Representative image.

The market extended its northward journey for the third consecutive session as the benchmark indices gained more than half a percent on September 12, tracking positive global cues. All sectoral indices closed in green.

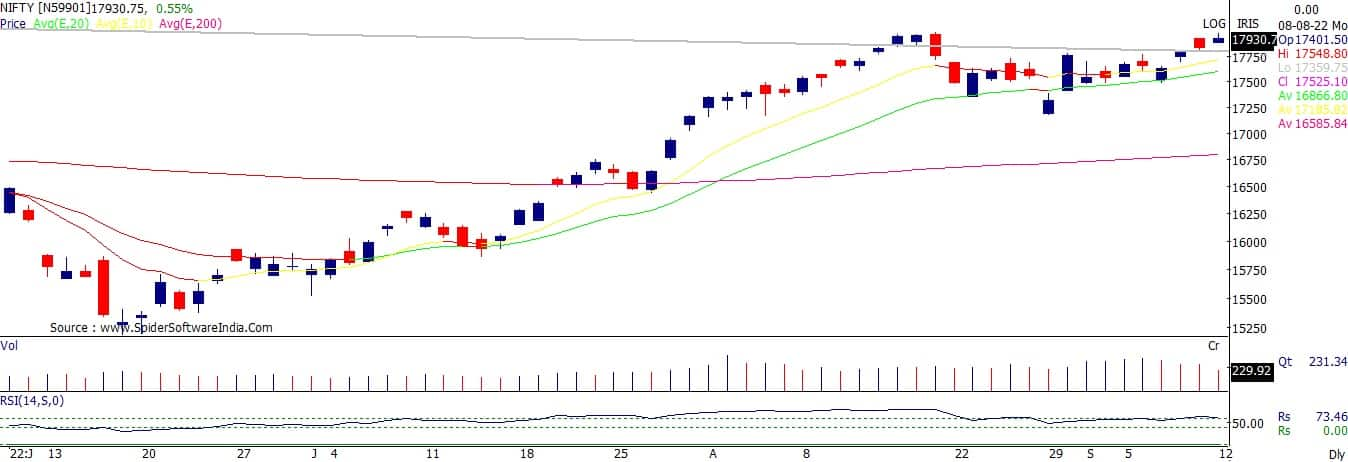

The BSE Sensex closed above the 60,000 mark for the first time since August 18, rising 322 points to 60,115, while the Nifty50 rose 103 points to 17,936 and formed a small-bodied bullish candle on the daily charts.

“The crucial overhead resistance of 17,800 levels (significant down sloping trend line, connected from the top of October 2021) has been surpassed amidst a range movement, but the strength which is required for a decisive upside breakout of the key overhead resistance is absent so far,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Hence, though the short-term trend of the Nifty continues to be positive, with the lack of strength visible above the trend line resistance, there is a possibility of the Nifty slipping into a downward correction from the near 18,000 mark. Immediate support is placed at 17,800.

The broader markets also joined the bulls’ party and performed better than benchmark indices. The Nifty Midcap 100 index gained 1 percent and Smallcap 100 index was up 1.3 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,890, followed by 17,844. If the index moves up, the key resistance levels to watch out for are 17,981 and 18,027.

Nifty Bank

The Nifty Bank rose 158 points to 40,574 and formed a Doji kind of pattern on the daily charts on Monday, indicating indecisiveness among bulls and bears about the future market trends. The important pivot level, which will act as crucial support for the index, is placed at 40,406, followed by 40,239. On the upside, key resistance levels are placed at 40,713 and 40,853 levels.

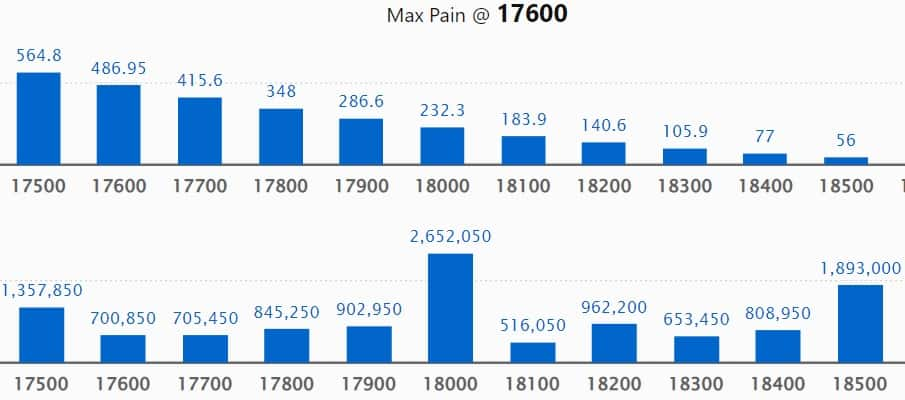

CALL OPTION DATA

Maximum Call open interest of 26.52 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the September series.

This is followed by 19,000 strike, which holds 19.12 lakh contracts, and 18,500 strike, which has 18.93 lakh contracts.

Call writing was seen at 18,800 strike, which added 2.23 lakh contracts, followed by 19,000 strike which added 1.2 lakh contracts, and 18,200 strike which added 95,400 contracts.

Call unwinding was seen at 17,800 strike, which shed 3.37 lakh contracts, followed by 17,700 strike which shed 1.46 lakh contracts, and 18,100 strike which shed 1.17 lakh contracts.

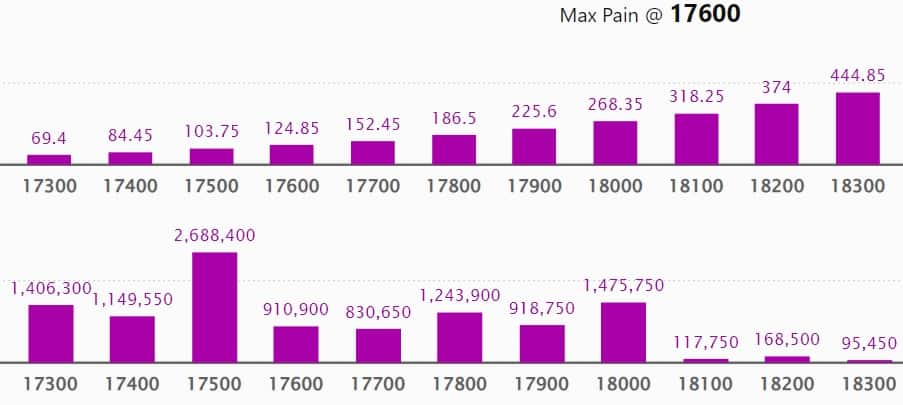

PUT OPTION DATA

Maximum Put open interest of 33.71 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 26.88 lakh contracts, and 17,000 strike, which has accumulated 25.67 lakh contracts.

Put writing was seen at 16,500 strike, which added 3.53 lakh contracts, followed by 17,900 strike, which added 3.28 lakh contracts, and 18,000 strike which added 2.12 lakh contracts.

Put unwinding was seen at 17,600 strike, which shed 1.64 lakh contracts, followed by 17,800 strike which shed 1.48 lakh contracts, and 17,000 strike, which shed 1.11 lakh contracts.

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Whirlpool, Max Financial Services, NTPC, Voltas, and HDFC Bank, among others.

78 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, the top 10 stocks in which a long build-up was seen include Atul, JK Cement, Aarti Industries, Hindustan Aeronautics, and Voltas.

11 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including JSW Steel, Syngene International, NTPC, Hindustan Unilever, and Colgate Palmolive, in which a long unwinding was seen.

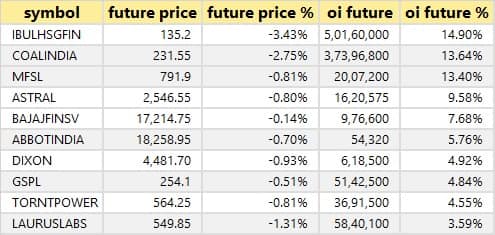

26 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, the top 10 stocks in which a short build-up was seen include Indiabulls Housing Finance, Coal India, Max Financial Services, Astral, and Bajaj Finserv.

82 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, the top 10 stocks in which short-covering was seen include PVR, L&T Technology Services, Ambuja Cements, GNFC, and Divis Laboratories.

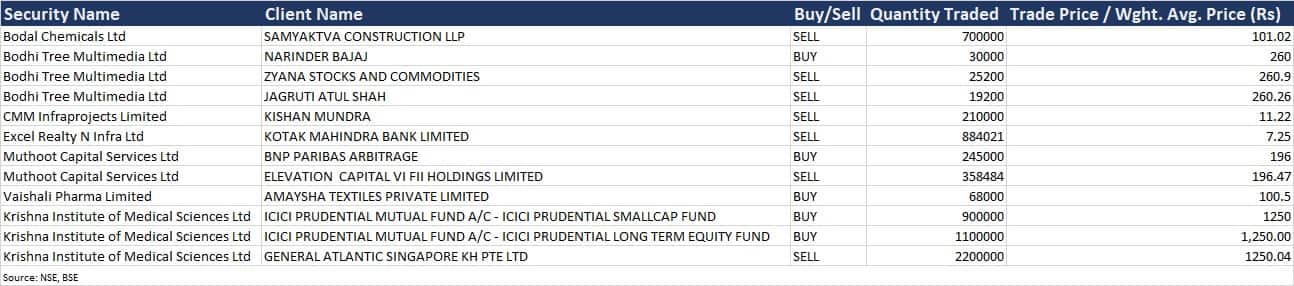

Bulk Deals

Krishna Institute of Medical Sciences: ICICI Prudential Mutual Fund through its Smallcap Fund and Long Term Equity Fund acquired 9 lakh equity shares and 11 lakh shares in the company via open market transactions. These shares were bought at an average price of Rs 1,250 per share. However, General Atlantic Singapore KH Pte Ltd sold 22 lakh shares at an average price of Rs 1,250.04 per share and thereby reduced shareholding to 12.42 percent, from 15.17 percent earlier. In addition, the company acquired a 51 percent equity stake in Spanv Medisearch Lifesciences (Kingsway Hospitals).

Muthoot Capital Services: BNP Paribas Arbitrage bought 2.45 lakh equity shares in the company at an average price of Rs 196 per share. However, Elevation Capital VI FII Holdings offloaded 3,58,484 shares at an average price of Rs 196.47 per share.

(For more bulk deals, click here)

Investors Meetings on September 13

ITC, Tata Consultancy Services, Delhivery: Officials of companies will attend the 29th Annual CITIC CLSA Investors’ Forum 2022.

Tech Mahindra: Officials of the company will attend Citi’s GEMS Conference 2022.

Sun Pharma: Officials of the company will participate in CLSA Asia Investor’s Forum 2022, Citigroup India Healthcare Trip, and InCred Capital Investor Conference.

Ajanta Pharma: Officials of the company will attend Incred Capital Investor Conference.

Macrotech Developers: Officials of the company will attend Annual CLSA Flagship Investors’ Forum.

Mishra Dhatu Nigam: Officials of the company will meet investors in non-deal roadshows in the UAE.

Hindustan Aeronautics: Officials of the company will meet investors in non-deal roadshows.

State Bank of India: Officials of the bank will attend India Financials Investor Group Trip organised by Morgan Stanley.

Crompton Greaves Consumer Electricals: Officials of the company will meet Aberdeen.

Data Patterns (India), and Birlasoft: Officials of companies will attend InCred Equities’ investor conference.

Shoppers Stop: Senior Management of the company will be meeting DSP Mutual Fund.

Indian Energy Exchange: Officials of the company will meet Aditya Birla AMC and JK Capital.

Greaves Cotton: Officials of the company will interact with Aditya Birla AMC and JM Financial PMS.

Eicher Motors: Officials of the company will interact with Morgan Stanley.

Indian Hotels: Officials of the company will meet Redwood Investments LLC, Putnam Investment Management, Fidelity Management & Research (FMR), and Allspring Global Investments.

Stocks in News

Tata Consultancy Services: C&S Wholesale Grocers, Inc, an industry leader in supply chain solutions and wholesale grocery supply in the United States, has selected Tata Consultancy Services to build its new operations platform on Google Cloud. This will help C&S reduce its carbon footprint and enhance customer experience.

Gujarat Apollo Industries: The company has entered into a joint venture agreement with Belgium-based PFH BV. They will enter into the business of agricultural and farming machinery and components.

Ujjivan Financial Services: Duro India Opportunities Fund Pte Ltd & Duro One Investments Ltd acquired additional 8.55 lakh shares or 0.7 percent stake in the company via open market transactions on September 8. With this, their shareholding in the company increased to 5.68 percent, up from 4.97 percent earlier.

Ujjivan Small Finance Bank: The bank opened its qualified institutional placement issue for subscription. The floor price has been fixed at Rs 21.93 per share.

HDFC Life Insurance company: Abrdn Plc is likely to sell 4.3 crore shares or 2 percent equity in HDFC Life via a block deal. Abrdn was earlier known as Standard Life, reports CNBC-TV18, quoting sources. Abrdn, which may raise up to $313 million via share sale, currently holds 3.72 percent equity in HDFC Life.

Krishna Institute of Medical Sciences: The company acquired a 51 percent equity stake in Spanv Medisearch Lifesciences (Kingsway Hospitals).

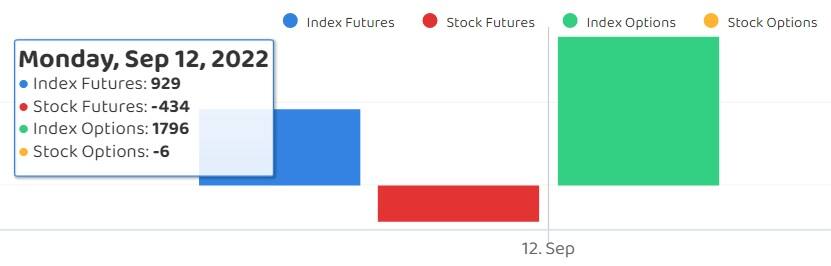

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net-bought shares worth Rs 2,049.65 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 890.51 crore on September 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks – Indiabulls Housing Finance, Ambuja Cements, and Delta Corp – are under the NSE F&O ban list for September 13. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.