,327 and formed big bearish candle on the daily charts following Doji kind of pattern formation in previous session.

“A long bear candle was formed on the daily chart, which indicates a sharp negative reversal in the market after a small upside bounce. Nifty has slipped below the immediate support of minor up trend line at 17,500 levels and closed below it. This is negative indication and one may expect further weakness ahead,” said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short-term trend of Nifty continues to be negative. The present sharp weakness is likely to drag Nifty down to 17,000-16,900 levels in the near term, the market expert said.

Any pullback rally up to 17,500 levels could be a sell on rise opportunity for the next week, he advised.

The broader markets have seen more correction compared to benchmarks, with the Nifty Midcap 100 and Smallcap 100 indices falling more than 2 percent each, while the volatility index India VIX climbed 9.44 percent to 20.59 levels, making the bulls more uncomfortable.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,199, followed by 17,070. If the index moves up, the key resistance levels to watch out for are 17,549 and 17,771.

Nifty Bank

The Nifty Bank corrected sharply by 1,084 points to close at 39,546 on Friday and formed bearish candle on the daily charts with lower low lower high formation for third straight session. The important pivot level, which will act as crucial support for the index, is placed at 39,130, followed by 38,713. On the upside, key resistance levels are placed at 40,245 and 40,945 levels.

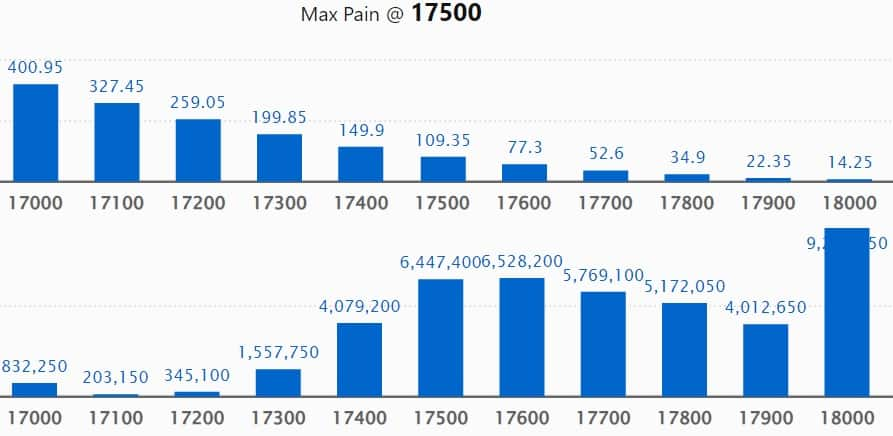

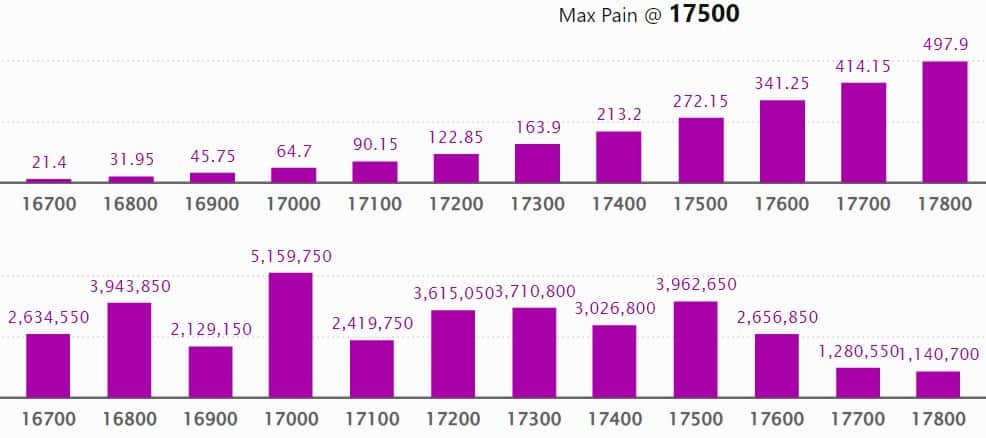

CALL OPTION DATA

Maximum Call open interest of 92.18 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 19,000 strike, which holds 74.44 lakh contracts, and 18,500 strike, which has 71.11 lakh contracts.

Call writing was seen at 17,500 strike, which added 44.71 lakh contracts, followed by 17,600 strike which added 38.89 lakh contracts, and 18,000 strike which added 38.78 lakh contracts.

Call unwinding was seen at 18,600 strike, which shed 4.74 lakh contracts, followed by 16,000 strike which shed 26,950 contracts, and 16,500 strike which shed 20,750 contracts.

PUT OPTION DATA

Maximum Put open interest of 58.17 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the September series.

This is followed by 17,000 strike, which holds 51.59 lakh contracts, and 16,500 strike, which has accumulated 44.52 lakh contracts.

Put writing was seen at 16,800 strike, which added 20.41 lakh contracts, followed by 17,300 strike, which added 11.71 lakh contracts, and 17,100 strike which added 9.25 lakh contracts.

Put unwinding was seen at 17,700 strike, which shed 15.6 lakh contracts, followed by 17,600 strike which shed 8.75 lakh contracts and 17,800 strike which shed 7.57 lakh contracts.

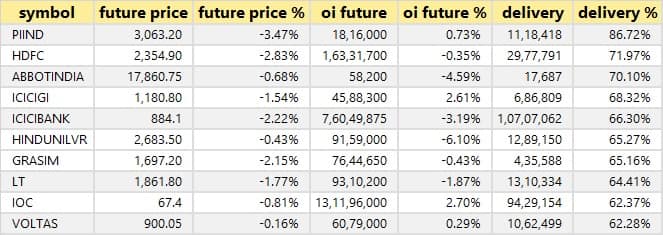

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in PI Industries, HDFC, Abbott India, ICICI Lombard General Insurance, and ICICI Bank, among others.

4 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 4 stocks – Cipla, ITC, Tata Steel, and Metropolis Healthcare – in which a long build-up was seen.

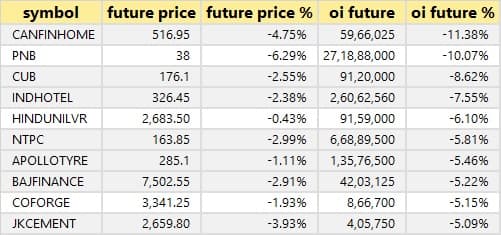

78 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Can Fin Homes, Punjab National Bank, City Union Bank, Indian Hotels, and Hindustan Unilever, in which long unwinding was seen.

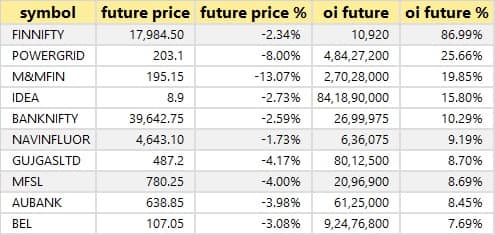

108 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, the top 10 stocks in which a short build-up was seen include Nifty Financial, Power Grid Corporation of India, M&M Financial Services, Vodafone Idea, and Bank Nifty.

6 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, the six stocks in which short-covering was seen include Ambuja Cements, Deepak Nitrite, Dr Lal PathLabs, Page Industries, and Divis Laboratories.

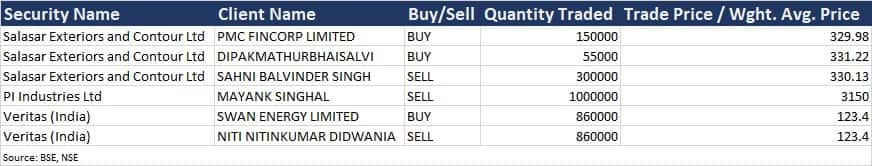

Bulk Deals

PI Industries: Promoter Mayank Singhal has offloaded 0.6 percent stake or 10 lakh shares in the company via open market transactions. These shares were sold at an average price of Rs 3,150 per share.

(For more bulk deals, click here)

Investors Meetings on September 26

Symphony: Officials of the company will meet Bajaj Allianz Life Insurance Company.

Sun Pharma: Company officials will attend Goldman Sachs India Pharma and Healthcare Tour September 2022.

Blue Star: Officials of the company will attend Equirus Virtual Annual Conference.

Gati: Officials of the company will meet Theleme Partners.

Shoppers Stop: Officials of the company will be meet representatives of Goldman Sachs Asset Management.

Centrum Electronics: Officials of the company will meet Aditya Birla Sunlife AMC.

AXISCADES Technologies: Officials of the company will interact with several analysts and investors.

Aether Industries: Officials of the company will interact with Capital Group (Hong Kong).

One 97 Communications (Paytm): Officials of the company will interact with institutional investors and analysts in Abu Dhabi & Dubai.

Stocks in News

Harsha Engineers International: The company will make its debut on the bourses on September 26. The offer price has been fixed at Rs 330 per share.

Embassy Office Parks REIT: Blackstone Inc will sell a stake worth up to $400 million in Embassy Office Parks REIT, India’s biggest real estate investment trust, via block deals, and Abu Dhabi’s sovereign wealth fund is likely to pick up at least half of the stake that Blackstone is to sell, reported Reuters quoting sources.

Bharat Petroleum: The state-run oil refiner signed a Memorandum of Understanding (MoU) with Brazil’s national oil company Petrobras to help it diversify its crude oil sourcing for energy security in India. BPCL’s subsidiary Bharat PetroResources Limited (BPRL) plans to invest $1.6 billion to develop an oil block in Brazil in an attempt to procure equity oil overseas.

Unichem Laboratories: The company has completed its sale of 19.97 percent equity shares in Optimus Drugs to Sekhmet Pharmaventures. Accordingly, it has received payment towards completion of sale of first tranche.

Coal India: The Coal Ministry said the company would sign Memorandum of Understanding with three major PSUs for coal to chemical products. The company will set up four surface coal gasification projects, and aims for 100 MT coal gasification by 2030, said the ministry, reported CNBC-TV18.

State Bank of India: The bank has raised Rs 4,000 crore via non-convertible debentures on private placement basis.

Sterlite Technologies: Mihir Modi has tendered his resignation as Chief Financial Officer and key managerial personnel of the company. He will be relieved from his duties with effect from October 15.

Britannia Industries: The board of directors has elevated Varun Berry to Executive Vice-Chairman and Managing Director of the company, and appointed Rajneet Kohli as Executive Director & Chief Executive Officer, with immediate effect. Rajneet Kohli will report to Varun Berry.

Infibeam Avenues: The fintech & payment infrastructure company has consolidated its international business to aggressively tap and expand its global digital payment gateway infrastructure market. The company’s three fully owned international subsidiaries – Infibeam Avenues Australia Pty Ltd, AI Fintech Inc in the US and Infibeam Avenues Saudi Arabia for Information Systems Technology will become a step-down subsidiary of the company after being transferred to its UAE-based subsidiary, Vavian International. Vavianis the second largest payment aggregator in UAE. The company plans to increase its global play in the digital payments space by going aggressively with its flagship brand CCAvenue.

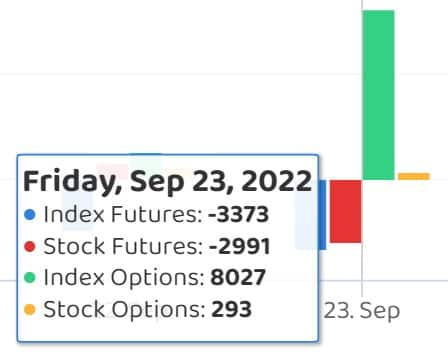

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net sold shares worth Rs 2,899.68 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 299.10 crore on September 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Vodafone Idea and Zee Entertainment Enterprises to its F&O ban list, taking the total stocks in F&O ban list to six for September 26. Ambuja Cements, Can Fin Homes, Delta Corp, and Punjab National Bank remained under the said list. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.