Delicious Zomato IPO listing is here and investors who received shares during allotment process have recorded more than 50% returns on the issue price. The IPO has crossed the market-capitalization of Rs 1 lakh crore on its listing day and moved ahead of big financial services stocks such as SBI Cards & Payments, ICICI Prudential Life Insurance, SBI Life Insurance and ICICI Lombard.

Zomato IPO listed at Rs 116 with 52.63% premium above its issue price of Rs 72-76. The issue size of Rs 9,375 crore, which was a mix of fresh issue and offer for sale, received bumper applications from retail investors with 7.45 times subscription of the allotted quota. Qualified Institutional Buyers and Non-Institutional Investors subscribed for the IPO 51.79 times and 32.96 times, respectively.

Luckily, we have a clear estimation of the returns retail investors have made on their applications in Zomato but the food-delivery platform has a lot of Private Equity investors who have invested in it since the inception stage. Tech startups always remain hungry for investments from the Private Equity investors and mutual funds.

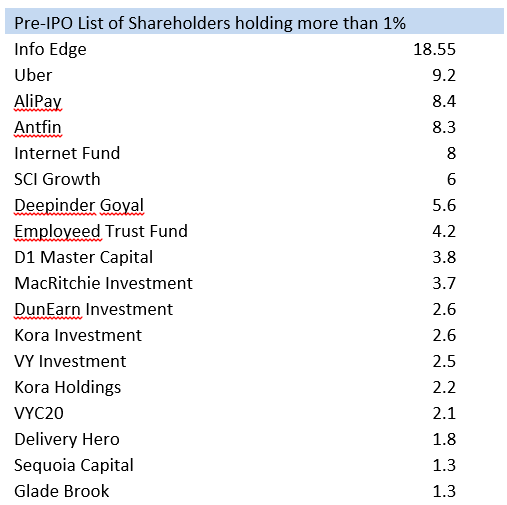

As technology-driven startups pours a lot of money into their technology, personnel and advertising and sales promotion campaign, they keep hunting for investors who can invest money in the initial stages of their offerings. Similarly, Zomato also has a long list of shareholders that have more than 1% stake in the company.

As per the last funding round of the Zomato, private investors parked $600 million in the food-delivery platform at a buying price of Rs 44.8. The shares have already delivered more than 60% returns over the issue price of Rs 76. Being the foremost investor in the digital food-delivery platform Info Edge (Naukri.com) is on cloud seven.

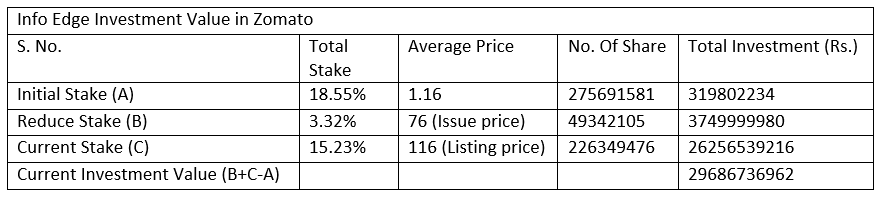

Sanjeev Bhikchandani-led-Info Edge has 18.55% stake in Zomato. Multi-tech starrer platform has divested 3.32% stake amounting at Rs 375 crores (as per the issue price) in Zomato.

One would be jealous after knowing that Info Edge had invested at an average cost of Rs 1.16 share. It has made a bumper profit of 64.5 times on the issue price.

Total investment value of Info Edge in Zomato is around Rs 3,000 cr. Who would have thought that a food-delivery platform will make fortune for their investors?

Founder Deepinder Goyal holds 5.6% stake in its startup. After the listing of its platform, Founder Deepinder Goyal stated that “It’s a new day zero for us and we are going to succeed further”. Founder Deepinder Goyal accounts now Rs. 965 cr. of its investment value in Zomato.

The food-delivery platform has initiated a revolutionary process of making India a tech country. Trading exchanges of western countries are flooded with technology stocks. Bold step of listing has opened doors for other technology-driven platforms and many startups are likely to list them in future.

Moreover, the market participants are expected to provide healthy premiums to the food delivery platform. This can enlarge the valuations of Zomato in future.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.