In a way, 50 companies of the Nifty 50 and the next 50 firms of the Nifty Next 50 form the top 100 companies. Many people assume that the Nifty100 index is all about a combination of these two benchmarks. But is it?

Is Nifty 100 made up of all companies that are part of Nifty 50 and Nifty Next 50? Yes. Does that mean that investing in Nifty100 means exactly the same as investing in Nifty50 plus Nifty Next50? No. Sounds odd? Stay with me.

I will explain why investing in Nifty 100 isn’t exactly the same as investing in Nifty 50 and Next 50 separately.

Portfolio weightages vary

Now, even though all 50 companies each of Nifty 50 and Next 50 are part of the Nifty 100, the same weights of individual indices are not replicated in the larger Nifty 100 index. That is, the weightages of stocks in the Nifty 100 will not be the exact sum of weightages of the same stocks in their individual indices.

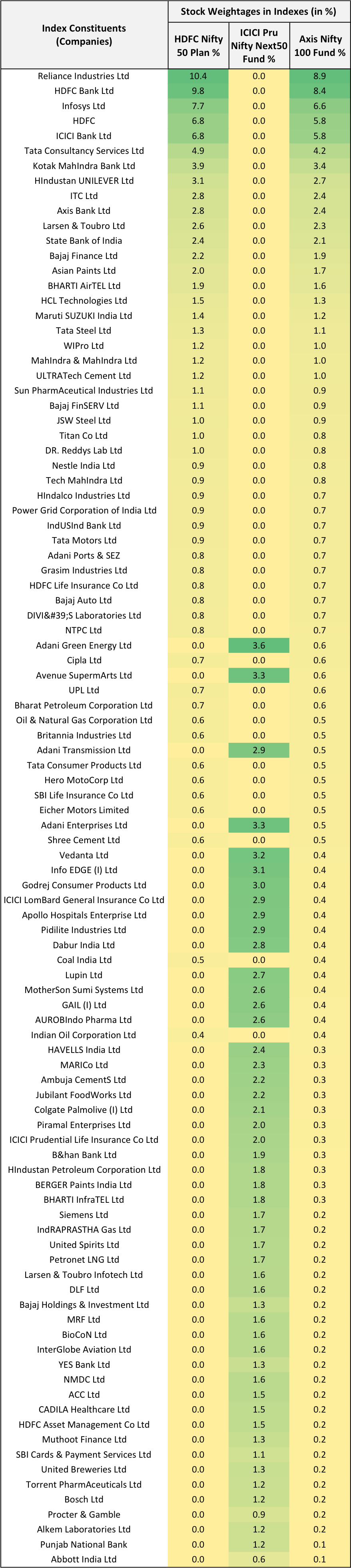

As an example, I have taken three representative index funds for all three indices and compared their portfolios. I have chosen the following funds

-HDFC Nifty 50 Index Plan (as representative of Nifty 50)

-ICICI Prudential Nifty Next50 Index Fund (as representative of Next 50)

-Axis Nifty 100 Fund (as representative of Nifty 100)

Now have a look at the portfolio comparison for these indices below:

-No stock of Nifty 50 is part of the Next 50. Also, no stock of Next 50 is part of Nifty 50. That is, there are zero overlaps between these two indices.

-All 50 stocks of Nifty 50 are part of Nifty100. Also, all 50 stocks of Next 50 are part of Nifty100.

–The weightage of the 50 stocks of Nifty 50 in the Nifty100 is more than 85 percent. Consequently, the remaining 15 percent of the Nifty100 weight is made up of the 50 stocks of the Nifty Next 50 index.

And that is the most important observation here.

Many clients ask me: If I have to invest in both Nifty50 and Next50, isn’t it simpler to just invest in one Nifty100 index?

As you have seen now, it isn’t the same.

Disproportionate exposure

So, if you invest in a Nifty100 index fund, then you get 85 percent exposure to the Nifty 50 and only 15 percent to Next 50. Another way to look at it is that if the Nifty50 does well, then Nifty100 will do very well too as it’s made up primarily of Nifty 50. But in a hypothetical scenario where Nifty 50 does poorly and Next 50 does well, the combined Nifty 100 will do poorly, too, as only 15 percent of Nifty 100 is made up of the performing Next 50 index.

Indian indices are top-heavy; they have inherent concentration risk where the top few companies have a lot of weightage in the indices. Let’s analyse the three indices from that angle.

-The top-10 stocks of Nifty 50 have 55-60 percent weightage in Nifty 50.

-The top-10 stocks of Nifty Next 50 have 30-35 percent weightage in Nifty Next 50.

-But if you see the weightages of top-10 stocks of either index in the combined index of Nifty 100, then you will find that the top-10 stocks of Nifty 50 form 50 percent of Nifty 100, while the top-10 stocks of Next 50 account for only about 5 percent of Nifty 100.

From a risk or volatility perspective, too, things get skewed in favour of Nifty 50 in Nifty 100. The Nifty 50 is made up of large-caps and due to its high weightage, its risk profile is replicated in Nifty 100. But the Next 50 (even though made up of 51-100 large-cap companies) behaves more like a mid-cap index with higher levels of volatility. But due to the lower 15 percent weightage in Nifty100, it doesn’t impact Nifty100’s nature much.