Economy

Updated : 2020-06-03 07:35:26

Indian share market is expected to open higher on Wednesday following the positive sentiment in the global markets due to the reopening of economies. At 7:32 am, the SGX Nifty traded 46 points or 0.46 percent higher at 10,084.50, indicating a positive opening for the Sensex and Nifty50.

CNBCTV18.com

1. Asia: Stocks in Asia jumped in Wednesday morning trade, with optimism over the reopening of economies as authorities ease coronavirus-induced lockdown measures continuing to keep investor sentiment afloat. Japan’s Nikkei 225 led gains among the region’s major markets, jumping 2.05 percent in early trade. The Topix index also added 1.39 percent. Over in South Korea, the Kospi gained 1.37 percent as shares of automaker Hyundai Motor soared about 4 percent. Shares in Australia also edged higher, with the S&P/ASX 200 up 0.76 percent. Overall, the MSCI Asia ex-Japan index traded 0.49 percent higher. (Image: Reuters)

2. Wall Street: A late-session rally pushed Wall Street to solid gains on Tuesday as market participants looked past widespread social unrest and pandemic worries to focus instead on easing lockdown restrictions and signs of economic recovery. Tech shares, along with cyclical stocks like industrials and financials, gave the biggest lift to all three major stock indexes. The Dow Jones Industrial Average rose 267.63 points, or 1.05 percent, to 25,742.65, the S&P 500 gained 25.09 points, or 0.82 percent to 3,080.82 and the Nasdaq Composite added 56.33 points or 0.59 percent to 9,608.38. (Image: Reuters)

3. Market At Close On Tuesday: Indian shares ended higher for the fifth session in a row for the first time in 2020 on Tuesday driven by a surge in financials, while a broadly positive global mood also helped the rally. Gains in index heavyweights like Kotak Bank, HDFC twins, and ICICI Bank helped offset the broader impact of a rating cut by Moody’s, citing slow economic growth. The Sensex ended 522 points higher at 33,825 while the Nifty rose 153 points to settle at 9,979. Market breadth was in favour of advances with the advance-decline ratio at 7:2. (Image: Reuters)

4. Crude Oil: Oil rose on Wednesday to a near three-month high amid optimism that major producers will extend production cuts as the world recovers from the coronavirus pandemic. Brent crude was up 22 cents, or 0.6 percent at $39.79, by 0003 GMT, the highest since March 6, having gained 3.3 percent on Tuesday. US West Texas Intermediate crude (WTI) gained 33 cents, or 0.9 percent, at $37.14, also the highest since March 6. The contract ended the previous session up 3.9 percent. (Image: Reuters)

5. Rupee Close: The rupee ended a volatile session on Tuesday stronger at 75.34 against the US dollar, tracking gains Asian currencies, a day after Moody’s lowered India’s credit rating to a notch above junk. The currency moved within a range of 75.35-75.61 during the four-hour session, having started the day nearly unchanged at 75.56 compared to its previous close. While strength in the dollar overseas kept pressure on the rupee, extended gains in the domestic equity markets amid foreign inflows provided some support to the currency, say analysts. (Image: Reuters)

6. States Knock At Centre’s Door Yet Again As They See A Revenue Decline: The state governments are struggling financially due to the COVID-19 pandemic. Now, they have again knocked at the Centre’s door seeking clearance of their pending dues. According to senior government officials and sources, states have demanded early disbursement of pending goods and services tax (GST) compensation dues and several grants and aids to deal with the pandemic. Revenue shortfall is the biggest challenge that the States and Union Territories across India are facing today, “States are juggling with various expenses to pay off their routine salaries and to meet their day to day expenses,” government officials added. (Image: Reuters)

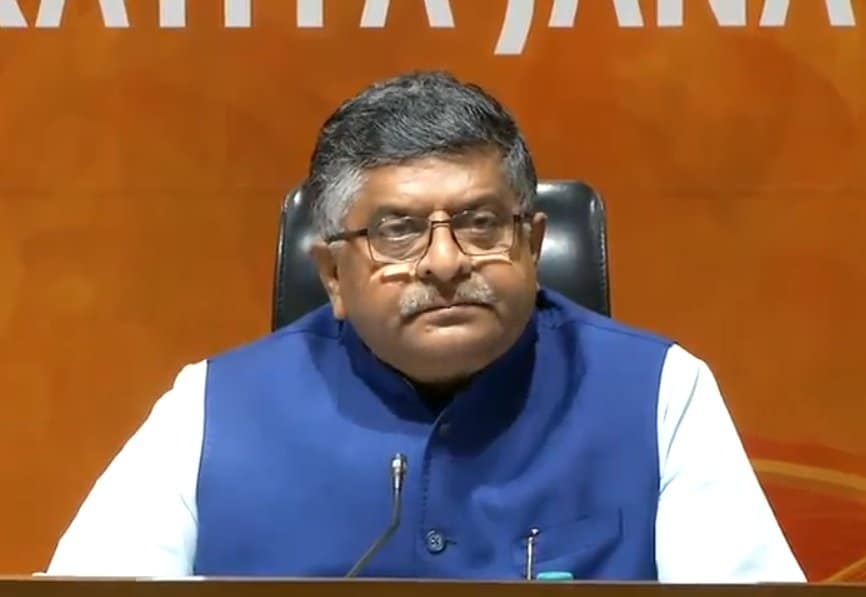

7. Ravi Shankar Prasad Says Electronics Incentive Scheme Is Pro-India: The government is inviting applications for the Rs 50,000 crore inventive scheme to attract global mobile device makers and boost local companies to manufacture more electronic products. Speaking exclusively with CNBC-TV18 Managing Editor Shereen Bhan, IT and Telecom Minister Ravi Shankar Prasad clarified that the incentive announced is pro-India and not against any particular country. Prasad was replying to a query on whether the border Indo-China border dispute would affect Chinese investments in India. “There is a total incentive of Rs 50,000 crore and there are five-six large companies that control 80 percent of the global mobile market. Initially, we will pick five global champions who under the PLI scheme will be permitted to participate,” he said. (Image: IANS)

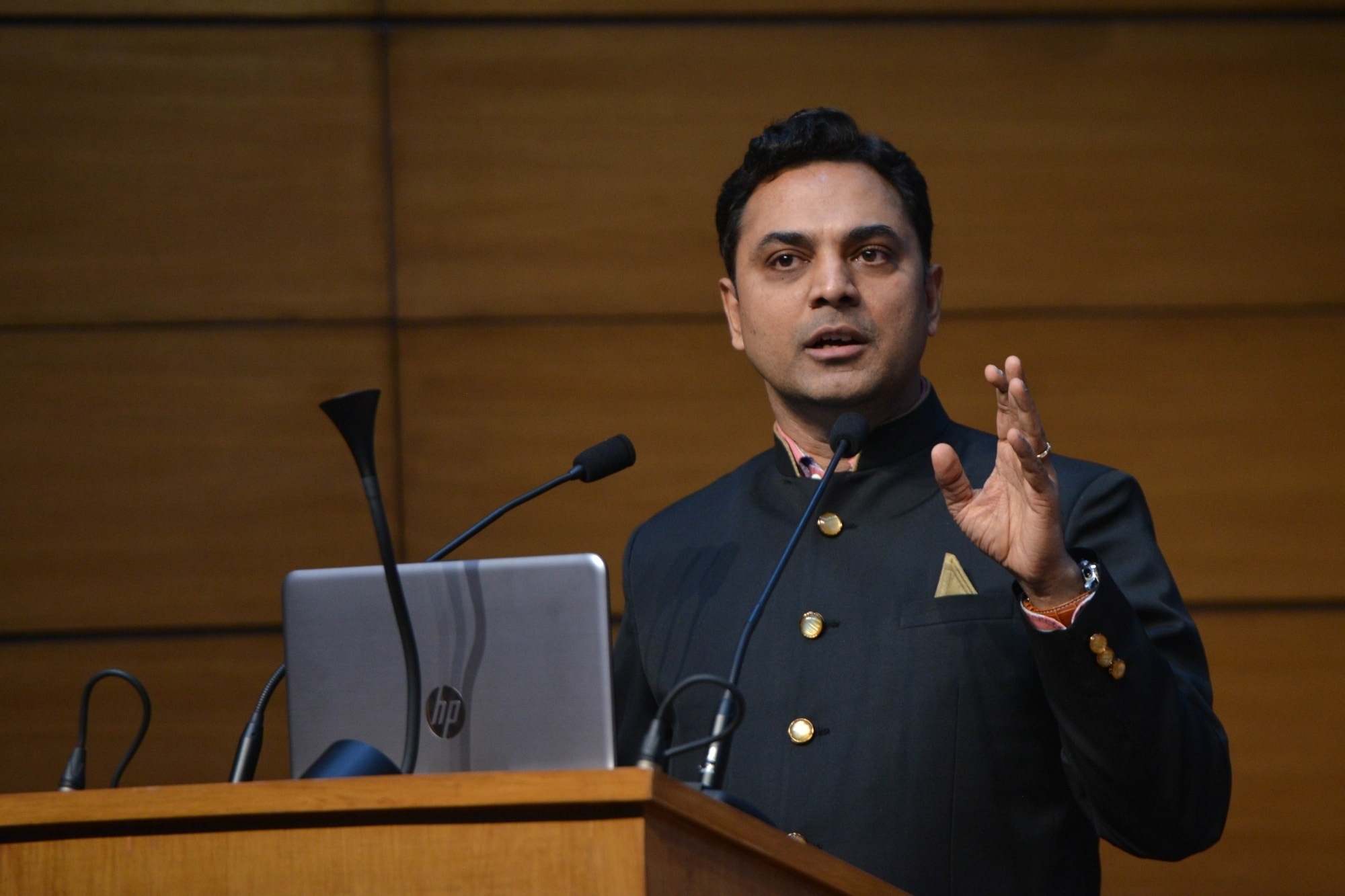

8. Rating Changes Have Little Impact On Markets, Says CEA: India’s rating downgrade will have a little impact on the market as sovereign ratings are not a leading indicator, said Chief Economic Adviser (CEA), Krishnamurthy Subramanian. Speaking to CNBC-TV18, Subramanian said that the rating agencies have downgraded 33 countries since COVID-19 outbreak. The comment comes after the global credit rating agency Moody’s Investors Services on Monday downgraded India’s foreign-currency and local-currency long-term issuer ratings to Baa3 from Baa2. “Debt sustainability is not an issue in India as long as the GDP growth stays around 4 percent. We have analyzed the impact of rating changes over the last 20 years and found that rating changes are not a big event for markets. We should not be guided by rating action,” Subramanian said. (Image: IANS)

9. India’s Drug Regulator Grants Gilead Sciences Marketing Authorisation: India’s drug regulator has granted US pharma giant Gilead Sciences marketing authorisation for its anti-viral drug remdesivir for “restricted emergency use” on hospitalised Covid-19 patients in view of the crisis posed by the pandemic. The approval process for remdesivir was accelerated in view of the emergency situation and the unmet need for medicines in light of the coronavirus outbreak, a source in the know of the developments told PTI. The drug has been allowed for restricted emergency use for the treatment of suspected or laboratory-confirmed cases of Covid-19 in adults and children hospitalised with severe symptoms, subject to several safeguards, the source said. (Image: Reuters)

10. Salon, Spas To Collect Aadhaar Number, Customer Phone Number: Hairdressing in saloons and beauty parlours in Tamil Nadu will require Aadhar card with the state government making it mandatory on the part of service providers to collect details, including the unique ID number, from customers as part of preventive measures against COVID- 19. According to the standard operating procedure for salons, beauty parlours and spas, they have to maintain a record of the name, address, Aadhaar and mobile phone numbers of the customers. The measure is aimed at containing the spread of COVID-19 and facilitate contact tracing, official sources said. (Image: Reuters)