The market made a strong attempt to extend the previous day’s sharp rally but failed and finally settled marginally lower on May 23, dragged by HDFC twins, ITC, Reliance Industries, and Tata Steel. Auto, technology, private banks stocks and HUL supported the market and cut down the losses.

The BSE Sensex declined 38 points to 54,289, while the Nifty50 lost 200 points from the day’s high and closed at 16,215, down 51 points, forming a bearish candle on the daily charts. The failure of holding 16,400 levels indicated that the market could remain rangebound in the coming days, experts feel.

“Zooming into the 15-minute chart, we see that the Nifty has failed to convincingly cross the crucial resistance of 16,400 and corrected from the highs. In the process, the index also closed below the 20 and 50-day moving averages. This indicates weakness. Traders will now need to watch if the Nifty can hold above the immediate support of 16,116. Else, we could see a further correction,” Subash Gangadharan, Senior Technical and Derivative Analyst at HDFC Securities said.

The daily time frame of the Nifty indicates that the index has made a double bottom around 15,735 levels and rallied sharply on Friday. The Nifty now needs to move above the recent swing high of 16,400 for the bulls to gain control. Till then, the Nifty could remain rangebound and weak, the market expert said.

The broader markets also traded lower given the weak breadth. The Nifty Midcap 100 index was down 0.35 percent and Smallcap 100 index fell 0.8 percent as about three shares declined for every two rising shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,129, followed by 16,043. If the index moves up, the key resistance levels to watch out for are 16,358 and 16,501.

Nifty Bank

Nifty Bank also closed moderately lower by 29 points at 34,248 on Monday and formed a bearish Shooting Star kind of pattern on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 33,970, followed by 33,692. On the upside, key resistance levels are placed at 34,672 and 35,097 levels.

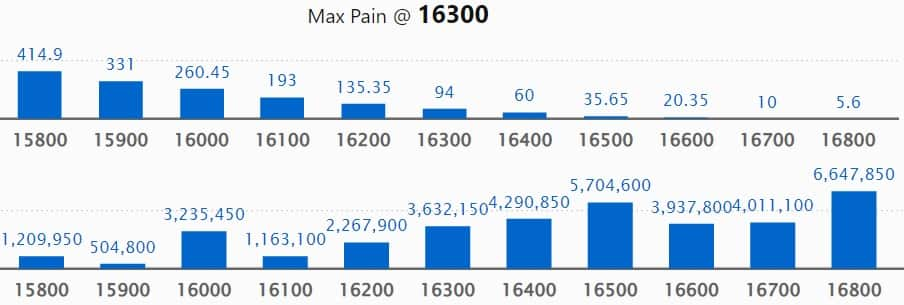

Call option data

Maximum Call open interest of 1.01 crore contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,800 strike, which holds 66.47 lakh contracts, and 16,500 strike, which has accumulated 57.04 lakh contracts.

Call writing was seen at 17,000 strike, which added 24.67 lakh contracts, followed by 16,800 strike which added 18.9 lakh contracts and 16,500 strike which added 12.84 lakh contracts.

Call unwinding was seen at 16,300 strike, which shed 11.9 lakh contracts, followed by 16,100 strike which shed 6.12 lakh contracts and 16,200 strike which shed 4.9 lakh contracts.

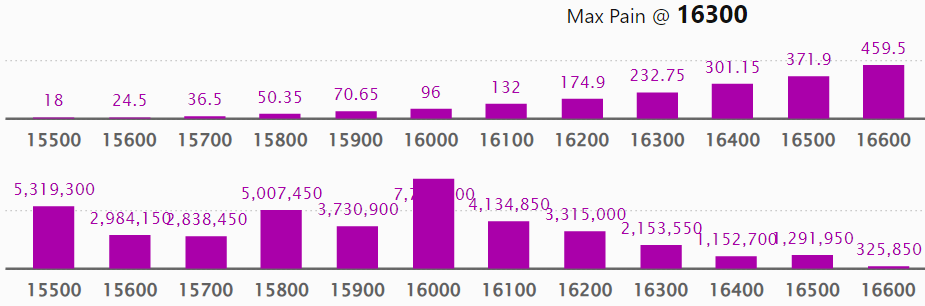

Put option data

Maximum Put open interest of 77.3 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 15,000 strike, which holds 54.97 lakh contracts, and 15,500 strike, which has accumulated 53.19 lakh contracts.

Put writing was seen at 15,100 strike, which added 8.94 lakh contracts, followed by 16,100 strike, which added 8.42 lakh contracts and 15,300 strike which added 8.11 lakh contracts.

Put unwinding was seen at 15,800 strike, which shed 3.57 lakh contracts, followed by 17,000 strike which shed 51,900 contracts, and 16,500 strike which shed 44,300 contracts.

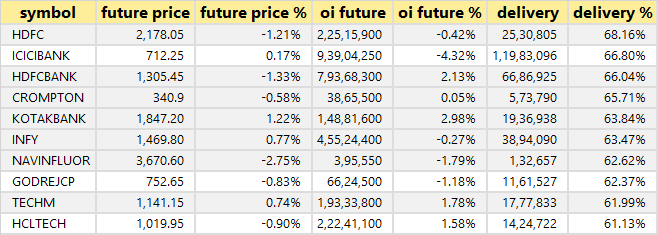

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HDFC, ICICI Bank, HDFC Bank, Crompton Greaves Consumer Electricals, and Kotak Mahindra Bank, among others.

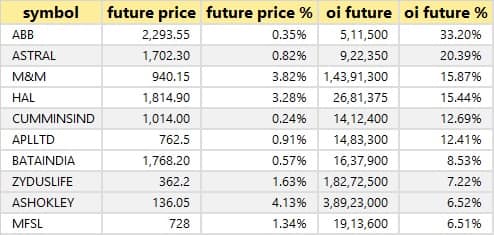

43 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Astral, M&M, Hindustan Aeronautics, and Cummins India, in which a long build-up was seen.

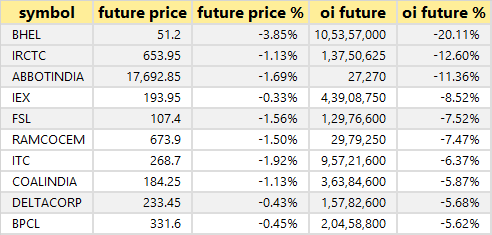

53 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including BHEL, IRCTC, Abbott India, Indian Energy Exchange, and Firstsource Solutions, in which long unwinding was seen.

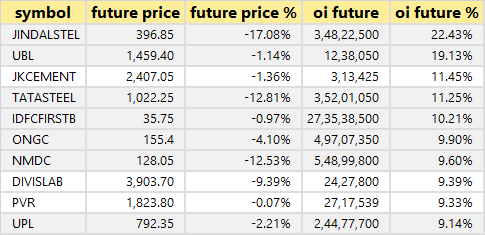

62 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Jindal Steel & Power, United Breweries, JK Cement, Tata Steel, and IDFC First Bank, in which a short build-up was seen.

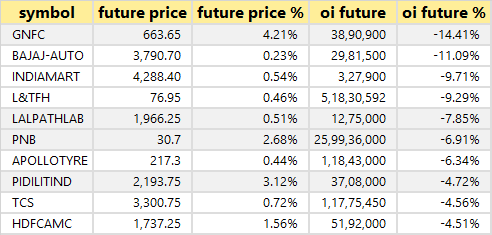

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including GNFC, Bajaj Auto, IndiaMART InterMESH, L&T Finance Holdings, and Dr Lal PathLabs, in which short-covering was seen.

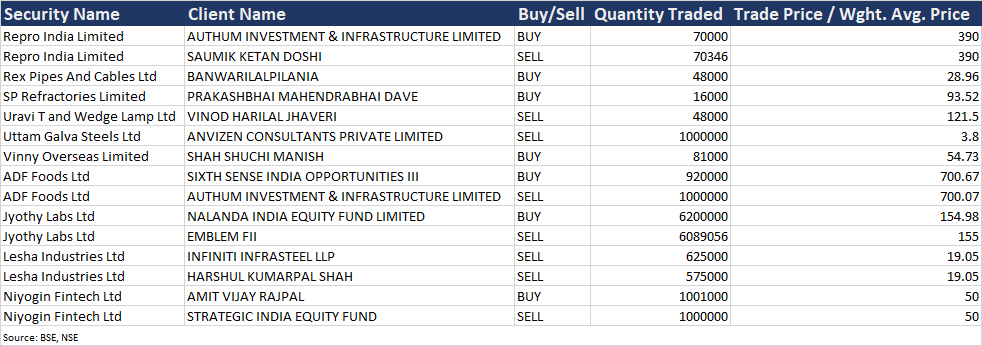

Bulk deals

ADF Foods: Sixth Sense India Opportunities III acquired 9.2 lakh equity shares in the company via open market transactions at an average price of Rs 700.67 per share. However, Authum Investment & Infrastructure sold 10 lakh shares at an average price of Rs 700.07 per share.

Jyothy Labs: Nalanda India Equity Fund bought 62 lakh equity shares in the company at an average price of Rs 154.98 per share. However, EMBLEM FII sold 60,89,056 shares at an average price of Rs 155 per share.

Lesha Industries: Infiniti Infrasteel LLP sold 6.25 lakh shares and Harshul Kumarpal Shah offloaded 5.75 lakh shares in the company at an average price of Rs 19.05 per share.

Niyogin Fintech: Amit Vijay Rajpal bought 10,01,000 equity shares in the company at an average price of Rs 50 per share. However, Strategic India Equity Fund sold 10 lakh shares at the same price.

(For more bulk deals, click here)

Results on May 24

Grasim Industries, Adani Ports, JM Financial, Clariant Chemicals, Ugro Capital, Bank of India, eClerx Services, Ipca Laboratories, Latent View Analytics, Jyothi Labs, Metropolis Healthcare, Minda Industries, MTAR Technologies, NIIT, National Fertilizers, RailTel Corporation of India, Shree Renuka Sugars, RITES, Strides Pharma Science, and Zee Media will be in focus ahead of March quarter earnings on May 24.

Stocks in News

Zomato said its consolidated net loss for the quarter ended March widened to Rs 359.7 crore compared to Rs 134.2 crore in the corresponding quarter last year. Revenue from operations came in at Rs 1,211.8 crore, up 75.01 percent compared to Rs 692.4 crore in the same quarter last year.

ONGC said on exchanges that it became the first explorer to trade natural gas produced from local fields on Indian Gas Exchange. The gas was sold from ONGC’s KG-DWN-98/2 in offshore Krishna Godavari Basin, the firm said without giving volume and price detail. The firm also said it will slowly increase the trading quantity.

Ramco Cements reported a 73 percent fall in standalone net profit after tax at Rs 124 crore for the quarter ended March compared with Rs 214 crore in the year-ago period, due to cost pressures and lower realisation. Revenue from operations for the quarter stood at Rs 1,698 crore compared to Rs 1,624 crore in the year-ago period, an increase of about 5 percent. Power and fuel costs shot up to Rs 467 crore compared to Rs 248 crore, while finance costs more than doubled to Rs 33 crore from Rs 15 crore.

Marico has announced a strategic investment in HW Wellness Solutions, owner of health food brand True Elements, with an acquisition of 54 percent equity stake. The firm said it is an all-cash deal but did not disclose the acquisition amount. True Elements is in the healthy breakfast and snacks segments. Its portfolio includes oats, quinoa, muesli, granola, flakes and Indian breakfast including poha, upma and dosa among others.

Bharat Electronics reported a 16 percent year-on-year drop in its net profit for the March quarter to Rs 1,140 crore. Revenue for the quarter fell 9 percent from a year ago to Rs 6,320 crore. According to a Bloomberg analysts poll, the firm expected to post a profit of Rs 1,240 crore while revenue was expected at Rs 6,370 crore. The total order book as on April 1 stood at Rs 57,570 crore.

Olectra Greentech announced securing the biggest ever order in the history for 2,100 electric buses from Brihanmumbai Electric Supply and Transport (BEST) worth Rs 3,675 crore. Evey Trans Private Ltd (EVEY), an arm of Olectra, has obtained the letter of award from BEST after being declared as an L1 (least quoted) bidder. In a statement, Olectra said this is the biggest order (letter of award) in the Indian electric mobility history as on date wherein the order is to supply 2,100 electric buses on the gross cost contract/ operational expenditure model spanning 12 years.

Rupa & Co said it accepted the resignation of Dinesh Kumar Lodha, from the post of Chief Executive Officer of the Company, w.e.f. May 31, 2022. It also accepted the resignation of Ramesh Agarwal from the post of Chief Financial Officer of the company, w.e.f May 31, 2022.

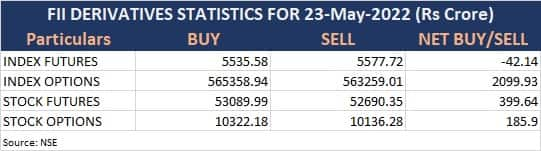

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,951.17 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,445.39 crore worth of shares on May 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks – Delta Corp, GNFC, and Indiabulls Housing Finance – are under the F&O ban for May 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes