The development have an impacted on the share price of Zee Entertainment, On September 14, the stock has surged nearly 40 percent.

Zee Entertainment Enterprises’ two biggest investors Invesco Developing Markets Fund & OFI Global China Fund LLC, with a combined holding of 17.88 percent, have called an extraordinary general meeting of shareholders to seek the ouster of chief executive officer and managing director Punit Goenka and two directors from the board. They have also asked for the appointment of six new independent directors nominated by them.

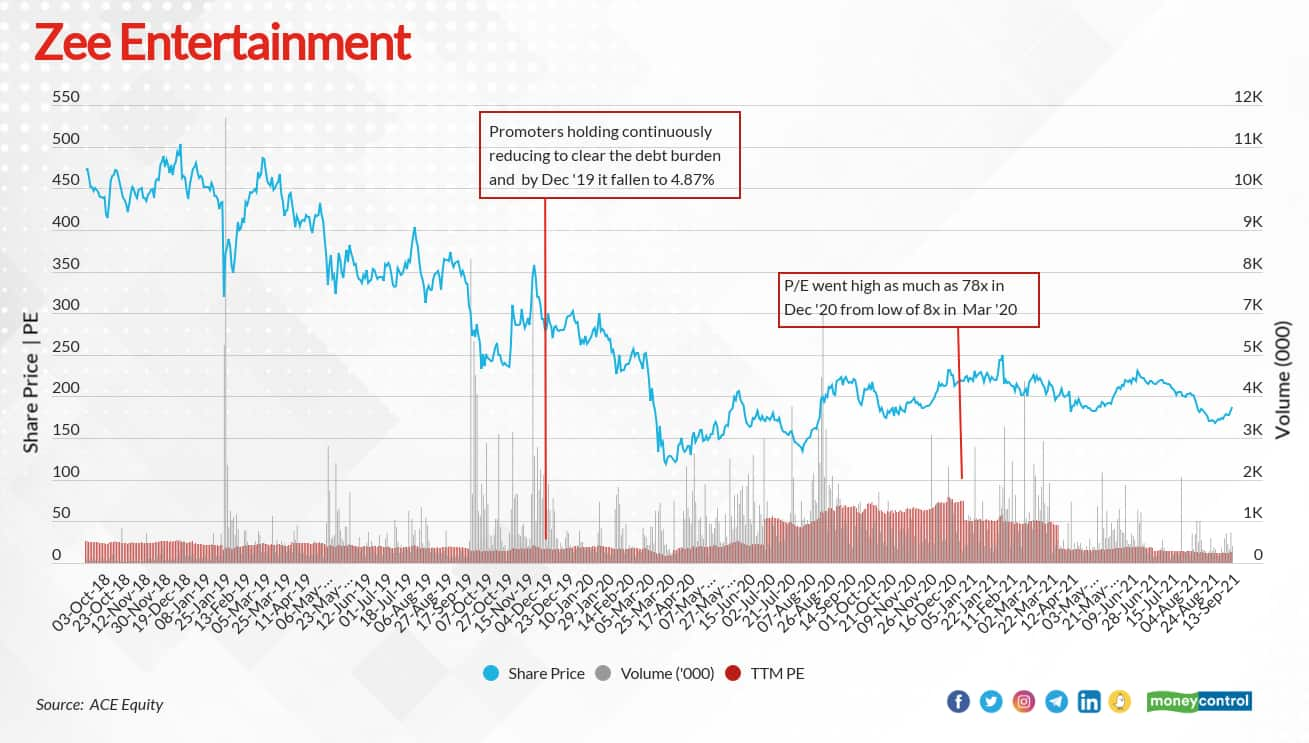

The development, hailed by analysts as a positive for corporate governance, saw the stock price zoom nearly 40 percent. It is in contrast to the past three years when the stock has fallen 60 percent from Rs 471.75 on September 14, 2018.

For Zee Entertainment, problems started when the Essel Group faced debt pressure. Promoter Subhash Chandra through Essel Infraprojects took loans for which Zee Entertainment shares were pledged, which were then sold to institutional investors to clear the debt burden in 2019.

Promoter Shareholding: In December 2018, the company’s promoters held about 41.62 percent, since then in each quarter company has reduced their stake and by September 2019 it dropped to 22.37 percent and in very next quarter in December 2019 the exchange data shows it fallen to 4.87 percent. During that quarter the total Public holding became 95.13 percent out of which FPI held 65.67 percent.

Zee Entertainments’ June 2021 quarter shareholding pattern shows that foreign portfolio investors holds maximum which is 57.46 percent, Domestic Institutional Investors holds 18.62 percent, public and promoters holds 19.93 percent and 3.99 percent, respectively.

The company’s price to earning bit better compared to its Industry PE. It TTM PE is 22.81x which is still lower than its Industry PE 23.75x. In the last 3 years, the company’s PE multiple improved as much as to 8.48x in March 2020 and went high 78x in December 2020. According to moneycontrol research P/E valuation for the stock likely improve further, P/E estimate for FY22 : 14.7x and for FY23 : 12.7x.

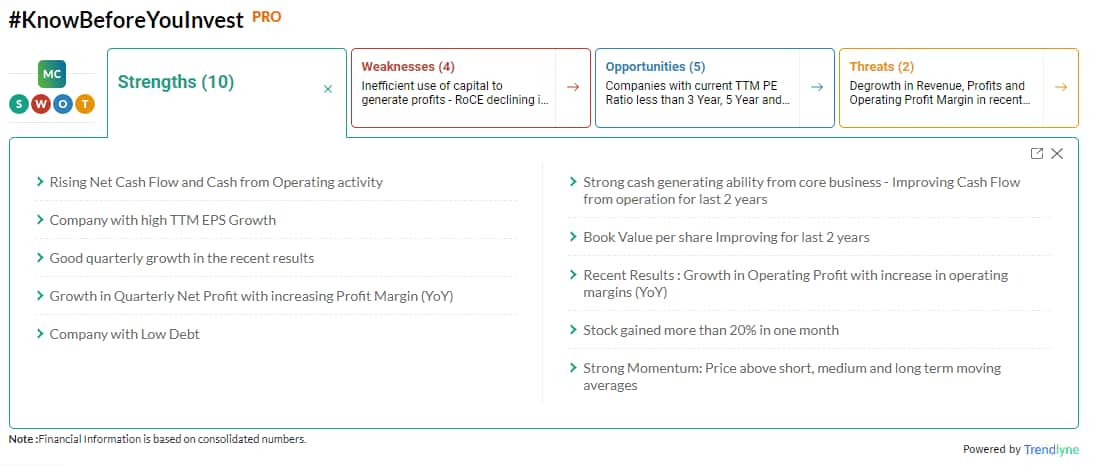

On moneycontrol SWOT analysis shows that the company has more strengthen points than its weakness. click here